National Bank of Canada (TSE:NA - Free Report) had its price objective increased by TD Securities from C$129.00 to C$140.00 in a research note issued to investors on Friday,BayStreet.CA reports.

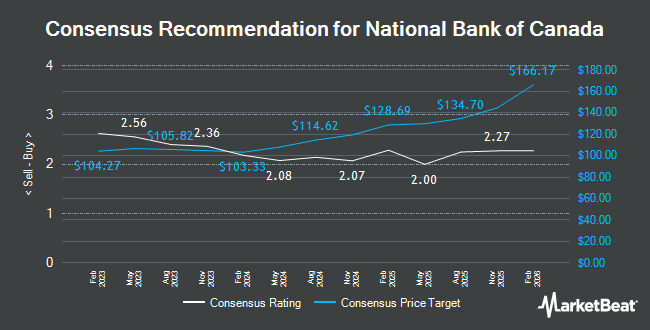

NA has been the topic of a number of other reports. Royal Bank of Canada upped their price target on National Bank of Canada from C$113.00 to C$116.00 in a research report on Thursday, August 29th. Jefferies Financial Group increased their target price on shares of National Bank of Canada from C$119.00 to C$126.00 in a research report on Thursday, August 29th. BMO Capital Markets boosted their price target on shares of National Bank of Canada from C$115.00 to C$125.00 in a research report on Thursday, August 29th. Canaccord Genuity Group raised their price objective on shares of National Bank of Canada from C$113.00 to C$123.00 in a report on Thursday, August 29th. Finally, Cibc World Mkts downgraded National Bank of Canada from a "strong-buy" rating to a "hold" rating in a report on Friday, September 20th. One investment analyst has rated the stock with a sell rating, ten have issued a hold rating and two have given a buy rating to the company. According to MarketBeat, National Bank of Canada has a consensus rating of "Hold" and an average price target of C$123.64.

Check Out Our Latest Stock Analysis on National Bank of Canada

National Bank of Canada Stock Up 0.3 %

National Bank of Canada stock traded up C$0.46 on Friday, hitting C$133.67. The company's stock had a trading volume of 1,052,500 shares, compared to its average volume of 1,736,176. The company has a fifty day moving average price of C$129.70 and a 200-day moving average price of C$119.45. The firm has a market cap of C$45.50 billion, a P/E ratio of 13.02, a price-to-earnings-growth ratio of 7.14 and a beta of 1.12. National Bank of Canada has a one year low of C$87.92 and a one year high of C$135.00.

National Bank of Canada (TSE:NA - Get Free Report) last announced its quarterly earnings results on Wednesday, August 28th. The financial services provider reported C$2.68 EPS for the quarter, topping analysts' consensus estimates of C$2.50 by C$0.18. National Bank of Canada had a net margin of 34.50% and a return on equity of 15.18%. The firm had revenue of C$2.98 billion during the quarter, compared to analysts' expectations of C$2.95 billion. Analysts anticipate that National Bank of Canada will post 10.8360791 EPS for the current year.

National Bank of Canada Dividend Announcement

The firm also recently declared a quarterly dividend, which was paid on Friday, November 1st. Investors of record on Monday, September 30th were paid a dividend of $1.10 per share. This represents a $4.40 dividend on an annualized basis and a dividend yield of 3.29%. The ex-dividend date was Friday, September 27th. National Bank of Canada's dividend payout ratio (DPR) is 42.84%.

Insider Buying and Selling at National Bank of Canada

In related news, Director Yvon Charest acquired 325 shares of the firm's stock in a transaction dated Monday, August 19th. The stock was bought at an average price of C$117.24 per share, for a total transaction of C$38,103.00. Insiders own 0.21% of the company's stock.

About National Bank of Canada

(

Get Free Report)

National Bank of Canada provides financial services to individuals, businesses, institutional clients, and governments in Canada and internationally. It operates through four segments: Personal and Commercial, Wealth Management, Financial Markets, and U.S. Specialty Finance and International. The Personal and Commercial segment offers personal banking services, including transaction solutions, mortgage loans and home equity lines of credit, consumer loans, payment solutions, and savings and investment solutions; various insurance products; and commercial banking services, such as credit, and deposit, investment solutions, international trade, foreign exchange transactions, payroll, cash management, insurance, electronic transactions, and complimentary services.

Further Reading

Before you consider National Bank of Canada, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and National Bank of Canada wasn't on the list.

While National Bank of Canada currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.