National Pension Service purchased a new stake in shares of Jabil Inc. (NYSE:JBL - Free Report) during the third quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The fund purchased 23,319 shares of the technology company's stock, valued at approximately $2,794,000.

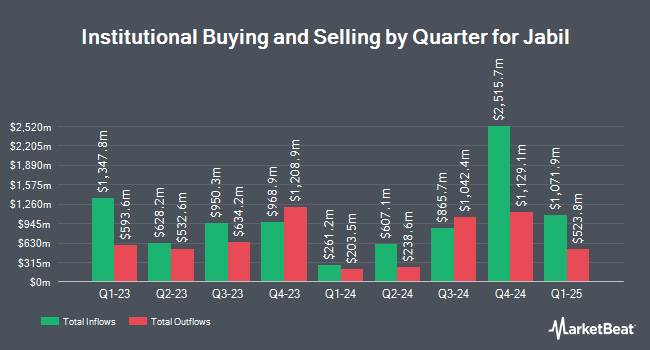

Other large investors also recently made changes to their positions in the company. Cetera Investment Advisers boosted its holdings in Jabil by 141.7% in the 1st quarter. Cetera Investment Advisers now owns 17,350 shares of the technology company's stock worth $2,324,000 after acquiring an additional 10,173 shares during the period. CreativeOne Wealth LLC increased its stake in Jabil by 239.2% during the 1st quarter. CreativeOne Wealth LLC now owns 10,116 shares of the technology company's stock worth $1,355,000 after buying an additional 7,134 shares during the period. Westfield Capital Management Co. LP purchased a new position in Jabil in the 1st quarter valued at about $39,040,000. State Board of Administration of Florida Retirement System grew its stake in shares of Jabil by 7.9% during the first quarter. State Board of Administration of Florida Retirement System now owns 156,119 shares of the technology company's stock valued at $20,912,000 after acquiring an additional 11,469 shares in the last quarter. Finally, CCM Investment Advisers LLC increased its position in shares of Jabil by 6.0% during the second quarter. CCM Investment Advisers LLC now owns 149,208 shares of the technology company's stock worth $16,232,000 after acquiring an additional 8,405 shares during the last quarter. Institutional investors and hedge funds own 93.39% of the company's stock.

Analyst Upgrades and Downgrades

Several research firms have issued reports on JBL. JPMorgan Chase & Co. dropped their price objective on Jabil from $137.00 to $133.00 and set an "overweight" rating on the stock in a report on Tuesday, September 3rd. Barclays lifted their price target on shares of Jabil from $135.00 to $157.00 and gave the stock an "overweight" rating in a research note on Friday, September 27th. Stifel Nicolaus increased their price objective on shares of Jabil from $130.00 to $140.00 and gave the company a "buy" rating in a research note on Friday, September 27th. Finally, Bank of America boosted their target price on shares of Jabil from $135.00 to $150.00 and gave the stock a "buy" rating in a research report on Friday, September 27th. Two investment analysts have rated the stock with a hold rating and six have given a buy rating to the stock. According to data from MarketBeat, Jabil currently has an average rating of "Moderate Buy" and an average target price of $143.50.

Check Out Our Latest Analysis on Jabil

Insider Buying and Selling

In other news, SVP Francis Mckay sold 11,755 shares of the business's stock in a transaction on Thursday, October 31st. The shares were sold at an average price of $121.71, for a total transaction of $1,430,701.05. Following the completion of the transaction, the senior vice president now owns 41,507 shares of the company's stock, valued at approximately $5,051,816.97. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which can be accessed through the SEC website. In related news, EVP Frederic E. Mccoy sold 4,000 shares of the firm's stock in a transaction that occurred on Tuesday, October 1st. The stock was sold at an average price of $118.70, for a total value of $474,800.00. Following the sale, the executive vice president now directly owns 108,753 shares in the company, valued at $12,908,981.10. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, SVP Francis Mckay sold 11,755 shares of the business's stock in a transaction on Thursday, October 31st. The stock was sold at an average price of $121.71, for a total value of $1,430,701.05. Following the transaction, the senior vice president now owns 41,507 shares of the company's stock, valued at $5,051,816.97. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. In the last 90 days, insiders have sold 43,689 shares of company stock valued at $5,377,431. Insiders own 2.62% of the company's stock.

Jabil Stock Performance

Jabil stock traded down $1.55 during mid-day trading on Friday, reaching $135.75. The company's stock had a trading volume of 936,561 shares, compared to its average volume of 1,458,252. The company has a current ratio of 1.09, a quick ratio of 0.72 and a debt-to-equity ratio of 1.66. Jabil Inc. has a twelve month low of $95.85 and a twelve month high of $156.94. The business has a 50 day moving average price of $117.98 and a 200-day moving average price of $114.87. The firm has a market cap of $15.32 billion, a price-to-earnings ratio of 12.46, a PEG ratio of 1.50 and a beta of 1.24.

Jabil (NYSE:JBL - Get Free Report) last posted its quarterly earnings results on Thursday, September 26th. The technology company reported $2.30 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $2.22 by $0.08. Jabil had a net margin of 4.81% and a return on equity of 42.64%. The company had revenue of $6.96 billion for the quarter, compared to the consensus estimate of $6.59 billion. During the same period last year, the firm posted $2.34 EPS. The company's revenue for the quarter was down 17.7% on a year-over-year basis. Sell-side analysts predict that Jabil Inc. will post 7.84 EPS for the current fiscal year.

Jabil Announces Dividend

The business also recently declared a quarterly dividend, which will be paid on Tuesday, December 3rd. Stockholders of record on Friday, November 15th will be given a dividend of $0.08 per share. This represents a $0.32 dividend on an annualized basis and a dividend yield of 0.24%. The ex-dividend date is Friday, November 15th. Jabil's payout ratio is 2.90%.

Jabil Company Profile

(

Free Report)

Jabil Inc provides manufacturing services and solutions worldwide. It operates in two segments, Electronics Manufacturing Services and Diversified Manufacturing Services. The company offers electronics design, production, and product management services; electronic circuit design services, such as application-specific integrated circuit design, firmware development, and rapid prototyping services; and designs plastic and metal enclosures that include the electro-mechanics, such as the printed circuit board assemblies (PCBA).

Read More

Before you consider Jabil, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Jabil wasn't on the list.

While Jabil currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report