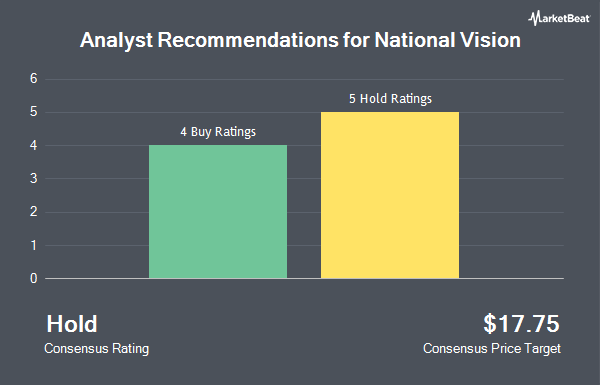

Shares of National Vision Holdings, Inc. (NASDAQ:EYE - Get Free Report) have earned an average rating of "Hold" from the six brokerages that are currently covering the firm, Marketbeat reports. Five analysts have rated the stock with a hold recommendation and one has given a buy recommendation to the company. The average 1 year price target among brokerages that have updated their coverage on the stock in the last year is $14.00.

EYE has been the subject of several research reports. Citigroup increased their target price on shares of National Vision from $12.00 to $13.00 and gave the company a "neutral" rating in a research note on Friday. Morgan Stanley reduced their price objective on National Vision from $14.00 to $13.00 and set an "equal weight" rating for the company in a research report on Tuesday, January 21st. Wells Fargo & Company raised their target price on National Vision from $12.00 to $13.00 and gave the stock an "equal weight" rating in a research report on Thursday, February 27th. Finally, Barclays raised their target price on National Vision from $12.00 to $14.00 and gave the stock an "equal weight" rating in a research report on Monday, March 3rd.

Check Out Our Latest Research Report on EYE

Institutional Inflows and Outflows

Hedge funds and other institutional investors have recently made changes to their positions in the stock. Vanguard Group Inc. lifted its holdings in National Vision by 1.6% during the 4th quarter. Vanguard Group Inc. now owns 10,411,838 shares of the company's stock valued at $108,491,000 after purchasing an additional 167,735 shares during the last quarter. Burgundy Asset Management Ltd. raised its position in National Vision by 138.6% in the 4th quarter. Burgundy Asset Management Ltd. now owns 4,675,539 shares of the company's stock valued at $48,719,000 after purchasing an additional 2,715,582 shares during the last quarter. Dimensional Fund Advisors LP raised its position in National Vision by 0.8% in the 4th quarter. Dimensional Fund Advisors LP now owns 3,702,371 shares of the company's stock valued at $38,577,000 after purchasing an additional 30,235 shares during the last quarter. Engine Capital Management LP raised its position in National Vision by 127.5% in the 4th quarter. Engine Capital Management LP now owns 2,528,053 shares of the company's stock valued at $26,342,000 after purchasing an additional 1,417,002 shares during the last quarter. Finally, Arrowstreet Capital Limited Partnership raised its position in National Vision by 81.5% in the 4th quarter. Arrowstreet Capital Limited Partnership now owns 2,308,375 shares of the company's stock valued at $24,053,000 after purchasing an additional 1,036,459 shares during the last quarter.

National Vision Stock Performance

Shares of EYE traded up $0.44 during mid-day trading on Friday, hitting $12.16. The company's stock had a trading volume of 1,993,093 shares, compared to its average volume of 1,507,243. The company has a debt-to-equity ratio of 0.30, a quick ratio of 0.37 and a current ratio of 0.57. National Vision has a one year low of $9.56 and a one year high of $24.11. The stock's 50-day moving average is $11.46 and its two-hundred day moving average is $11.06. The firm has a market capitalization of $958.00 million, a PE ratio of -60.80, a price-to-earnings-growth ratio of 3.27 and a beta of 1.51.

About National Vision

(

Get Free ReportNational Vision Holdings, Inc, through its subsidiaries, operates as an optical retailer in the United States. The company operates in two segments, Owned & Host and Legacy. It offers eyeglasses and contact lenses, and optical accessory products; provides eye exams through its America's Best, Eyeglass World, Vista Optical, Fred Meyer, and Vista Optical military, as well as Vision Center branded stores; and offers health maintenance organization and optometric services.

Featured Stories

Before you consider National Vision, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and National Vision wasn't on the list.

While National Vision currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.