Flagship Communities Real Estate Investment Trust (TSE:MHC.UN - Free Report) had its target price lifted by National Bankshares from C$20.00 to C$21.00 in a report published on Friday morning,BayStreet.CA reports. National Bankshares currently has an outperform rating on the stock.

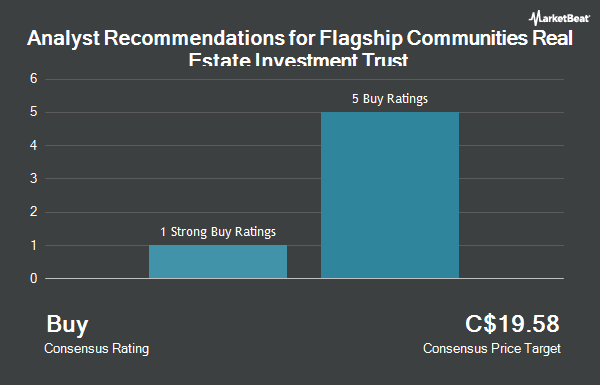

A number of other analysts also recently issued reports on the company. Raymond James lifted their price target on Flagship Communities Real Estate Investment Trust from C$19.00 to C$20.00 and gave the company a "strong-buy" rating in a research report on Friday. Desjardins lifted their price target on Flagship Communities Real Estate Investment Trust from C$19.50 to C$20.50 and gave the company a "buy" rating in a research report on Friday. Four investment analysts have rated the stock with a buy rating and one has assigned a strong buy rating to the company. According to MarketBeat, the company currently has an average rating of "Buy" and a consensus target price of C$20.10.

Check Out Our Latest Analysis on MHC.UN

Flagship Communities Real Estate Investment Trust Trading Up 1.4 %

Shares of MHC.UN traded up C$0.33 during trading hours on Friday, reaching C$23.98. 3,902 shares of the company's stock traded hands, compared to its average volume of 2,101. The stock has a market cap of C$339.08 million, a PE ratio of 5.09 and a beta of 0.28. The firm's 50 day simple moving average is C$21.26 and its 200-day simple moving average is C$20.85. Flagship Communities Real Estate Investment Trust has a 12 month low of C$18.00 and a 12 month high of C$24.70.

About Flagship Communities Real Estate Investment Trust

(

Get Free Report)

Flagship Communities Real Estate Investment Trust is an internally managed, unincorporated, open-ended real estate investment trust established pursuant to a declaration of trust under the laws of the Province of Ontario. The REIT has been formed to own and operate a portfolio of income-producing manufactured housing communities located in Kentucky, Indiana, Ohio, Tennessee, Arkansas, Missouri, and Illinois, including a fleet of manufactured homes for lease to residents of such housing communities.

See Also

Before you consider Flagship Communities Real Estate Investment Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Flagship Communities Real Estate Investment Trust wasn't on the list.

While Flagship Communities Real Estate Investment Trust currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.