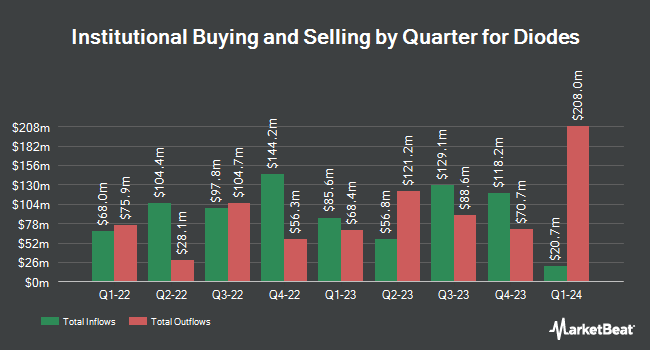

Natixis Advisors LLC trimmed its position in shares of Diodes Incorporated (NASDAQ:DIOD - Free Report) by 47.1% during the third quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 52,583 shares of the semiconductor company's stock after selling 46,887 shares during the quarter. Natixis Advisors LLC owned 0.11% of Diodes worth $3,370,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

Several other institutional investors have also recently made changes to their positions in DIOD. GAMMA Investing LLC raised its stake in shares of Diodes by 66.5% during the 2nd quarter. GAMMA Investing LLC now owns 453 shares of the semiconductor company's stock worth $33,000 after purchasing an additional 181 shares during the period. EntryPoint Capital LLC bought a new stake in shares of Diodes in the 1st quarter worth approximately $40,000. Innealta Capital LLC purchased a new position in Diodes in the second quarter valued at approximately $88,000. KBC Group NV lifted its stake in Diodes by 33.9% in the third quarter. KBC Group NV now owns 1,454 shares of the semiconductor company's stock valued at $93,000 after purchasing an additional 368 shares during the last quarter. Finally, EMC Capital Management grew its holdings in Diodes by 25.8% during the first quarter. EMC Capital Management now owns 1,632 shares of the semiconductor company's stock valued at $115,000 after purchasing an additional 335 shares during the period. Institutional investors own 99.23% of the company's stock.

Wall Street Analyst Weigh In

DIOD has been the topic of several research reports. StockNews.com upgraded Diodes from a "sell" rating to a "hold" rating in a research note on Monday, November 11th. Benchmark lowered their price objective on Diodes from $83.00 to $75.00 and set a "buy" rating on the stock in a research note on Monday, November 11th. Finally, Truist Financial cut their target price on shares of Diodes from $69.00 to $62.00 and set a "hold" rating for the company in a research report on Friday, November 8th. Four research analysts have rated the stock with a hold rating and two have given a buy rating to the company's stock. According to MarketBeat, the company presently has an average rating of "Hold" and an average price target of $72.80.

Get Our Latest Stock Analysis on Diodes

Diodes Price Performance

Shares of DIOD traded up $2.13 during midday trading on Friday, hitting $61.31. 423,739 shares of the company traded hands, compared to its average volume of 342,756. Diodes Incorporated has a one year low of $52.71 and a one year high of $86.74. The firm has a market cap of $2.84 billion, a P/E ratio of 46.44 and a beta of 1.32. The company has a debt-to-equity ratio of 0.01, a current ratio of 3.58 and a quick ratio of 2.21. The stock has a 50-day moving average of $61.47 and a 200-day moving average of $68.09.

Insider Buying and Selling at Diodes

In other Diodes news, CFO Brett R. Whitmire sold 1,900 shares of Diodes stock in a transaction dated Thursday, August 29th. The stock was sold at an average price of $69.99, for a total transaction of $132,981.00. Following the completion of the sale, the chief financial officer now owns 46,365 shares of the company's stock, valued at $3,245,086.35. The trade was a 3.94 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, SVP Emily Yang sold 1,000 shares of the stock in a transaction dated Friday, August 30th. The shares were sold at an average price of $70.48, for a total value of $70,480.00. Following the transaction, the senior vice president now owns 59,820 shares in the company, valued at $4,216,113.60. This trade represents a 1.64 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 4,172 shares of company stock valued at $295,249 in the last 90 days. Corporate insiders own 2.30% of the company's stock.

Diodes Company Profile

(

Free Report)

Diodes Incorporated, together with its subsidiaries, manufactures and supplies application-specific standard products in the broad discrete, logic, analog, and mixed-signal semiconductor markets worldwide. The company offers discrete semiconductor products, such as MOSFETs, SiC MOSFETs; data line protection, power line protection, thyristers, USB Type-C protection, and transient voltage suppressors; Schottky, small signal switching, Zener, and SiC diodes; bridges, super barrier, Schottky, Schottky bridge, and fast/ultra-fast rectifiers; and bipolar, avalanche, gate driver, and pre-bias transistors.

See Also

Before you consider Diodes, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Diodes wasn't on the list.

While Diodes currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.