Unity Software (NYSE:U - Get Free Report) had its target price boosted by equities research analysts at Needham & Company LLC from $23.00 to $26.00 in a note issued to investors on Friday,Benzinga reports. The firm currently has a "buy" rating on the stock. Needham & Company LLC's target price indicates a potential upside of 26.89% from the stock's current price.

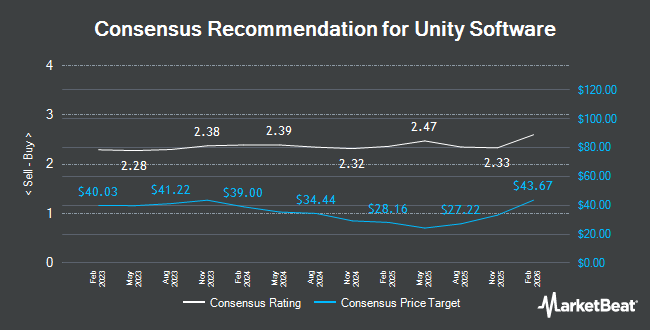

A number of other analysts have also recently commented on U. Stifel Nicolaus upped their price objective on shares of Unity Software from $20.00 to $25.00 and gave the company a "buy" rating in a research report on Friday, September 13th. Benchmark dropped their price target on Unity Software from $16.00 to $10.00 and set a "sell" rating on the stock in a research report on Friday, August 9th. Wells Fargo & Company initiated coverage on Unity Software in a report on Monday, October 28th. They set an "equal weight" rating and a $20.00 price objective on the stock. UBS Group increased their target price on Unity Software from $15.00 to $20.00 and gave the stock a "neutral" rating in a research note on Friday, October 18th. Finally, Macquarie lifted their price target on shares of Unity Software from $12.00 to $15.00 and gave the company an "underperform" rating in a research note on Tuesday, September 17th. Two equities research analysts have rated the stock with a sell rating, nine have issued a hold rating and six have assigned a buy rating to the stock. According to MarketBeat, the company currently has an average rating of "Hold" and an average price target of $23.35.

Check Out Our Latest Stock Analysis on U

Unity Software Trading Down 7.7 %

Shares of U stock traded down $1.72 during trading hours on Friday, reaching $20.49. The company had a trading volume of 24,545,422 shares, compared to its average volume of 10,404,142. The company has a 50 day moving average of $20.33 and a 200 day moving average of $18.99. The firm has a market cap of $8.13 billion, a price-to-earnings ratio of -10.00 and a beta of 2.29. The company has a debt-to-equity ratio of 0.70, a current ratio of 2.36 and a quick ratio of 2.36. Unity Software has a 1-year low of $13.90 and a 1-year high of $43.54.

Unity Software (NYSE:U - Get Free Report) last announced its quarterly earnings results on Thursday, August 8th. The company reported ($0.32) earnings per share for the quarter, beating analysts' consensus estimates of ($0.44) by $0.12. Unity Software had a negative net margin of 38.52% and a negative return on equity of 8.78%. The business had revenue of $449.30 million for the quarter, compared to the consensus estimate of $438.37 million. During the same period last year, the company posted ($0.26) EPS. Unity Software's revenue for the quarter was down 15.8% on a year-over-year basis. On average, equities research analysts anticipate that Unity Software will post -1.86 EPS for the current year.

Insider Activity at Unity Software

In other news, Director David Helgason sold 250,000 shares of the company's stock in a transaction that occurred on Friday, September 13th. The stock was sold at an average price of $20.59, for a total transaction of $5,147,500.00. Following the sale, the director now owns 8,201,851 shares in the company, valued at $168,876,112.09. This represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available at this link. In other news, Director David Helgason sold 250,000 shares of the company's stock in a transaction dated Friday, September 13th. The shares were sold at an average price of $20.59, for a total value of $5,147,500.00. Following the sale, the director now directly owns 8,201,851 shares of the company's stock, valued at approximately $168,876,112.09. This represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, SVP Felix The sold 30,000 shares of the firm's stock in a transaction dated Thursday, September 12th. The shares were sold at an average price of $17.89, for a total transaction of $536,700.00. Following the completion of the sale, the senior vice president now owns 423,679 shares of the company's stock, valued at $7,579,617.31. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last quarter, insiders have sold 281,600 shares of company stock valued at $5,714,000. 6.30% of the stock is owned by insiders.

Hedge Funds Weigh In On Unity Software

Several large investors have recently modified their holdings of the stock. Farther Finance Advisors LLC raised its holdings in Unity Software by 4.0% in the 3rd quarter. Farther Finance Advisors LLC now owns 13,947 shares of the company's stock valued at $315,000 after acquiring an additional 538 shares during the period. Advisors Asset Management Inc. increased its position in Unity Software by 31.6% during the 1st quarter. Advisors Asset Management Inc. now owns 2,338 shares of the company's stock worth $62,000 after buying an additional 562 shares during the period. Venturi Wealth Management LLC grew its stake in shares of Unity Software by 28.7% in the third quarter. Venturi Wealth Management LLC now owns 3,923 shares of the company's stock valued at $89,000 after acquiring an additional 876 shares in the last quarter. GAMMA Investing LLC raised its stake in Unity Software by 343.8% in the 3rd quarter. GAMMA Investing LLC now owns 1,225 shares of the company's stock worth $28,000 after purchasing an additional 949 shares in the last quarter. Finally, Intech Investment Management LLC grew its position in shares of Unity Software by 8.2% during the 2nd quarter. Intech Investment Management LLC now owns 13,270 shares of the company's stock worth $216,000 after purchasing an additional 1,010 shares in the last quarter. 73.46% of the stock is owned by institutional investors.

Unity Software Company Profile

(

Get Free Report)

Unity Software Inc operates a real-time 3D development platform. Its platform provides software solutions to create, run, and monetize interactive, real-time 2D and 3D content for mobile phones, tablets, PCs, consoles, and augmented and virtual reality devices. The company offers its solutions directly through its online store and field sales operations in North America, Denmark, Finland, the United Kingdom, Germany, Japan, China, Singapore, and South Korea, as well as indirectly through independent distributors and resellers worldwide.

Featured Stories

Before you consider Unity Software, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Unity Software wasn't on the list.

While Unity Software currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.