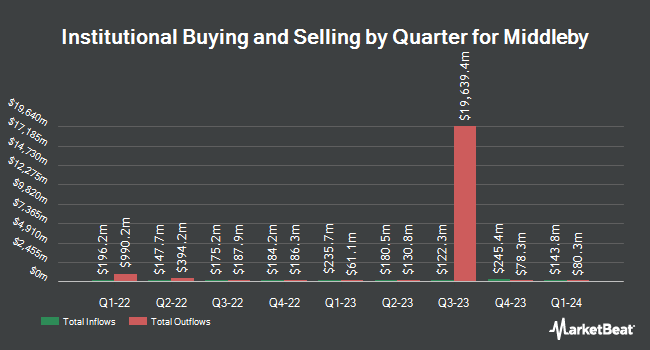

Natixis Advisors LLC purchased a new position in shares of The Middleby Co. (NASDAQ:MIDD - Free Report) in the 3rd quarter, according to its most recent Form 13F filing with the SEC. The firm purchased 78,545 shares of the industrial products company's stock, valued at approximately $10,928,000. Natixis Advisors LLC owned about 0.15% of Middleby at the end of the most recent quarter.

Several other institutional investors have also added to or reduced their stakes in MIDD. Coastline Trust Co acquired a new stake in shares of Middleby during the third quarter worth $104,000. CIBC Asset Management Inc bought a new position in Middleby during the third quarter worth about $218,000. Lummis Asset Management LP raised its stake in Middleby by 2.2% in the 3rd quarter. Lummis Asset Management LP now owns 8,979 shares of the industrial products company's stock worth $1,249,000 after purchasing an additional 195 shares in the last quarter. Oppenheimer Asset Management Inc. bought a new stake in Middleby in the 3rd quarter valued at about $2,220,000. Finally, Entropy Technologies LP acquired a new position in shares of Middleby during the 3rd quarter worth approximately $250,000. 98.55% of the stock is currently owned by institutional investors.

Analysts Set New Price Targets

A number of research firms have recently weighed in on MIDD. StockNews.com upgraded shares of Middleby from a "hold" rating to a "buy" rating in a research report on Monday, November 4th. Canaccord Genuity Group cut their target price on Middleby from $164.00 to $155.00 and set a "buy" rating for the company in a research report on Friday, November 1st. Robert W. Baird raised their price target on Middleby from $155.00 to $169.00 and gave the stock an "outperform" rating in a research report on Friday, August 2nd. Canaccord Genuity Group reaffirmed a "buy" rating and set a $164.00 price objective on shares of Middleby in a research report on Saturday, September 14th. Finally, JPMorgan Chase & Co. increased their price objective on shares of Middleby from $118.00 to $120.00 and gave the stock an "underweight" rating in a research note on Friday, August 2nd. One research analyst has rated the stock with a sell rating, two have assigned a hold rating and six have issued a buy rating to the company. Based on data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and a consensus price target of $154.67.

Get Our Latest Report on MIDD

Middleby Stock Down 0.4 %

MIDD stock opened at $135.73 on Thursday. The firm has a 50-day moving average price of $137.32 and a 200-day moving average price of $133.36. The Middleby Co. has a 12 month low of $118.41 and a 12 month high of $161.01. The company has a current ratio of 2.81, a quick ratio of 1.70 and a debt-to-equity ratio of 0.66. The stock has a market capitalization of $7.30 billion, a P/E ratio of 18.72 and a beta of 1.58.

Middleby (NASDAQ:MIDD - Get Free Report) last issued its quarterly earnings data on Thursday, October 31st. The industrial products company reported $2.33 EPS for the quarter, missing the consensus estimate of $2.48 by ($0.15). The company had revenue of $942.81 million during the quarter, compared to the consensus estimate of $996.60 million. Middleby had a net margin of 10.14% and a return on equity of 14.66%. Middleby's revenue for the quarter was down 3.9% on a year-over-year basis. During the same period in the previous year, the company earned $2.35 EPS. As a group, equities research analysts anticipate that The Middleby Co. will post 9.2 EPS for the current fiscal year.

Middleby Profile

(

Free Report)

The Middleby Corporation designs, markets, manufactures, distributes, and services foodservice, food processing, and residential kitchen equipment worldwide. Its Commercial Foodservice Equipment Group segment offers conveyor, combi, convection, baking, proofing, deck, speed cooking, and hydrovection ovens; ranges, fryers, and rethermalizers; steam cooking, food warming, catering, induction cooking, and countertop cooking equipment; heated cabinets, charbroilers, ventless cooking systems, kitchen ventilation, toasters, griddles, charcoal grills, professional mixers, stainless steel fabrication, custom millwork, professional refrigerators, blast chillers, cold rooms, ice machines, and freezers; soft serve ice cream, coffee and beverage dispensing, home and professional craft brewing equipment; and fry dispensers, bottle filling and canning equipment, IoT solutions, and controls development and manufacturing.

Further Reading

Before you consider Middleby, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Middleby wasn't on the list.

While Middleby currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.