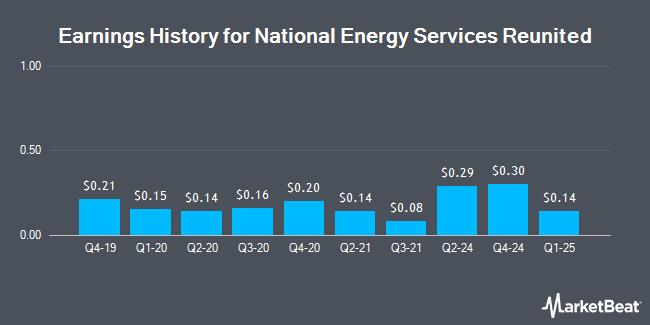

National Energy Services Reunited (NASDAQ:NESR - Get Free Report) is expected to release its earnings data before the market opens on Wednesday, March 12th. Analysts expect National Energy Services Reunited to post earnings of $0.30 per share and revenue of $339.84 million for the quarter. Persons that are interested in registering for the company's earnings conference call can do so using this link.

National Energy Services Reunited Stock Performance

NESR traded up $0.20 during mid-day trading on Friday, hitting $7.92. The stock had a trading volume of 220,841 shares, compared to its average volume of 177,062. The stock's fifty day simple moving average is $8.95 and its 200-day simple moving average is $9.00. The company has a current ratio of 1.10, a quick ratio of 0.91 and a debt-to-equity ratio of 0.33. National Energy Services Reunited has a 1-year low of $7.40 and a 1-year high of $10.30.

Analysts Set New Price Targets

A number of equities research analysts recently commented on NESR shares. Benchmark started coverage on shares of National Energy Services Reunited in a report on Tuesday, January 21st. They set a "buy" rating and a $15.00 price objective on the stock. Barclays restated an "overweight" rating and set a $16.00 price objective on shares of National Energy Services Reunited in a report on Friday, January 31st. Finally, JPMorgan Chase & Co. started coverage on shares of National Energy Services Reunited in a report on Friday, December 6th. They set an "overweight" rating and a $13.00 price objective on the stock.

Get Our Latest Stock Analysis on National Energy Services Reunited

National Energy Services Reunited Company Profile

(

Get Free Report)

National Energy Services Reunited Corp. provides oilfield services in the Middle East and North Africa region. The company's Production Services segment offers hydraulic fracturing services; coiled tubing services, including nitrogen lifting, fishing, milling, clean-out, scale removal, and other well applications; stimulation and pumping services; primary and remedial cementing services; nitrogen services; filtration services, as well as frac tanks and pumping units; and pipeline and industrial services, such as water filling and hydro testing, nitrogen purging, and de-gassing and pressure testing, as well as cutting/welding and cooling down piping/vessels systems.

Further Reading

Before you consider National Energy Services Reunited, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and National Energy Services Reunited wasn't on the list.

While National Energy Services Reunited currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.