Natixis Advisors LLC lifted its holdings in Comfort Systems USA, Inc. (NYSE:FIX - Free Report) by 871.4% during the third quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 132,693 shares of the construction company's stock after acquiring an additional 119,033 shares during the quarter. Natixis Advisors LLC owned 0.37% of Comfort Systems USA worth $51,797,000 as of its most recent SEC filing.

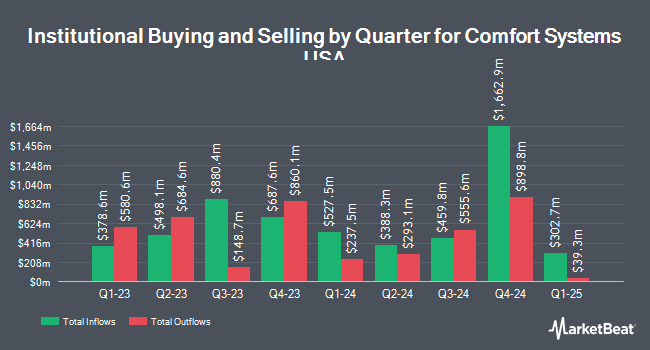

Other institutional investors have also recently made changes to their positions in the company. Capital World Investors increased its holdings in shares of Comfort Systems USA by 26.6% during the 1st quarter. Capital World Investors now owns 2,153,707 shares of the construction company's stock valued at $684,254,000 after purchasing an additional 451,852 shares in the last quarter. Millennium Management LLC lifted its holdings in Comfort Systems USA by 477.9% in the 2nd quarter. Millennium Management LLC now owns 342,724 shares of the construction company's stock valued at $104,229,000 after purchasing an additional 283,416 shares in the last quarter. Blackstone Inc. acquired a new position in Comfort Systems USA during the first quarter worth about $41,302,000. Swedbank AB purchased a new stake in shares of Comfort Systems USA in the first quarter valued at approximately $31,771,000. Finally, Susquehanna Fundamental Investments LLC acquired a new stake in shares of Comfort Systems USA in the second quarter valued at approximately $29,743,000. Hedge funds and other institutional investors own 96.51% of the company's stock.

Insider Buying and Selling

In other news, insider Brian E. Lane sold 15,000 shares of the firm's stock in a transaction that occurred on Wednesday, November 13th. The shares were sold at an average price of $448.88, for a total transaction of $6,733,200.00. Following the transaction, the insider now directly owns 204,205 shares in the company, valued at approximately $91,663,540.40. This trade represents a 6.84 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is accessible through this link. Also, CFO William George III sold 5,845 shares of Comfort Systems USA stock in a transaction on Tuesday, August 20th. The shares were sold at an average price of $332.16, for a total transaction of $1,941,475.20. Following the completion of the transaction, the chief financial officer now directly owns 55,099 shares in the company, valued at $18,301,683.84. The trade was a 9.59 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 41,591 shares of company stock worth $16,625,615 in the last ninety days. 1.80% of the stock is owned by corporate insiders.

Comfort Systems USA Stock Up 1.3 %

Shares of FIX stock traded up $5.61 during trading hours on Friday, reaching $445.02. 284,473 shares of the stock were exchanged, compared to its average volume of 393,907. Comfort Systems USA, Inc. has a 12-month low of $185.83 and a 12-month high of $474.62. The business's fifty day moving average is $398.73 and its two-hundred day moving average is $348.11. The firm has a market capitalization of $15.84 billion, a P/E ratio of 34.05 and a beta of 1.13. The company has a debt-to-equity ratio of 0.04, a current ratio of 1.04 and a quick ratio of 1.02.

Comfort Systems USA (NYSE:FIX - Get Free Report) last posted its earnings results on Thursday, October 24th. The construction company reported $4.09 earnings per share for the quarter, topping the consensus estimate of $3.97 by $0.12. The firm had revenue of $1.81 billion during the quarter, compared to analysts' expectations of $1.84 billion. Comfort Systems USA had a return on equity of 32.74% and a net margin of 7.18%. The firm's revenue was up 31.5% compared to the same quarter last year. During the same quarter in the previous year, the business earned $2.74 earnings per share. As a group, research analysts expect that Comfort Systems USA, Inc. will post 13.88 EPS for the current fiscal year.

Comfort Systems USA Increases Dividend

The business also recently announced a quarterly dividend, which will be paid on Monday, November 25th. Investors of record on Thursday, November 14th will be given a $0.35 dividend. This represents a $1.40 dividend on an annualized basis and a dividend yield of 0.31%. This is an increase from Comfort Systems USA's previous quarterly dividend of $0.30. The ex-dividend date of this dividend is Thursday, November 14th. Comfort Systems USA's dividend payout ratio (DPR) is 10.71%.

Analyst Ratings Changes

Several brokerages have issued reports on FIX. Stifel Nicolaus started coverage on Comfort Systems USA in a report on Friday. They issued a "buy" rating and a $524.00 target price for the company. StockNews.com raised shares of Comfort Systems USA from a "hold" rating to a "buy" rating in a report on Saturday, October 12th. Two investment analysts have rated the stock with a hold rating and three have given a buy rating to the company. Based on data from MarketBeat, the stock has an average rating of "Moderate Buy" and an average price target of $376.00.

Read Our Latest Analysis on FIX

Comfort Systems USA Company Profile

(

Free Report)

Comfort Systems USA, Inc, together with its subsidiaries, provides mechanical and electrical installation, renovation, maintenance, repair, and replacement services for the mechanical and electrical services industry in the United States. It operates through two segments, Mechanical and Electrical. The company offers heating, ventilation, and air conditioning systems, as well as plumbing, electrical, piping and controls, off-site construction, monitoring, and fire protection.

Featured Articles

Before you consider Comfort Systems USA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Comfort Systems USA wasn't on the list.

While Comfort Systems USA currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.