Aecon Group (TSE:ARE - Free Report) had its target price lowered by National Bankshares from C$30.00 to C$23.00 in a research report sent to investors on Friday morning,BayStreet.CA reports. The brokerage currently has a sector perform rating on the stock.

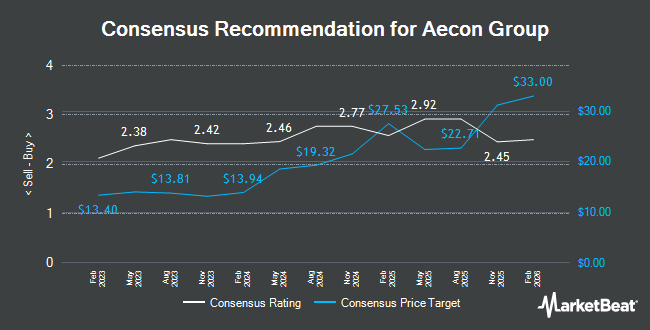

Several other brokerages have also recently weighed in on ARE. BMO Capital Markets decreased their price target on Aecon Group from C$29.00 to C$24.00 in a research note on Friday. Desjardins decreased their price objective on shares of Aecon Group from C$32.00 to C$29.00 and set a "buy" rating for the company in a research report on Friday. CIBC dropped their target price on shares of Aecon Group from C$33.00 to C$30.00 in a report on Friday. National Bank Financial downgraded Aecon Group from a "strong-buy" rating to a "hold" rating in a report on Tuesday, December 3rd. Finally, TD Securities lowered their price objective on Aecon Group from C$35.00 to C$30.00 and set a "buy" rating for the company in a research report on Friday. Six investment analysts have rated the stock with a hold rating, six have given a buy rating and one has assigned a strong buy rating to the company's stock. According to data from MarketBeat, the company currently has an average rating of "Moderate Buy" and an average price target of C$25.25.

Read Our Latest Research Report on Aecon Group

Aecon Group Price Performance

Shares of TSE ARE traded down C$0.03 during mid-day trading on Friday, hitting C$18.00. 270,784 shares of the stock traded hands, compared to its average volume of 437,780. The company has a market cap of C$1.14 billion, a PE ratio of -17.71, a price-to-earnings-growth ratio of 18.18 and a beta of 1.13. Aecon Group has a twelve month low of C$13.03 and a twelve month high of C$29.70. The company has a debt-to-equity ratio of 32.84, a current ratio of 1.19 and a quick ratio of 1.27. The firm has a 50 day simple moving average of C$24.01 and a two-hundred day simple moving average of C$23.93.

Aecon Group Announces Dividend

The company also recently declared a quarterly dividend, which was paid on Friday, January 3rd. Shareholders of record on Friday, January 3rd were issued a $0.19 dividend. The ex-dividend date of this dividend was Tuesday, December 24th. This represents a $0.76 annualized dividend and a yield of 4.22%. Aecon Group's payout ratio is currently -74.76%.

Insider Buying and Selling at Aecon Group

In other Aecon Group news, Director Stuart Lee acquired 5,700 shares of the stock in a transaction on Monday, March 10th. The shares were purchased at an average price of C$18.35 per share, for a total transaction of C$104,595.00. Insiders own 0.82% of the company's stock.

About Aecon Group

(

Get Free Report)

Aecon Group Inc is a Canada-based company that operates in two segments: Construction and Concessions. The Construction segment includes various aspects of the construction of public and private infrastructure projects, mainly in the transportation sector. Its concessions segment is engaged in the development, financing, construction, and operation of infrastructure projects.

Read More

Before you consider Aecon Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Aecon Group wasn't on the list.

While Aecon Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.