Natixis Advisors LLC lifted its position in shares of Marvell Technology, Inc. (NASDAQ:MRVL - Free Report) by 55.4% during the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission. The institutional investor owned 1,068,155 shares of the semiconductor company's stock after purchasing an additional 380,876 shares during the quarter. Natixis Advisors LLC owned approximately 0.12% of Marvell Technology worth $77,035,000 as of its most recent filing with the Securities and Exchange Commission.

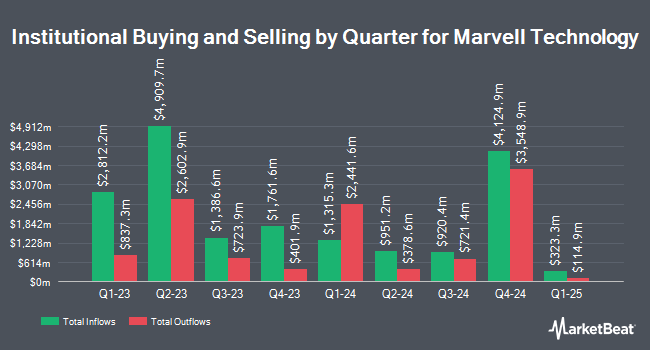

Other institutional investors also recently modified their holdings of the company. Quarry LP acquired a new stake in Marvell Technology in the 2nd quarter valued at $32,000. Strategic Investment Solutions Inc. IL acquired a new stake in Marvell Technology in the 2nd quarter valued at $32,000. Whittier Trust Co. boosted its stake in Marvell Technology by 74.5% in the 3rd quarter. Whittier Trust Co. now owns 492 shares of the semiconductor company's stock valued at $35,000 after buying an additional 210 shares in the last quarter. Exchange Traded Concepts LLC boosted its stake in Marvell Technology by 125.4% in the third quarter. Exchange Traded Concepts LLC now owns 604 shares of the semiconductor company's stock worth $44,000 after purchasing an additional 336 shares in the last quarter. Finally, Unique Wealth Strategies LLC acquired a new position in Marvell Technology in the second quarter worth $45,000. Institutional investors and hedge funds own 83.51% of the company's stock.

Analyst Upgrades and Downgrades

A number of research firms have commented on MRVL. Needham & Company LLC reissued a "buy" rating and issued a $95.00 price objective on shares of Marvell Technology in a research note on Friday, August 30th. Morgan Stanley boosted their price objective on Marvell Technology from $77.00 to $82.00 and gave the stock an "equal weight" rating in a research note on Friday, August 30th. Barclays boosted their price objective on Marvell Technology from $80.00 to $85.00 and gave the stock an "overweight" rating in a research note on Friday, August 30th. The Goldman Sachs Group boosted their price objective on Marvell Technology from $77.00 to $87.00 and gave the stock a "buy" rating in a research note on Friday, August 30th. Finally, Cantor Fitzgerald restated an "overweight" rating and set a $85.00 target price on shares of Marvell Technology in a research report on Friday, August 30th. One research analyst has rated the stock with a sell rating, two have given a hold rating, twenty have assigned a buy rating and one has given a strong buy rating to the stock. Based on data from MarketBeat.com, the company currently has an average rating of "Moderate Buy" and an average price target of $91.77.

View Our Latest Stock Analysis on MRVL

Insider Transactions at Marvell Technology

In related news, EVP Mark Casper sold 2,500 shares of the company's stock in a transaction that occurred on Tuesday, October 1st. The stock was sold at an average price of $70.83, for a total value of $177,075.00. Following the transaction, the executive vice president now owns 22,494 shares in the company, valued at approximately $1,593,250.02. This represents a 10.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Also, insider Muhammad Raghib Hussain sold 150,000 shares of the company's stock in a transaction that occurred on Tuesday, October 15th. The shares were sold at an average price of $80.50, for a total value of $12,075,000.00. Following the completion of the transaction, the insider now owns 694,487 shares in the company, valued at approximately $55,906,203.50. The trade was a 17.76 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 259,500 shares of company stock worth $20,230,710 in the last 90 days. Insiders own 0.33% of the company's stock.

Marvell Technology Price Performance

Shares of NASDAQ MRVL traded down $2.87 during mid-day trading on Friday, hitting $87.83. 10,001,282 shares of the stock traded hands, compared to its average volume of 9,496,007. The firm has a 50 day simple moving average of $78.89 and a two-hundred day simple moving average of $72.74. Marvell Technology, Inc. has a twelve month low of $50.35 and a twelve month high of $95.09. The company has a debt-to-equity ratio of 0.28, a current ratio of 1.79 and a quick ratio of 1.26. The company has a market cap of $77.83 billion, a PE ratio of -79.13, a price-to-earnings-growth ratio of 3.82 and a beta of 1.44.

Marvell Technology (NASDAQ:MRVL - Get Free Report) last posted its quarterly earnings data on Thursday, August 29th. The semiconductor company reported $0.30 earnings per share for the quarter, hitting the consensus estimate of $0.30. Marvell Technology had a positive return on equity of 4.31% and a negative net margin of 18.30%. The firm had revenue of $1.27 billion during the quarter, compared to analyst estimates of $1.25 billion. During the same period last year, the company posted $0.18 EPS. The business's quarterly revenue was down 5.1% on a year-over-year basis. As a group, equities research analysts forecast that Marvell Technology, Inc. will post 0.78 EPS for the current fiscal year.

Marvell Technology Dividend Announcement

The firm also recently announced a quarterly dividend, which was paid on Thursday, October 31st. Stockholders of record on Friday, October 11th were paid a $0.06 dividend. The ex-dividend date was Friday, October 11th. This represents a $0.24 dividend on an annualized basis and a dividend yield of 0.27%. Marvell Technology's payout ratio is presently -21.62%.

Marvell Technology Profile

(

Free Report)

Marvell Technology, Inc, together with its subsidiaries, provides data infrastructure semiconductor solutions, spanning the data center core to network edge. The company develops and scales complex System-on-a-Chip architectures, integrating analog, mixed-signal, and digital signal processing functionality.

Further Reading

Before you consider Marvell Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Marvell Technology wasn't on the list.

While Marvell Technology currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.