National Health Investors (NYSE:NHI - Get Free Report) updated its FY24 earnings guidance on Tuesday. The company provided earnings per share (EPS) guidance of $4.43-$4.44 for the period, compared to the consensus estimate of $4.52.

National Health Investors Stock Performance

NHI stock traded up $0.81 during mid-day trading on Tuesday, reaching $76.73. The company had a trading volume of 340,584 shares, compared to its average volume of 190,436. The company has a quick ratio of 10.27, a current ratio of 10.27 and a debt-to-equity ratio of 0.91. The stock has a market capitalization of $3.33 billion, a P/E ratio of 26.00, a P/E/G ratio of 5.09 and a beta of 1.05. National Health Investors has a one year low of $49.25 and a one year high of $86.13. The stock's 50-day simple moving average is $80.53 and its two-hundred day simple moving average is $73.03.

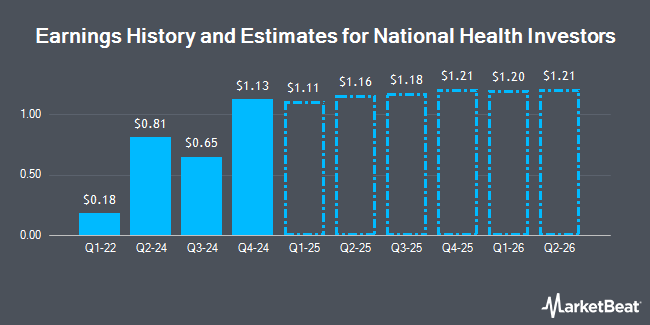

National Health Investors (NYSE:NHI - Get Free Report) last issued its quarterly earnings data on Tuesday, August 6th. The real estate investment trust reported $0.81 earnings per share for the quarter, missing analysts' consensus estimates of $1.10 by ($0.29). National Health Investors had a net margin of 39.11% and a return on equity of 10.11%. The company had revenue of $84.97 million for the quarter, compared to the consensus estimate of $64.95 million. During the same quarter in the prior year, the firm earned $1.06 earnings per share. National Health Investors's revenue for the quarter was up 9.1% compared to the same quarter last year. Research analysts anticipate that National Health Investors will post 4.48 EPS for the current year.

Wall Street Analysts Forecast Growth

Several equities research analysts have commented on the stock. Wells Fargo & Company cut shares of National Health Investors from an "overweight" rating to an "equal weight" rating and boosted their price target for the stock from $81.00 to $86.00 in a research report on Tuesday, October 1st. Bank of America initiated coverage on National Health Investors in a research note on Tuesday, September 24th. They set a "buy" rating and a $92.00 target price on the stock. StockNews.com cut National Health Investors from a "buy" rating to a "hold" rating in a research note on Tuesday, October 15th. Finally, Truist Financial boosted their target price on National Health Investors from $65.00 to $78.00 and gave the stock a "hold" rating in a report on Friday, August 30th. Four analysts have rated the stock with a hold rating and four have assigned a buy rating to the company. Based on data from MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and a consensus price target of $73.29.

View Our Latest Research Report on National Health Investors

National Health Investors Company Profile

(

Get Free Report)

Incorporated in 1991, National Health Investors, Inc NYSE: NHI is a real estate investment trust specializing in sale, leasebacks, joint-ventures, senior housing operating partnerships, and mortgage and mezzanine financing of need-driven and discretionary senior housing and medical investments. NHI's portfolio consists of independent living, assisted living and memory care communities, entrance-fee retirement communities, skilled nursing facilities, and specialty hospitals.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider National Health Investors, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and National Health Investors wasn't on the list.

While National Health Investors currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.