Natixis Advisors LLC bought a new position in shares of MakeMyTrip Limited (NASDAQ:MMYT - Free Report) during the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor bought 13,119 shares of the technology company's stock, valued at approximately $1,219,000.

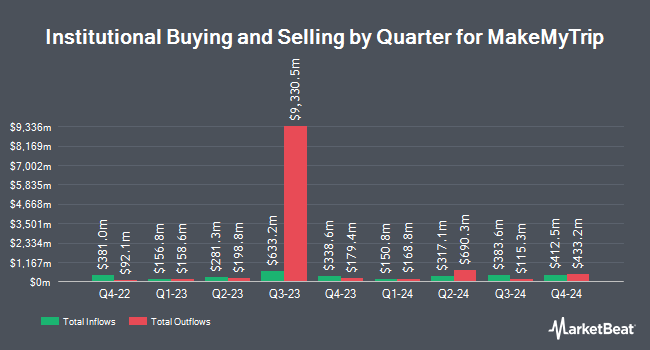

Several other institutional investors and hedge funds also recently added to or reduced their stakes in MMYT. Vanguard Group Inc. acquired a new position in MakeMyTrip during the first quarter worth about $2,317,000. Bayesian Capital Management LP acquired a new position in MakeMyTrip during the first quarter worth about $443,000. Janus Henderson Group PLC grew its position in MakeMyTrip by 143.2% during the first quarter. Janus Henderson Group PLC now owns 458,534 shares of the technology company's stock worth $32,574,000 after buying an additional 269,988 shares during the period. Tidal Investments LLC acquired a new position in MakeMyTrip during the first quarter worth about $3,891,000. Finally, LRI Investments LLC acquired a new position in MakeMyTrip during the first quarter worth about $149,000. 51.89% of the stock is currently owned by institutional investors and hedge funds.

MakeMyTrip Stock Up 4.0 %

MMYT stock opened at $114.25 on Wednesday. The company's 50 day simple moving average is $102.58 and its 200-day simple moving average is $93.13. The firm has a market capitalization of $12.54 billion, a PE ratio of 62.43, a P/E/G ratio of 6.18 and a beta of 1.27. MakeMyTrip Limited has a 12 month low of $41.56 and a 12 month high of $114.69. The company has a debt-to-equity ratio of 0.19, a current ratio of 2.82 and a quick ratio of 2.81.

MakeMyTrip (NASDAQ:MMYT - Get Free Report) last announced its quarterly earnings data on Wednesday, October 23rd. The technology company reported $0.36 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.26 by $0.10. The business had revenue of $210.99 million for the quarter, compared to the consensus estimate of $214.90 million. MakeMyTrip had a net margin of 26.64% and a return on equity of 11.54%. During the same quarter in the prior year, the firm posted $0.18 earnings per share. Equities analysts expect that MakeMyTrip Limited will post 1.29 earnings per share for the current fiscal year.

Wall Street Analysts Forecast Growth

Several analysts have recently commented on MMYT shares. StockNews.com lowered shares of MakeMyTrip from a "hold" rating to a "sell" rating in a research report on Wednesday, November 20th. Bank of America increased their price target on shares of MakeMyTrip from $112.00 to $119.00 and gave the company a "buy" rating in a research report on Thursday, October 24th.

Read Our Latest Analysis on MMYT

About MakeMyTrip

(

Free Report)

MakeMyTrip Limited, an online travel company, sells travel products and solutions in India, the United States, Singapore, Malaysia, Thailand, the United Arab Emirates, Peru, Colombia, Vietnam, and Indonesia. The company operates through three segments: Air Ticketing, Hotels and Packages, and Bus Ticketing.

Featured Stories

Before you consider MakeMyTrip, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MakeMyTrip wasn't on the list.

While MakeMyTrip currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.