National Bank of Canada FI bought a new stake in shares of KT Co. (NYSE:KT - Free Report) in the third quarter, according to its most recent disclosure with the Securities and Exchange Commission. The fund bought 494,840 shares of the technology company's stock, valued at approximately $7,611,000. National Bank of Canada FI owned approximately 0.10% of KT as of its most recent SEC filing.

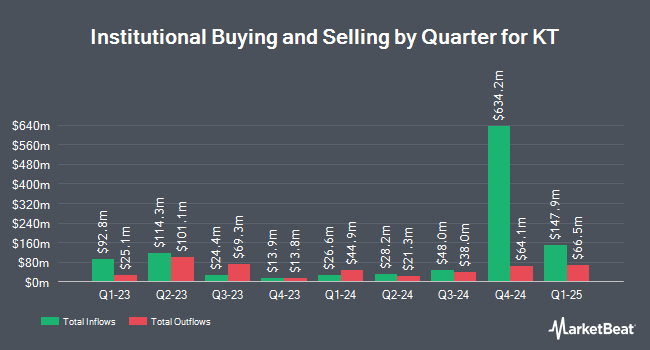

Several other hedge funds have also made changes to their positions in KT. Venturi Wealth Management LLC increased its holdings in KT by 3,915.8% during the third quarter. Venturi Wealth Management LLC now owns 4,578 shares of the technology company's stock valued at $70,000 after buying an additional 4,464 shares during the period. Envestnet Portfolio Solutions Inc. bought a new stake in KT during the 2nd quarter valued at $140,000. Private Advisor Group LLC purchased a new position in shares of KT in the 3rd quarter valued at $164,000. Centiva Capital LP bought a new position in shares of KT in the 3rd quarter worth $191,000. Finally, Townsquare Capital LLC purchased a new stake in shares of KT during the 3rd quarter worth $219,000. 18.86% of the stock is currently owned by hedge funds and other institutional investors.

KT Stock Performance

Shares of NYSE:KT traded up $0.25 during midday trading on Thursday, reaching $16.00. The company's stock had a trading volume of 2,461,279 shares, compared to its average volume of 953,911. The firm has a market capitalization of $8.25 billion, a PE ratio of 8.84, a P/E/G ratio of 1.20 and a beta of 0.93. The stock has a fifty day moving average of $15.95 and a 200 day moving average of $14.78. KT Co. has a twelve month low of $12.10 and a twelve month high of $18.45. The company has a quick ratio of 0.98, a current ratio of 1.04 and a debt-to-equity ratio of 0.28.

Analyst Upgrades and Downgrades

Several research firms have issued reports on KT. StockNews.com raised shares of KT from a "buy" rating to a "strong-buy" rating in a report on Saturday, November 16th. New Street Research raised KT to a "strong-buy" rating in a research report on Monday, September 9th.

Read Our Latest Research Report on KT

KT Profile

(

Free Report)

KT Corporation provides integrated telecommunications and platform services in Korea and internationally. The company offers mobile voice and data telecommunications services based on 5G, 4G LTE and 3G W-CDMA technology; fixed-line telephone services, including local, domestic long-distance, international long-distance, and voice over Internet protocol telephone services, as well as interconnection services; broadband Internet access service and other Internet-related services; and data communication services, such as fixed-line and leased line services, as well as broadband Internet connection services.

Featured Articles

Before you consider KT, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and KT wasn't on the list.

While KT currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.