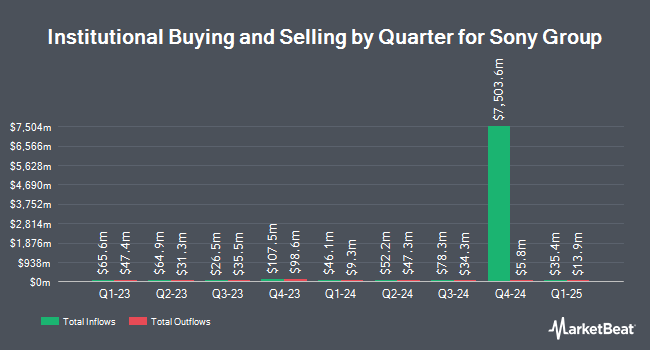

Natural Investments LLC bought a new position in Sony Group Co. (NYSE:SONY - Free Report) in the 4th quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm bought 68,734 shares of the company's stock, valued at approximately $1,454,000.

Several other large investors have also recently modified their holdings of SONY. Wealthfront Advisers LLC purchased a new position in Sony Group during the fourth quarter valued at approximately $838,000. Markel Group Inc. grew its stake in Sony Group by 400.0% during the fourth quarter. Markel Group Inc. now owns 335,000 shares of the company's stock valued at $7,089,000 after acquiring an additional 268,000 shares in the last quarter. S&CO Inc. grew its stake in Sony Group by 400.0% during the fourth quarter. S&CO Inc. now owns 55,000 shares of the company's stock valued at $1,163,000 after acquiring an additional 44,000 shares in the last quarter. Dearborn Partners LLC grew its stake in Sony Group by 384.8% during the fourth quarter. Dearborn Partners LLC now owns 16,114 shares of the company's stock valued at $341,000 after acquiring an additional 12,790 shares in the last quarter. Finally, Investors Research Corp grew its stake in Sony Group by 400.0% during the fourth quarter. Investors Research Corp now owns 6,820 shares of the company's stock valued at $144,000 after acquiring an additional 5,456 shares in the last quarter. Hedge funds and other institutional investors own 14.05% of the company's stock.

Sony Group Trading Down 5.3 %

Shares of SONY opened at $22.87 on Tuesday. The firm has a market cap of $138.28 billion, a price-to-earnings ratio of 18.56, a PEG ratio of 9.95 and a beta of 0.91. The company has a debt-to-equity ratio of 0.25, a quick ratio of 0.49 and a current ratio of 0.66. Sony Group Co. has a fifty-two week low of $15.02 and a fifty-two week high of $25.64. The firm has a 50 day moving average price of $22.48 and a 200-day moving average price of $17.66.

Sony Group (NYSE:SONY - Get Free Report) last announced its quarterly earnings data on Thursday, February 13th. The company reported $0.41 earnings per share for the quarter, topping analysts' consensus estimates of $0.27 by $0.14. Sony Group had a net margin of 8.21% and a return on equity of 14.10%. The firm had revenue of $28.95 billion during the quarter, compared to analyst estimates of $24.32 billion. As a group, equities research analysts forecast that Sony Group Co. will post 1.23 earnings per share for the current year.

Analysts Set New Price Targets

Several equities analysts recently commented on the stock. StockNews.com cut shares of Sony Group from a "buy" rating to a "hold" rating in a research note on Tuesday, February 25th. Sanford C. Bernstein initiated coverage on shares of Sony Group in a research report on Thursday, January 16th. They set an "outperform" rating for the company. Finally, Oppenheimer reiterated an "outperform" rating and set a $33.00 target price (up from $25.00) on shares of Sony Group in a research report on Thursday, February 20th. One equities research analyst has rated the stock with a hold rating, three have assigned a buy rating and one has issued a strong buy rating to the company. Based on data from MarketBeat.com, the stock currently has an average rating of "Buy" and a consensus target price of $28.00.

View Our Latest Stock Analysis on SONY

Sony Group Company Profile

(

Free Report)

Sony Group Corporation designs, develops, produces, and sells electronic equipment, instruments, and devices for the consumer, professional, and industrial markets in Japan, the United States, Europe, China, the Asia-Pacific, and internationally. The company distributes software titles and add-on content through digital networks; network services related to game, video, and music content; and home gaming consoles, packaged and game software, and peripheral devices.

Further Reading

Want to see what other hedge funds are holding SONY? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Sony Group Co. (NYSE:SONY - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Sony Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sony Group wasn't on the list.

While Sony Group currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.