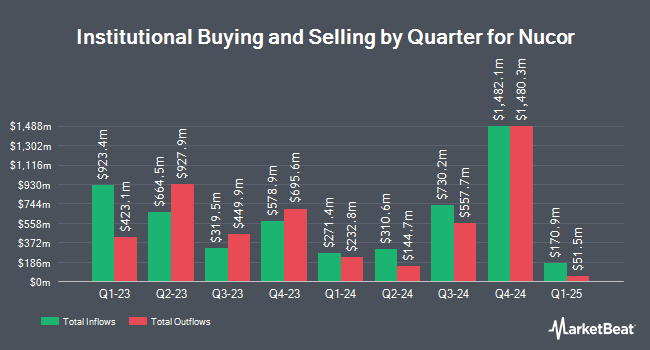

National Pension Service lifted its holdings in shares of Nucor Co. (NYSE:NUE - Free Report) by 3.2% in the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission. The firm owned 652,502 shares of the basic materials company's stock after acquiring an additional 20,258 shares during the quarter. National Pension Service owned approximately 0.27% of Nucor worth $98,097,000 as of its most recent SEC filing.

Several other hedge funds and other institutional investors also recently made changes to their positions in NUE. McClarren Financial Advisors Inc. lifted its holdings in Nucor by 129.0% during the 2nd quarter. McClarren Financial Advisors Inc. now owns 158 shares of the basic materials company's stock worth $25,000 after purchasing an additional 89 shares during the last quarter. Chilton Capital Management LLC lifted its holdings in Nucor by 94.2% during the 1st quarter. Chilton Capital Management LLC now owns 134 shares of the basic materials company's stock worth $27,000 after purchasing an additional 65 shares during the last quarter. Central Pacific Bank Trust Division acquired a new stake in Nucor during the 1st quarter worth approximately $28,000. Brown Lisle Cummings Inc. acquired a new stake in Nucor during the 3rd quarter worth approximately $30,000. Finally, Salomon & Ludwin LLC lifted its holdings in Nucor by 45.6% during the 3rd quarter. Salomon & Ludwin LLC now owns 230 shares of the basic materials company's stock worth $35,000 after purchasing an additional 72 shares during the last quarter. 76.48% of the stock is currently owned by institutional investors.

Insider Buying and Selling

In related news, EVP Kenneth Rex Query sold 9,000 shares of the business's stock in a transaction on Tuesday, October 29th. The stock was sold at an average price of $146.80, for a total transaction of $1,321,200.00. Following the sale, the executive vice president now owns 98,770 shares in the company, valued at $14,499,436. The trade was a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available at this hyperlink. 0.64% of the stock is currently owned by corporate insiders.

Analyst Upgrades and Downgrades

Several analysts recently weighed in on NUE shares. Argus raised Nucor to a "strong-buy" rating in a report on Monday, August 26th. JPMorgan Chase & Co. dropped their price target on Nucor from $170.00 to $168.00 and set an "overweight" rating for the company in a report on Wednesday, October 23rd. BMO Capital Markets dropped their price objective on Nucor from $175.00 to $160.00 and set a "market perform" rating for the company in a report on Wednesday, September 18th. Finally, Morgan Stanley dropped their price objective on Nucor from $170.00 to $166.00 and set an "overweight" rating for the company in a report on Wednesday, October 23rd. Three analysts have rated the stock with a hold rating, five have issued a buy rating and one has assigned a strong buy rating to the company's stock. According to data from MarketBeat, Nucor currently has a consensus rating of "Moderate Buy" and an average price target of $190.57.

Check Out Our Latest Research Report on Nucor

Nucor Price Performance

NYSE NUE traded up $23.13 during midday trading on Wednesday, hitting $167.74. The company had a trading volume of 7,477,538 shares, compared to its average volume of 1,533,003. The company has a market capitalization of $39.81 billion, a PE ratio of 16.21 and a beta of 1.55. The company has a current ratio of 2.59, a quick ratio of 1.61 and a debt-to-equity ratio of 0.26. The firm has a 50-day moving average price of $147.68 and a 200-day moving average price of $155.96. Nucor Co. has a twelve month low of $133.42 and a twelve month high of $203.00.

Nucor (NYSE:NUE - Get Free Report) last posted its quarterly earnings results on Monday, October 21st. The basic materials company reported $1.49 EPS for the quarter, topping analysts' consensus estimates of $1.40 by $0.09. Nucor had a return on equity of 12.06% and a net margin of 8.05%. The company had revenue of $7.44 billion during the quarter, compared to analysts' expectations of $7.28 billion. During the same quarter in the previous year, the firm earned $4.57 EPS. Nucor's revenue was down 15.2% on a year-over-year basis. As a group, analysts anticipate that Nucor Co. will post 8.65 earnings per share for the current fiscal year.

Nucor Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Friday, November 8th. Investors of record on Friday, September 27th will be given a dividend of $0.54 per share. The ex-dividend date of this dividend is Friday, September 27th. This represents a $2.16 dividend on an annualized basis and a yield of 1.29%. Nucor's dividend payout ratio is currently 20.87%.

Nucor Profile

(

Free Report)

Nucor Corporation engages in manufacture and sale of steel and steel products. It operates in three segments: steel mills, steel products, and raw materials. The Steel Mills segment produces hot-rolled, cold-rolled, and galvanized sheet steel products; plate steel products; wide-flange beams, beam blanks, and H-piling and sheet piling structural steel products; bar steel products, such as blooms, billets, concrete reinforcing and merchant bars, and engineered special bar quality products; and engages in the steel trading and rebar distribution businesses.

See Also

Before you consider Nucor, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nucor wasn't on the list.

While Nucor currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.