Needham & Company LLC reiterated their buy rating on shares of Avidity Biosciences (NASDAQ:RNA - Free Report) in a research report released on Wednesday morning,Benzinga reports. Needham & Company LLC currently has a $60.00 price objective on the biotechnology company's stock.

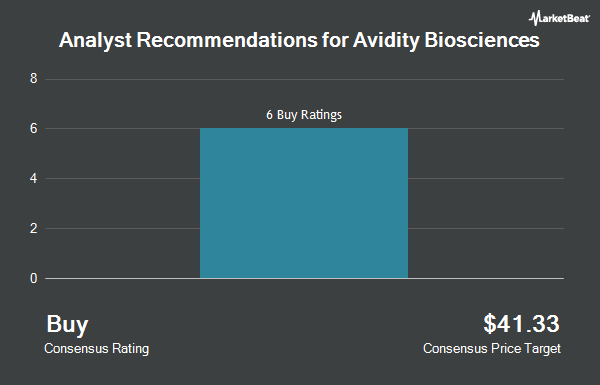

Several other brokerages also recently commented on RNA. TD Cowen upped their price objective on Avidity Biosciences from $56.00 to $78.00 and gave the company a "buy" rating in a research report on Monday, October 21st. Cantor Fitzgerald reaffirmed an "overweight" rating and issued a $96.00 price target on shares of Avidity Biosciences in a research note on Monday, September 16th. The Goldman Sachs Group assumed coverage on shares of Avidity Biosciences in a research report on Tuesday, September 24th. They issued a "buy" rating and a $59.00 price objective for the company. Evercore ISI reduced their target price on shares of Avidity Biosciences from $54.00 to $53.00 and set an "outperform" rating on the stock in a research report on Monday, August 26th. Finally, Chardan Capital boosted their price target on Avidity Biosciences from $60.00 to $65.00 and gave the company a "buy" rating in a report on Wednesday, October 30th. Nine equities research analysts have rated the stock with a buy rating, Based on data from MarketBeat.com, the company currently has an average rating of "Buy" and a consensus price target of $63.22.

View Our Latest Report on RNA

Avidity Biosciences Stock Performance

NASDAQ:RNA traded up $5.76 during midday trading on Wednesday, hitting $52.49. 2,995,677 shares of the company traded hands, compared to its average volume of 1,312,475. The firm's fifty day moving average is $44.83 and its 200-day moving average is $39.92. Avidity Biosciences has a 12-month low of $5.68 and a 12-month high of $56.00.

Avidity Biosciences (NASDAQ:RNA - Get Free Report) last released its earnings results on Thursday, November 7th. The biotechnology company reported ($0.65) earnings per share (EPS) for the quarter, topping the consensus estimate of ($0.79) by $0.14. Avidity Biosciences had a negative net margin of 2,772.45% and a negative return on equity of 27.66%. The firm had revenue of $2.34 million during the quarter, compared to analyst estimates of $7.09 million. On average, sell-side analysts anticipate that Avidity Biosciences will post -2.91 earnings per share for the current year.

Insider Activity

In related news, CEO Sarah Boyce sold 32,880 shares of the firm's stock in a transaction dated Monday, September 23rd. The stock was sold at an average price of $44.00, for a total transaction of $1,446,720.00. Following the sale, the chief executive officer now directly owns 234,663 shares of the company's stock, valued at $10,325,172. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this hyperlink. In related news, CEO Sarah Boyce sold 32,880 shares of the firm's stock in a transaction on Monday, September 23rd. The shares were sold at an average price of $44.00, for a total transaction of $1,446,720.00. Following the sale, the chief executive officer now owns 234,663 shares in the company, valued at approximately $10,325,172. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, Director Arthur A. Levin sold 5,000 shares of the firm's stock in a transaction that occurred on Monday, August 19th. The shares were sold at an average price of $45.19, for a total value of $225,950.00. Following the completion of the sale, the director now directly owns 14,830 shares in the company, valued at approximately $670,167.70. The trade was a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 127,543 shares of company stock valued at $5,782,042 in the last ninety days. Insiders own 3.68% of the company's stock.

Institutional Investors Weigh In On Avidity Biosciences

Large investors have recently bought and sold shares of the company. Advantage Alpha Capital Partners LP purchased a new position in shares of Avidity Biosciences in the third quarter worth about $471,000. FMR LLC raised its holdings in Avidity Biosciences by 4.3% in the 3rd quarter. FMR LLC now owns 16,848,776 shares of the biotechnology company's stock valued at $773,864,000 after acquiring an additional 689,729 shares during the last quarter. Nwam LLC lifted its stake in Avidity Biosciences by 24.0% in the 3rd quarter. Nwam LLC now owns 29,662 shares of the biotechnology company's stock worth $1,362,000 after purchasing an additional 5,746 shares in the last quarter. Charles Schwab Investment Management Inc. boosted its holdings in shares of Avidity Biosciences by 24.8% during the 3rd quarter. Charles Schwab Investment Management Inc. now owns 990,182 shares of the biotechnology company's stock worth $45,479,000 after purchasing an additional 197,065 shares during the last quarter. Finally, Landscape Capital Management L.L.C. purchased a new stake in shares of Avidity Biosciences in the third quarter valued at approximately $265,000.

About Avidity Biosciences

(

Get Free Report)

Avidity Biosciences, Inc, a biopharmaceutical company, engages in the delivery of RNA therapeutics. It develops antibody oligonucleotide conjugates (AOC) that are designed to treat diseases previously untreatable with RNA therapeutics. The company's lead product candidate AOC 1001 for the treatment of myotonic dystrophy type 1, a rare monogenic muscle disease that is in phase 1/2 clinical trial.

Read More

Before you consider Avidity Biosciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Avidity Biosciences wasn't on the list.

While Avidity Biosciences currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.