National Pension Service grew its stake in shares of Owens Corning (NYSE:OC - Free Report) by 52.1% in the 3rd quarter, according to its most recent filing with the Securities & Exchange Commission. The firm owned 218,216 shares of the construction company's stock after buying an additional 74,703 shares during the period. National Pension Service owned 0.25% of Owens Corning worth $38,519,000 as of its most recent SEC filing.

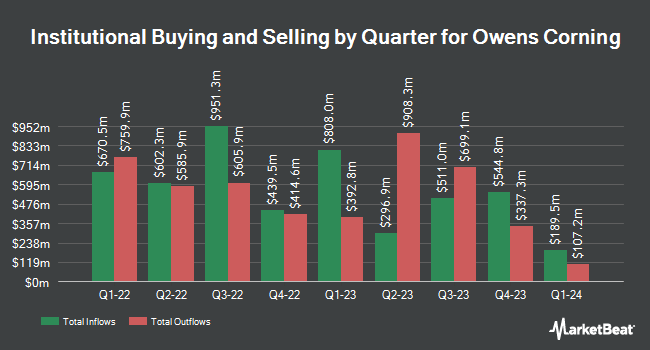

A number of other institutional investors and hedge funds have also made changes to their positions in OC. Robeco Institutional Asset Management B.V. boosted its holdings in Owens Corning by 6.8% in the 3rd quarter. Robeco Institutional Asset Management B.V. now owns 367,734 shares of the construction company's stock worth $64,912,000 after acquiring an additional 23,316 shares during the period. Van ECK Associates Corp boosted its stake in shares of Owens Corning by 6.9% in the third quarter. Van ECK Associates Corp now owns 39,318 shares of the construction company's stock valued at $7,129,000 after purchasing an additional 2,530 shares during the period. Janney Montgomery Scott LLC grew its holdings in Owens Corning by 1.7% during the 3rd quarter. Janney Montgomery Scott LLC now owns 50,375 shares of the construction company's stock valued at $8,892,000 after purchasing an additional 835 shares in the last quarter. F M Investments LLC purchased a new stake in Owens Corning during the 3rd quarter worth $227,000. Finally, Chicago Partners Investment Group LLC lifted its holdings in Owens Corning by 10.6% in the 3rd quarter. Chicago Partners Investment Group LLC now owns 1,269 shares of the construction company's stock worth $230,000 after buying an additional 122 shares in the last quarter. 88.40% of the stock is currently owned by institutional investors and hedge funds.

Insiders Place Their Bets

In other Owens Corning news, insider Marcio A. Sandri sold 3,051 shares of Owens Corning stock in a transaction that occurred on Thursday, September 19th. The shares were sold at an average price of $176.50, for a total transaction of $538,501.50. Following the transaction, the insider now directly owns 57,079 shares in the company, valued at approximately $10,074,443.50. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is accessible through this hyperlink. In other Owens Corning news, insider Marcio A. Sandri sold 3,051 shares of Owens Corning stock in a transaction dated Thursday, September 19th. The stock was sold at an average price of $176.50, for a total transaction of $538,501.50. Following the transaction, the insider now owns 57,079 shares of the company's stock, valued at $10,074,443.50. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is available through this hyperlink. Also, insider Marcio A. Sandri sold 3,050 shares of the company's stock in a transaction dated Tuesday, September 17th. The shares were sold at an average price of $170.00, for a total value of $518,500.00. Following the completion of the transaction, the insider now owns 60,130 shares in the company, valued at $10,222,100. This represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Corporate insiders own 0.89% of the company's stock.

Analyst Upgrades and Downgrades

OC has been the topic of several analyst reports. UBS Group upped their target price on Owens Corning from $197.00 to $218.00 and gave the company a "buy" rating in a research report on Thursday. StockNews.com lowered shares of Owens Corning from a "buy" rating to a "hold" rating in a report on Friday, November 1st. Citigroup upgraded shares of Owens Corning from a "neutral" rating to a "buy" rating and upped their target price for the company from $178.00 to $191.00 in a research note on Thursday, July 11th. Evercore ISI boosted their price objective on Owens Corning from $189.00 to $196.00 and gave the company an "in-line" rating in a report on Thursday. Finally, Royal Bank of Canada upped their price objective on Owens Corning from $213.00 to $217.00 and gave the company an "outperform" rating in a research note on Thursday. Eight equities research analysts have rated the stock with a hold rating and seven have given a buy rating to the company. According to MarketBeat.com, Owens Corning presently has an average rating of "Hold" and an average target price of $192.62.

View Our Latest Research Report on Owens Corning

Owens Corning Price Performance

NYSE:OC traded up $2.82 during midday trading on Thursday, hitting $187.46. 919,943 shares of the stock were exchanged, compared to its average volume of 682,967. The company has a market capitalization of $16.30 billion, a price-to-earnings ratio of 15.83, a P/E/G ratio of 2.20 and a beta of 1.41. The company has a current ratio of 1.37, a quick ratio of 0.79 and a debt-to-equity ratio of 0.91. Owens Corning has a one year low of $120.17 and a one year high of $191.44. The business has a 50-day moving average price of $174.98 and a two-hundred day moving average price of $173.36.

Owens Corning (NYSE:OC - Get Free Report) last issued its quarterly earnings results on Wednesday, November 6th. The construction company reported $4.38 EPS for the quarter, topping the consensus estimate of $4.01 by $0.37. Owens Corning had a net margin of 10.66% and a return on equity of 26.33%. The firm had revenue of $3.05 billion for the quarter, compared to analysts' expectations of $3.04 billion. During the same period in the previous year, the business earned $4.15 earnings per share. Owens Corning's revenue for the quarter was up 22.9% compared to the same quarter last year. Sell-side analysts predict that Owens Corning will post 15.34 EPS for the current year.

Owens Corning Announces Dividend

The business also recently disclosed a quarterly dividend, which was paid on Monday, November 4th. Shareholders of record on Friday, October 18th were issued a dividend of $0.60 per share. The ex-dividend date of this dividend was Friday, October 18th. This represents a $2.40 annualized dividend and a yield of 1.28%. Owens Corning's payout ratio is presently 20.32%.

Owens Corning Profile

(

Free Report)

Owens Corning manufactures and sells building and construction materials in the United States, Europe, the Asia Pacific, and internationally. It operates in three segments: Roofing, Insulation, and Composites. The Roofing segment manufactures and sells laminate and strip asphalt roofing shingles, oxidized asphalt materials, and roofing components used in residential and commercial construction, and specialty applications.

Featured Stories

Before you consider Owens Corning, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Owens Corning wasn't on the list.

While Owens Corning currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.