Genpact (NYSE:G - Get Free Report) had its price target hoisted by research analysts at Needham & Company LLC from $42.00 to $55.00 in a note issued to investors on Monday,Benzinga reports. The brokerage currently has a "buy" rating on the business services provider's stock. Needham & Company LLC's price objective indicates a potential upside of 17.87% from the company's current price.

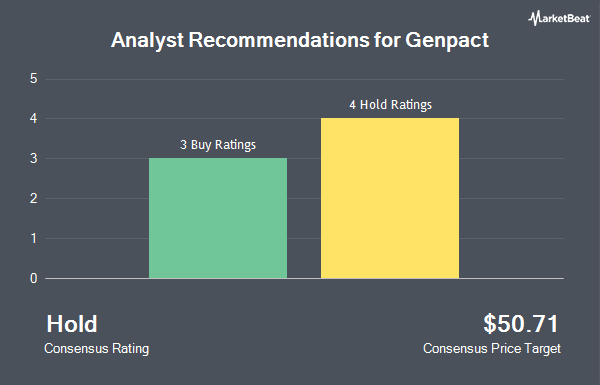

Several other analysts have also issued reports on the stock. JPMorgan Chase & Co. boosted their price target on shares of Genpact from $35.00 to $43.00 and gave the company a "neutral" rating in a research report on Friday, September 6th. TD Cowen upped their target price on shares of Genpact from $40.00 to $45.00 and gave the stock a "hold" rating in a report on Friday. BMO Capital Markets upped their target price on shares of Genpact from $38.00 to $42.00 and gave the stock a "market perform" rating in a report on Monday, August 12th. Robert W. Baird upped their target price on shares of Genpact from $44.00 to $48.00 and gave the stock a "neutral" rating in a report on Friday. Finally, Jefferies Financial Group upped their target price on shares of Genpact from $35.00 to $40.00 and gave the stock a "hold" rating in a report on Monday, September 9th. Eight research analysts have rated the stock with a hold rating and two have issued a buy rating to the stock. According to MarketBeat, Genpact currently has an average rating of "Hold" and a consensus price target of $42.33.

Read Our Latest Report on Genpact

Genpact Stock Up 1.6 %

Shares of NYSE G traded up $0.72 during mid-day trading on Monday, reaching $46.66. 1,418,006 shares of the company's stock traded hands, compared to its average volume of 1,328,302. The stock has a market cap of $8.31 billion, a P/E ratio of 12.62, a PEG ratio of 1.92 and a beta of 1.13. The business has a 50-day simple moving average of $39.03 and a 200 day simple moving average of $35.57. Genpact has a 1-year low of $30.23 and a 1-year high of $47.98. The company has a debt-to-equity ratio of 0.52, a current ratio of 1.89 and a quick ratio of 1.89.

Genpact (NYSE:G - Get Free Report) last released its quarterly earnings results on Thursday, August 8th. The business services provider reported $0.69 earnings per share for the quarter, topping the consensus estimate of $0.64 by $0.05. Genpact had a net margin of 14.22% and a return on equity of 22.09%. The business had revenue of $1.18 billion for the quarter, compared to analysts' expectations of $1.15 billion. On average, analysts expect that Genpact will post 2.85 EPS for the current fiscal year.

Institutional Trading of Genpact

A number of institutional investors have recently made changes to their positions in the stock. Capital International Investors increased its holdings in Genpact by 51.8% during the first quarter. Capital International Investors now owns 3,086,957 shares of the business services provider's stock valued at $101,715,000 after buying an additional 1,053,236 shares during the last quarter. Dimensional Fund Advisors LP increased its holdings in Genpact by 34.2% during the second quarter. Dimensional Fund Advisors LP now owns 3,326,054 shares of the business services provider's stock valued at $107,065,000 after buying an additional 847,249 shares during the last quarter. Pzena Investment Management LLC increased its holdings in Genpact by 130.3% during the second quarter. Pzena Investment Management LLC now owns 1,163,870 shares of the business services provider's stock valued at $37,465,000 after buying an additional 658,560 shares during the last quarter. Los Angeles Capital Management LLC purchased a new stake in Genpact during the third quarter valued at approximately $19,779,000. Finally, Tandem Investment Advisors Inc. purchased a new stake in Genpact during the third quarter valued at approximately $17,025,000. Hedge funds and other institutional investors own 96.03% of the company's stock.

Genpact Company Profile

(

Get Free Report)

Genpact Limited provides business process outsourcing and information technology services in India, rest of Asia, North and Latin America, and Europe. It operates through three segments: Financial services; Consumer and Healthcare; and High Tech and Manufacturing. The Financial Services segment offers retail customer onboarding, customer service, collections, card servicing operations, loan and payment operations, commercial loan, equipment and auto loan, mortgage origination, compliance services, reporting and monitoring, and wealth management operations support; financial crime and risk management services; and underwriting support, new business processing, policy administration, claims management, catastrophe modeling and actuarial services, as well as property and casualty claims.

Read More

Before you consider Genpact, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Genpact wasn't on the list.

While Genpact currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.