Natixis Advisors LLC boosted its stake in shares of Huron Consulting Group Inc. (NASDAQ:HURN - Free Report) by 32.7% during the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The firm owned 18,571 shares of the business services provider's stock after buying an additional 4,576 shares during the quarter. Natixis Advisors LLC owned approximately 0.10% of Huron Consulting Group worth $2,019,000 as of its most recent SEC filing.

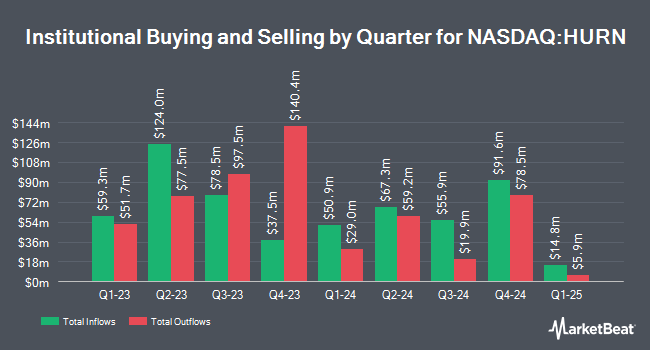

Several other hedge funds and other institutional investors have also recently bought and sold shares of HURN. Boston Partners lifted its holdings in Huron Consulting Group by 36.6% during the 1st quarter. Boston Partners now owns 922,254 shares of the business services provider's stock worth $88,994,000 after buying an additional 247,218 shares during the period. F M Investments LLC acquired a new position in shares of Huron Consulting Group in the 2nd quarter valued at about $10,202,000. William Blair Investment Management LLC acquired a new position in shares of Huron Consulting Group in the 2nd quarter valued at about $9,533,000. Assenagon Asset Management S.A. lifted its stake in shares of Huron Consulting Group by 240.8% in the 2nd quarter. Assenagon Asset Management S.A. now owns 136,307 shares of the business services provider's stock valued at $13,426,000 after purchasing an additional 96,308 shares during the period. Finally, Kennedy Capital Management LLC acquired a new position in shares of Huron Consulting Group in the 1st quarter valued at about $5,614,000. 93.90% of the stock is owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

HURN has been the topic of a number of recent analyst reports. Barrington Research boosted their price objective on Huron Consulting Group from $137.00 to $142.00 and gave the company an "outperform" rating in a research note on Monday, November 4th. StockNews.com raised Huron Consulting Group from a "hold" rating to a "buy" rating in a research note on Thursday, October 31st. Finally, Benchmark reissued a "buy" rating and issued a $140.00 price objective on shares of Huron Consulting Group in a research note on Wednesday, October 30th. Five investment analysts have rated the stock with a buy rating, Based on data from MarketBeat.com, the company presently has a consensus rating of "Buy" and an average price target of $133.00.

Read Our Latest Research Report on Huron Consulting Group

Huron Consulting Group Stock Down 0.8 %

Huron Consulting Group stock traded down $1.06 during midday trading on Tuesday, reaching $124.54. The stock had a trading volume of 83,647 shares, compared to its average volume of 123,187. Huron Consulting Group Inc. has a 12 month low of $84.26 and a 12 month high of $131.06. The company has a market capitalization of $2.21 billion, a P/E ratio of 27.06 and a beta of 0.60. The company has a fifty day moving average price of $112.94 and a two-hundred day moving average price of $104.76. The company has a current ratio of 1.61, a quick ratio of 1.61 and a debt-to-equity ratio of 0.82.

Huron Consulting Group (NASDAQ:HURN - Get Free Report) last issued its earnings results on Tuesday, October 29th. The business services provider reported $1.68 EPS for the quarter, beating analysts' consensus estimates of $1.57 by $0.11. Huron Consulting Group had a return on equity of 21.51% and a net margin of 5.80%. The business had revenue of $370.00 million during the quarter, compared to analyst estimates of $377.63 million. During the same period in the previous year, the company posted $1.39 EPS. The firm's revenue was up 3.3% compared to the same quarter last year. As a group, equities analysts expect that Huron Consulting Group Inc. will post 6.1 EPS for the current fiscal year.

Insiders Place Their Bets

In other Huron Consulting Group news, Director H Eugene Lockhart sold 1,042 shares of the business's stock in a transaction that occurred on Tuesday, October 1st. The stock was sold at an average price of $108.27, for a total transaction of $112,817.34. Following the completion of the sale, the director now directly owns 28,840 shares of the company's stock, valued at approximately $3,122,506.80. The trade was a 3.49 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, Director James H. Roth sold 2,000 shares of the business's stock in a transaction that occurred on Wednesday, November 6th. The stock was sold at an average price of $128.42, for a total value of $256,840.00. Following the sale, the director now directly owns 54,825 shares of the company's stock, valued at $7,040,626.50. This represents a 3.52 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders sold 5,126 shares of company stock valued at $604,420. Corporate insiders own 2.20% of the company's stock.

Huron Consulting Group Company Profile

(

Free Report)

Huron Consulting Group Inc, a professional services firm, provides consultancy services in the United States and internationally. It operates through three segments: Healthcare, Education, and Commercial. The Healthcare segment provides financial and operational performance improvement consulting services; digital offerings, spanning technology and analytic-related services; software products; organizational transformation services; revenue cycle managed and outsourcing services; financial and capital advisory consulting services; and strategy and innovation consulting services to national and regional health systems, academic and community health systems, federal health system, public, children's and critical access hospitals, physician practices and medical groups, payors, and long-term care or post-acute providers.

Featured Stories

Before you consider Huron Consulting Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Huron Consulting Group wasn't on the list.

While Huron Consulting Group currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.