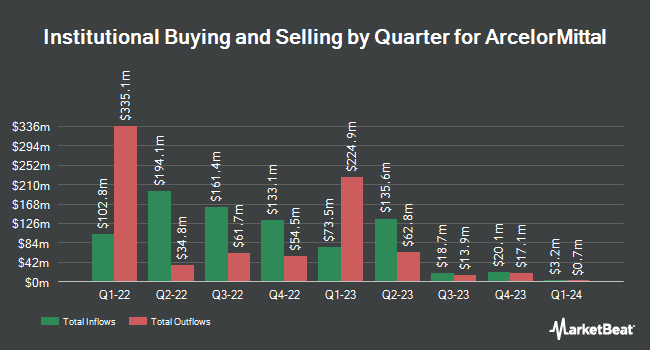

Natixis Advisors LLC boosted its holdings in shares of ArcelorMittal S.A. (NYSE:MT - Free Report) by 171.4% in the third quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 130,100 shares of the basic materials company's stock after purchasing an additional 82,164 shares during the period. Natixis Advisors LLC's holdings in ArcelorMittal were worth $3,416,000 as of its most recent SEC filing.

Several other institutional investors have also recently bought and sold shares of MT. Bank of New York Mellon Corp raised its position in shares of ArcelorMittal by 2,038.3% during the second quarter. Bank of New York Mellon Corp now owns 822,426 shares of the basic materials company's stock worth $18,858,000 after acquiring an additional 783,965 shares during the last quarter. Encompass Capital Advisors LLC bought a new stake in ArcelorMittal during the 2nd quarter worth about $12,679,000. Mediolanum International Funds Ltd acquired a new position in ArcelorMittal during the 3rd quarter valued at about $3,042,000. Robotti Robert bought a new position in shares of ArcelorMittal in the 1st quarter valued at about $1,435,000. Finally, Sei Investments Co. grew its position in shares of ArcelorMittal by 191.9% during the 2nd quarter. Sei Investments Co. now owns 53,358 shares of the basic materials company's stock worth $1,223,000 after buying an additional 35,077 shares during the period. Institutional investors own 9.88% of the company's stock.

ArcelorMittal Trading Down 0.7 %

Shares of NYSE MT opened at $25.11 on Friday. The company has a quick ratio of 0.59, a current ratio of 1.46 and a debt-to-equity ratio of 0.16. ArcelorMittal S.A. has a twelve month low of $20.52 and a twelve month high of $29.01. The company's fifty day moving average is $24.77 and its 200-day moving average is $24.02. The stock has a market cap of $20.22 billion, a price-to-earnings ratio of -17.81, a P/E/G ratio of 0.61 and a beta of 1.77.

ArcelorMittal (NYSE:MT - Get Free Report) last posted its earnings results on Thursday, November 7th. The basic materials company reported $0.63 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.58 by $0.05. ArcelorMittal had a positive return on equity of 5.26% and a negative net margin of 1.99%. The firm had revenue of $15.20 billion during the quarter, compared to analysts' expectations of $15.11 billion. The company's revenue was down 8.5% on a year-over-year basis. During the same period in the previous year, the firm earned $1.10 earnings per share. Equities research analysts predict that ArcelorMittal S.A. will post 2.99 EPS for the current year.

Analyst Ratings Changes

Several equities analysts recently weighed in on the stock. Bank of America upgraded shares of ArcelorMittal from a "neutral" rating to a "buy" rating and increased their price objective for the company from $30.00 to $32.90 in a report on Thursday, November 14th. Deutsche Bank Aktiengesellschaft upgraded ArcelorMittal from a "hold" rating to a "buy" rating and raised their price target for the stock from $29.00 to $31.00 in a research report on Wednesday, August 28th. JPMorgan Chase & Co. downgraded ArcelorMittal from an "overweight" rating to a "neutral" rating in a report on Friday, October 11th. Finally, Barclays upgraded ArcelorMittal from an "equal weight" rating to an "overweight" rating in a report on Monday, August 19th. Three equities research analysts have rated the stock with a hold rating and three have assigned a buy rating to the company's stock. According to data from MarketBeat, the company currently has a consensus rating of "Moderate Buy" and a consensus target price of $31.17.

Check Out Our Latest Research Report on MT

About ArcelorMittal

(

Free Report)

ArcelorMittal SA, together with its subsidiaries, operates as integrated steel and mining companies in the United States, Europe, and internationally. It offers semi-finished flat products, including slabs; finished flat products comprising plates, hot- and cold-rolled coils and sheets, hot-dipped and electro-galvanized coils and sheets, tinplate, and color coated coils and sheets; semi-finished long products, such as blooms and billets; finished long products consisting of bars, wire-rods, structural sections, rails, sheet piles, and wire-products; and seamless and welded pipes and tubes.

See Also

Before you consider ArcelorMittal, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ArcelorMittal wasn't on the list.

While ArcelorMittal currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.