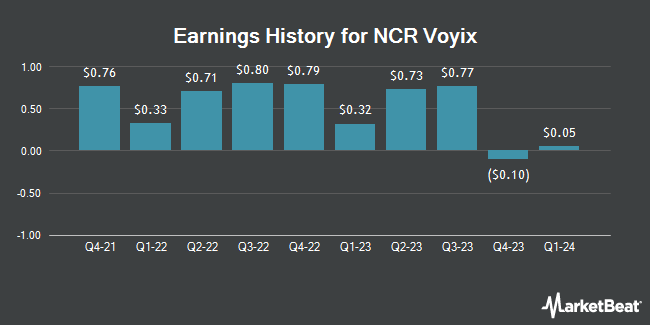

NCR Voyix (NYSE:VYX - Get Free Report) announced its quarterly earnings data on Thursday. The company reported ($0.24) earnings per share (EPS) for the quarter, missing the consensus estimate of ($0.01) by ($0.23), Zacks reports. NCR Voyix had a negative net margin of 11.68% and a positive return on equity of 7.35%. The business had revenue of $711.00 million for the quarter, compared to analysts' expectations of $692.58 million. During the same period in the prior year, the company posted $0.77 EPS. The firm's revenue was down 12.1% on a year-over-year basis. NCR Voyix updated its FY 2024 guidance to EPS.

NCR Voyix Trading Up 3.0 %

NCR Voyix stock traded up $0.42 during mid-day trading on Friday, hitting $14.39. The stock had a trading volume of 2,563,372 shares, compared to its average volume of 1,029,272. The stock has a market capitalization of $2.09 billion, a PE ratio of -3.60 and a beta of 1.64. The stock has a 50-day simple moving average of $13.23 and a two-hundred day simple moving average of $13.13. NCR Voyix has a 12 month low of $10.87 and a 12 month high of $17.39.

Insider Activity at NCR Voyix

In related news, EVP Eric Schoch acquired 21,692 shares of the firm's stock in a transaction dated Tuesday, August 13th. The stock was bought at an average price of $12.19 per share, for a total transaction of $264,425.48. Following the acquisition, the executive vice president now directly owns 101,671 shares of the company's stock, valued at approximately $1,239,369.49. The trade was a 0.00 % increase in their ownership of the stock. The acquisition was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this link. In other NCR Voyix news, insider James G. Kelly acquired 14,800 shares of the company's stock in a transaction that occurred on Tuesday, August 27th. The stock was acquired at an average cost of $13.41 per share, for a total transaction of $198,468.00. Following the transaction, the insider now directly owns 46,900 shares in the company, valued at $628,929. This represents a 0.00 % increase in their ownership of the stock. The acquisition was disclosed in a legal filing with the SEC, which is available through this link. Also, EVP Eric Schoch purchased 21,692 shares of NCR Voyix stock in a transaction dated Tuesday, August 13th. The shares were purchased at an average price of $12.19 per share, for a total transaction of $264,425.48. Following the completion of the acquisition, the executive vice president now owns 101,671 shares of the company's stock, valued at approximately $1,239,369.49. The trade was a 0.00 % increase in their position. The disclosure for this purchase can be found here. 0.61% of the stock is currently owned by corporate insiders.

Analyst Ratings Changes

VYX has been the subject of several analyst reports. Needham & Company LLC reissued a "buy" rating and set a $20.00 target price on shares of NCR Voyix in a research note on Monday, October 14th. DA Davidson dropped their price target on NCR Voyix from $20.00 to $16.00 and set a "buy" rating for the company in a research report on Friday, August 9th. Royal Bank of Canada dropped their price objective on NCR Voyix from $19.00 to $16.00 and set an "outperform" rating for the company in a report on Wednesday, August 7th. Finally, The Goldman Sachs Group assumed coverage on shares of NCR Voyix in a report on Monday, October 14th. They issued a "neutral" rating and a $14.00 target price on the stock. One equities research analyst has rated the stock with a hold rating and six have assigned a buy rating to the company. Based on data from MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and an average price target of $16.43.

View Our Latest Stock Analysis on NCR Voyix

NCR Voyix Company Profile

(

Get Free Report)

NCR Voyix Corporation provides various software and services in the United States, the Americas, the Asia Pacific, Europe, the Middle East, and Africa. The company operates through three segments: Retail; Restaurants; and Digital Banking. It offers software, services, and hardware; and digital banking solutions for financial institution's consumer and business customers.

Recommended Stories

Before you consider NCR Voyix, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NCR Voyix wasn't on the list.

While NCR Voyix currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.