Nayax (NASDAQ:NYAX - Free Report) had its price target boosted by Keefe, Bruyette & Woods from $33.00 to $38.00 in a research report sent to investors on Thursday,Benzinga reports. The brokerage currently has a market perform rating on the stock.

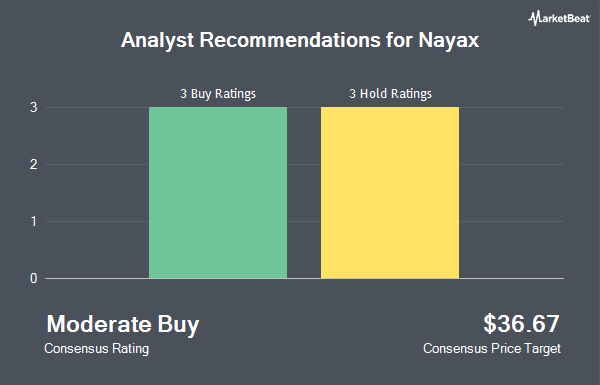

Separately, B. Riley restated a "buy" rating and issued a $44.00 price target (up from $42.00) on shares of Nayax in a research note on Wednesday, March 5th. Four research analysts have rated the stock with a hold rating and two have assigned a buy rating to the company's stock. According to MarketBeat, the company presently has an average rating of "Hold" and an average price target of $34.75.

Check Out Our Latest Research Report on Nayax

Nayax Stock Performance

NYAX traded down $0.77 during trading on Thursday, hitting $35.06. The stock had a trading volume of 28,046 shares, compared to its average volume of 8,344. The company has a debt-to-equity ratio of 0.11, a current ratio of 1.25 and a quick ratio of 1.16. The company has a 50 day moving average price of $36.12 and a 200-day moving average price of $29.98. Nayax has a one year low of $20.31 and a one year high of $40.70. The firm has a market cap of $1.24 billion, a price-to-earnings ratio of -113.10 and a beta of 0.08.

Institutional Trading of Nayax

Several large investors have recently modified their holdings of NYAX. Y.D. More Investments Ltd lifted its position in Nayax by 42.7% during the fourth quarter. Y.D. More Investments Ltd now owns 1,183,988 shares of the company's stock worth $34,630,000 after purchasing an additional 354,350 shares during the period. Swedbank AB raised its holdings in shares of Nayax by 107.6% during the 3rd quarter. Swedbank AB now owns 207,559 shares of the company's stock worth $5,233,000 after buying an additional 107,559 shares in the last quarter. Barclays PLC lifted its position in shares of Nayax by 5,526.8% during the 3rd quarter. Barclays PLC now owns 2,307 shares of the company's stock worth $58,000 after buying an additional 2,266 shares during the last quarter. Public Employees Retirement System of Ohio acquired a new stake in Nayax in the third quarter valued at about $69,000. Finally, Verdence Capital Advisors LLC bought a new position in Nayax in the fourth quarter valued at about $326,000. 34.87% of the stock is owned by institutional investors and hedge funds.

About Nayax

(

Get Free Report)

Nayax Ltd., a fintech company, operates system and payment platform for multiple retailers in the United States, Europe, the United Kingdom, Australia, Israel, and rest of the world. The company offers AMIT 3.0, a machine-to-machine vending telemetry solution; Nayax Core, a management and monitoring software for vending machines and other unattended machines; MoMa, a mobile app for unattended machine; Tigapo back-office software suite, a cloud-based platform; EV Core, a smart, cloud-based management platform; Retail Management Cloud, a comprehensive attended retail management platform; Loyalty and Marketing Suite, a consumer engagement marketing and loyalty platform; Monyx Wallet, a digital wallet app enabling cashless payments with mobile phones; Weezmo, a consumer engagement and marketing platform; and Tigapo app, a proprietary mobile app to help family entertainment center businesses.

Featured Articles

Before you consider Nayax, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nayax wasn't on the list.

While Nayax currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.