Morgan Stanley Institutional Investment Advisors LLC trimmed its position in shares of National HealthCare Co. (NYSE:NHC - Free Report) by 1.1% in the fourth quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 772,110 shares of the company's stock after selling 8,327 shares during the period. National HealthCare makes up 19.1% of Morgan Stanley Institutional Investment Advisors LLC's portfolio, making the stock its 2nd biggest holding. Morgan Stanley Institutional Investment Advisors LLC owned approximately 5.00% of National HealthCare worth $83,048,000 at the end of the most recent reporting period.

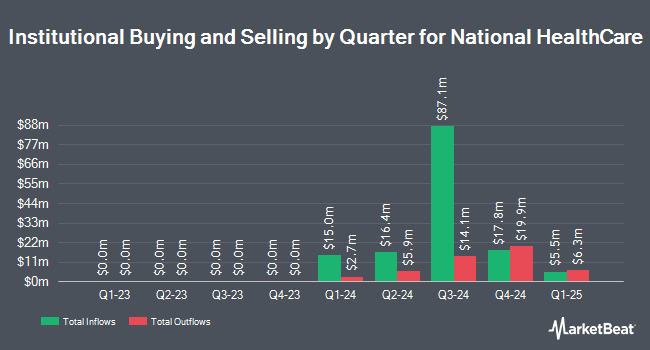

Several other hedge funds and other institutional investors also recently made changes to their positions in NHC. Jane Street Group LLC increased its position in National HealthCare by 213.3% during the third quarter. Jane Street Group LLC now owns 28,887 shares of the company's stock worth $3,633,000 after acquiring an additional 19,667 shares during the period. Barclays PLC grew its position in National HealthCare by 345.6% in the 3rd quarter. Barclays PLC now owns 21,063 shares of the company's stock worth $2,649,000 after purchasing an additional 16,336 shares during the last quarter. Franklin Resources Inc. increased its holdings in shares of National HealthCare by 6.5% during the 3rd quarter. Franklin Resources Inc. now owns 6,655 shares of the company's stock worth $806,000 after purchasing an additional 409 shares during the period. JPMorgan Chase & Co. lifted its stake in shares of National HealthCare by 6.0% in the third quarter. JPMorgan Chase & Co. now owns 43,073 shares of the company's stock valued at $5,417,000 after buying an additional 2,419 shares during the period. Finally, Ellsworth Advisors LLC bought a new stake in shares of National HealthCare in the fourth quarter valued at about $650,000. 56.44% of the stock is owned by institutional investors and hedge funds.

Analyst Ratings Changes

Separately, StockNews.com cut National HealthCare from a "strong-buy" rating to a "buy" rating in a report on Monday, March 3rd.

Get Our Latest Research Report on National HealthCare

National HealthCare Stock Performance

NHC stock traded up $1.42 during midday trading on Wednesday, hitting $94.00. The stock had a trading volume of 40,519 shares, compared to its average volume of 60,932. National HealthCare Co. has a 52 week low of $89.14 and a 52 week high of $138.49. The company has a current ratio of 1.80, a quick ratio of 1.77 and a debt-to-equity ratio of 0.14. The stock has a 50-day simple moving average of $93.35 and a 200 day simple moving average of $107.02. The firm has a market capitalization of $1.45 billion, a price-to-earnings ratio of 11.78 and a beta of 0.42.

National HealthCare Dividend Announcement

The firm also recently disclosed a quarterly dividend, which will be paid on Friday, April 25th. Stockholders of record on Friday, March 28th will be issued a dividend of $0.61 per share. This represents a $2.44 dividend on an annualized basis and a dividend yield of 2.60%. The ex-dividend date of this dividend is Friday, March 28th. National HealthCare's payout ratio is 37.31%.

National HealthCare Company Profile

(

Free Report)

National HealthCare Corporation engages in the operation of services to skilled nursing facilities, assisted and independent living facilities, homecare and hospice agencies, and health hospitals. Its skilled nursing facilities offer licensed therapy services, nutrition services, social services, activities, and housekeeping and laundry services, as well as medical services prescribed by physicians; and rehabilitative services, such as physical, speech, respiratory, and occupational therapy for patients recovering from strokes, heart attacks, orthopedic conditions, neurological illnesses, or other illnesses, injuries, or disabilities.

Further Reading

Before you consider National HealthCare, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and National HealthCare wasn't on the list.

While National HealthCare currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.