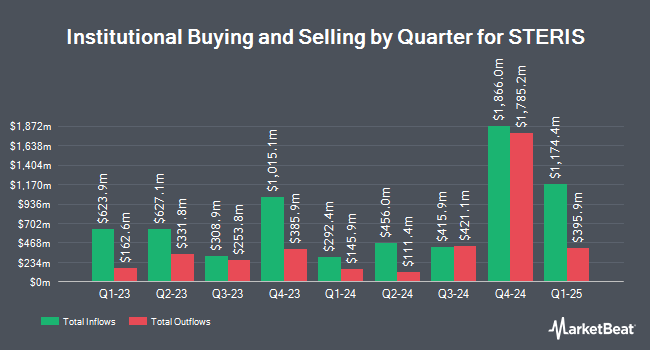

Natural Investments LLC acquired a new stake in STERIS plc (NYSE:STE - Free Report) during the 4th quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor acquired 1,628 shares of the medical equipment provider's stock, valued at approximately $334,000.

Other hedge funds also recently bought and sold shares of the company. Ashton Thomas Securities LLC purchased a new stake in shares of STERIS in the 3rd quarter worth $25,000. Human Investing LLC purchased a new stake in shares of STERIS in the 4th quarter worth $31,000. Anfield Capital Management LLC lifted its holdings in shares of STERIS by 100.0% in the 4th quarter. Anfield Capital Management LLC now owns 182 shares of the medical equipment provider's stock worth $37,000 after buying an additional 91 shares during the period. Central Pacific Bank Trust Division lifted its holdings in shares of STERIS by 65.5% in the 4th quarter. Central Pacific Bank Trust Division now owns 192 shares of the medical equipment provider's stock worth $39,000 after buying an additional 76 shares during the period. Finally, Manchester Capital Management LLC lifted its holdings in shares of STERIS by 182.7% in the 4th quarter. Manchester Capital Management LLC now owns 212 shares of the medical equipment provider's stock worth $44,000 after buying an additional 137 shares during the period. Institutional investors own 94.69% of the company's stock.

STERIS Trading Down 1.5 %

Shares of NYSE:STE opened at $228.13 on Wednesday. The business's 50-day moving average is $217.94 and its 200 day moving average is $222.62. STERIS plc has a 1 year low of $197.82 and a 1 year high of $248.24. The firm has a market capitalization of $22.41 billion, a P/E ratio of 48.44 and a beta of 0.92. The company has a debt-to-equity ratio of 0.32, a current ratio of 2.13 and a quick ratio of 1.40.

STERIS (NYSE:STE - Get Free Report) last announced its earnings results on Wednesday, February 5th. The medical equipment provider reported $2.32 earnings per share (EPS) for the quarter, missing the consensus estimate of $2.33 by ($0.01). STERIS had a net margin of 8.66% and a return on equity of 13.91%. On average, research analysts predict that STERIS plc will post 9.08 earnings per share for the current fiscal year.

STERIS Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Friday, March 21st. Stockholders of record on Thursday, February 20th will be issued a $0.57 dividend. This represents a $2.28 dividend on an annualized basis and a dividend yield of 1.00%. The ex-dividend date of this dividend is Thursday, February 20th. STERIS's dividend payout ratio is presently 48.41%.

Wall Street Analyst Weigh In

Several brokerages have weighed in on STE. Piper Sandler upped their target price on STERIS from $260.00 to $265.00 and gave the stock an "overweight" rating in a report on Monday, February 3rd. JMP Securities restated a "market outperform" rating and set a $265.00 price objective on shares of STERIS in a research note on Thursday, February 6th. Finally, Stephens restated an "overweight" rating and set a $240.00 price objective on shares of STERIS in a research note on Thursday, February 6th. One equities research analyst has rated the stock with a hold rating and five have issued a buy rating to the stock. According to MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and an average price target of $258.75.

Get Our Latest Stock Analysis on STERIS

STERIS Company Profile

(

Free Report)

STERIS plc provides infection prevention products and services worldwide. It operates through four segments: Healthcare, Applied Sterilization Technologies, Life Sciences, and Dental. The Healthcare segment offers cleaning chemistries and sterility assurance products; automated endoscope reprocessing system and tracking products; endoscopy accessories, washers, sterilizers, and other pieces of capital equipment for the operation of a sterile processing department; and equipment used directly in the operating room, including surgical tables, lights, and connectivity solutions, as well as equipment management services.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider STERIS, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and STERIS wasn't on the list.

While STERIS currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.