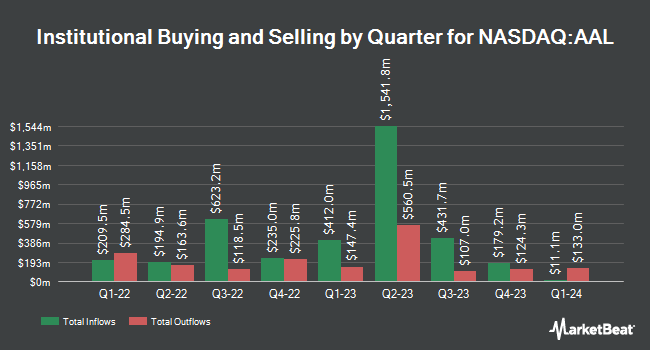

Nebula Research & Development LLC acquired a new position in shares of American Airlines Group Inc. (NASDAQ:AAL - Free Report) during the 4th quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm acquired 82,025 shares of the airline's stock, valued at approximately $1,430,000.

A number of other hedge funds and other institutional investors also recently modified their holdings of the company. Golden State Wealth Management LLC acquired a new position in American Airlines Group in the 4th quarter valued at $25,000. Brooklyn Investment Group raised its stake in American Airlines Group by 133.1% in the fourth quarter. Brooklyn Investment Group now owns 1,592 shares of the airline's stock valued at $28,000 after purchasing an additional 909 shares in the last quarter. Bfsg LLC grew its stake in American Airlines Group by 269.3% during the fourth quarter. Bfsg LLC now owns 2,057 shares of the airline's stock worth $36,000 after buying an additional 1,500 shares in the last quarter. Bernard Wealth Management Corp. bought a new position in American Airlines Group in the 4th quarter valued at about $42,000. Finally, Harvest Fund Management Co. Ltd acquired a new position in shares of American Airlines Group in the 4th quarter valued at approximately $45,000. Institutional investors and hedge funds own 52.44% of the company's stock.

American Airlines Group Stock Up 1.5 %

AAL opened at $9.75 on Friday. The stock has a market cap of $6.43 billion, a PE ratio of 8.55, a price-to-earnings-growth ratio of 0.21 and a beta of 1.17. American Airlines Group Inc. has a twelve month low of $8.50 and a twelve month high of $19.10. The company has a fifty day moving average of $11.47 and a 200-day moving average of $14.22.

American Airlines Group (NASDAQ:AAL - Get Free Report) last announced its quarterly earnings data on Thursday, April 24th. The airline reported ($0.59) earnings per share (EPS) for the quarter, beating analysts' consensus estimates of ($0.69) by $0.10. The company had revenue of $12.55 billion for the quarter, compared to the consensus estimate of $12.71 billion. American Airlines Group had a negative return on equity of 28.56% and a net margin of 1.56%. Sell-side analysts anticipate that American Airlines Group Inc. will post 2.42 EPS for the current fiscal year.

Insiders Place Their Bets

In other news, SVP Angela Owens sold 51,906 shares of the company's stock in a transaction that occurred on Monday, January 27th. The stock was sold at an average price of $17.15, for a total transaction of $890,187.90. Following the transaction, the senior vice president now directly owns 112,412 shares of the company's stock, valued at $1,927,865.80. This represents a 31.59 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Corporate insiders own 0.49% of the company's stock.

Wall Street Analyst Weigh In

A number of brokerages recently issued reports on AAL. Citigroup decreased their price objective on shares of American Airlines Group from $21.50 to $20.00 and set a "buy" rating on the stock in a research note on Tuesday, March 18th. TD Cowen boosted their price target on American Airlines Group to $13.00 and gave the stock an "unchanged" rating in a report on Friday. The Goldman Sachs Group downgraded American Airlines Group from a "neutral" rating to a "sell" rating and dropped their price objective for the stock from $16.00 to $8.00 in a research report on Tuesday, April 8th. Melius Research upgraded American Airlines Group from a "hold" rating to a "strong-buy" rating in a research report on Monday, January 6th. Finally, Bank of America reduced their price target on shares of American Airlines Group from $16.00 to $12.00 and set a "neutral" rating on the stock in a research note on Thursday, April 3rd. One investment analyst has rated the stock with a sell rating, eight have assigned a hold rating, ten have given a buy rating and two have assigned a strong buy rating to the company. According to MarketBeat, American Airlines Group presently has a consensus rating of "Moderate Buy" and an average price target of $16.25.

View Our Latest Analysis on AAL

American Airlines Group Profile

(

Free Report)

American Airlines Group Inc, through its subsidiaries, operates as a network air carrier. The company provides scheduled air transportation services for passengers and cargo through its hubs in Charlotte, Chicago, Dallas/Fort Worth, Los Angeles, Miami, New York, Philadelphia, Phoenix, and Washington, DC, as well as through partner gateways in London, Doha, Madrid, Seattle/Tacoma, Sydney, and Tokyo.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider American Airlines Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and American Airlines Group wasn't on the list.

While American Airlines Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.