National Pension Service boosted its stake in Aptiv PLC (NYSE:APTV - Free Report) by 16.6% during the third quarter, according to the company in its most recent filing with the SEC. The institutional investor owned 502,896 shares of the auto parts company's stock after buying an additional 71,633 shares during the quarter. National Pension Service owned approximately 0.18% of Aptiv worth $36,214,000 as of its most recent filing with the SEC.

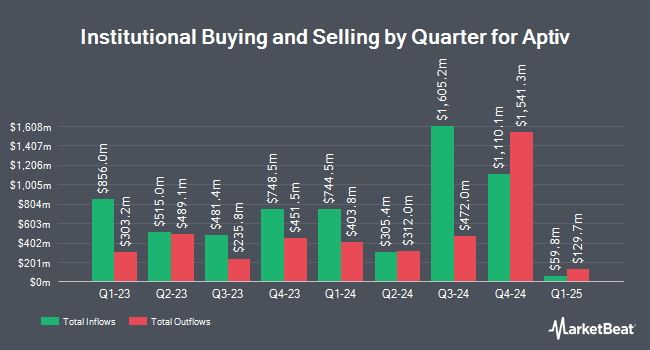

A number of other institutional investors also recently made changes to their positions in the stock. Independence Bank of Kentucky acquired a new position in shares of Aptiv during the 2nd quarter valued at about $25,000. Crewe Advisors LLC boosted its holdings in shares of Aptiv by 94.7% in the 2nd quarter. Crewe Advisors LLC now owns 442 shares of the auto parts company's stock valued at $31,000 after purchasing an additional 215 shares during the last quarter. Clearstead Trust LLC grew its stake in shares of Aptiv by 305.0% during the 1st quarter. Clearstead Trust LLC now owns 405 shares of the auto parts company's stock valued at $32,000 after buying an additional 305 shares during the period. Wolff Wiese Magana LLC grew its position in Aptiv by 44.3% during the third quarter. Wolff Wiese Magana LLC now owns 505 shares of the auto parts company's stock valued at $36,000 after acquiring an additional 155 shares during the period. Finally, Cullen Frost Bankers Inc. acquired a new stake in Aptiv during the second quarter worth about $38,000. 94.21% of the stock is owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

A number of research analysts have weighed in on the stock. UBS Group reduced their price target on shares of Aptiv from $107.00 to $99.00 and set a "buy" rating on the stock in a research report on Wednesday, July 10th. Wolfe Research assumed coverage on Aptiv in a research note on Thursday, September 5th. They issued an "outperform" rating and a $89.00 target price for the company. Fox Advisors lowered Aptiv from an "overweight" rating to an "equal weight" rating in a research report on Tuesday, October 1st. Citigroup lowered their price objective on shares of Aptiv from $128.00 to $108.00 and set a "buy" rating for the company in a research report on Friday, July 12th. Finally, StockNews.com started coverage on shares of Aptiv in a research note on Sunday. They issued a "hold" rating for the company. Two analysts have rated the stock with a sell rating, five have assigned a hold rating and thirteen have issued a buy rating to the company's stock. According to MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and an average price target of $87.00.

Read Our Latest Research Report on APTV

Aptiv Price Performance

Shares of APTV traded up $1.81 during midday trading on Thursday, reaching $55.64. The stock had a trading volume of 4,320,075 shares, compared to its average volume of 3,087,488. The company has a debt-to-equity ratio of 0.91, a current ratio of 1.50 and a quick ratio of 1.06. The firm's 50 day moving average price is $68.62 and its 200-day moving average price is $72.11. Aptiv PLC has a 52 week low of $52.81 and a 52 week high of $91.66. The company has a market capitalization of $13.08 billion, a P/E ratio of 6.22, a P/E/G ratio of 0.52 and a beta of 1.81.

Aptiv (NYSE:APTV - Get Free Report) last released its earnings results on Thursday, October 31st. The auto parts company reported $1.83 EPS for the quarter, topping analysts' consensus estimates of $1.68 by $0.15. The business had revenue of $4.85 billion for the quarter, compared to the consensus estimate of $5.10 billion. Aptiv had a net margin of 12.29% and a return on equity of 14.51%. The business's revenue for the quarter was down 5.1% on a year-over-year basis. During the same period in the previous year, the firm earned $1.30 EPS. On average, analysts forecast that Aptiv PLC will post 6.19 earnings per share for the current fiscal year.

Aptiv Profile

(

Free Report)

Aptiv PLC engages in design, manufacture, and sale of vehicle components in North America, Europe, Middle East, Africa, the Asia Pacific, South America, and internationally. The company provides electrical, electronic, and safety technology solutions to the automotive and commercial vehicle markets. It operates through two segments, Signal and Power Solutions, and Advanced Safety and User Experience.

Recommended Stories

Before you consider Aptiv, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Aptiv wasn't on the list.

While Aptiv currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.