Merus (NASDAQ:MRUS - Get Free Report)'s stock had its "buy" rating restated by equities research analysts at Needham & Company LLC in a report issued on Wednesday,Benzinga reports. They presently have a $85.00 price objective on the biotechnology company's stock. Needham & Company LLC's target price would suggest a potential upside of 98.00% from the company's previous close.

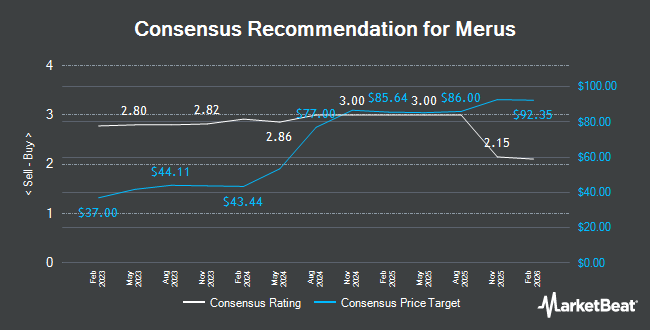

MRUS has been the topic of several other reports. UBS Group assumed coverage on Merus in a research report on Thursday, October 24th. They issued a "buy" rating and a $72.00 target price on the stock. Guggenheim lifted their target price on Merus from $93.00 to $111.00 and gave the stock a "buy" rating in a report on Tuesday, October 1st. HC Wainwright reissued a "buy" rating and set a $85.00 price target on shares of Merus in a research report on Friday, November 1st. Canaccord Genuity Group reaffirmed a "buy" rating and issued a $67.00 price objective on shares of Merus in a report on Thursday, July 25th. Finally, Canaccord Genuity Group raised shares of Merus to a "strong-buy" rating in a report on Thursday, July 25th. One analyst has rated the stock with a sell rating, eleven have given a buy rating and two have given a strong buy rating to the stock. According to MarketBeat.com, Merus currently has a consensus rating of "Buy" and an average target price of $86.70.

View Our Latest Report on MRUS

Merus Stock Performance

Merus stock traded down $0.56 during mid-day trading on Wednesday, reaching $42.93. 677,452 shares of the company were exchanged, compared to its average volume of 682,807. Merus has a 12-month low of $22.26 and a 12-month high of $61.61. The business has a fifty day moving average of $50.72 and a 200 day moving average of $51.92. The firm has a market cap of $2.94 billion, a P/E ratio of -10.87 and a beta of 1.12.

Merus (NASDAQ:MRUS - Get Free Report) last announced its earnings results on Thursday, October 31st. The biotechnology company reported ($0.95) earnings per share (EPS) for the quarter, missing the consensus estimate of ($0.90) by ($0.05). Merus had a negative net margin of 680.61% and a negative return on equity of 38.89%. The business had revenue of $11.77 million for the quarter, compared to analyst estimates of $9.11 million. Sell-side analysts predict that Merus will post -3.88 EPS for the current year.

Hedge Funds Weigh In On Merus

Institutional investors have recently added to or reduced their stakes in the stock. GSA Capital Partners LLP purchased a new position in Merus in the third quarter worth $675,000. Driehaus Capital Management LLC increased its position in shares of Merus by 26.4% in the second quarter. Driehaus Capital Management LLC now owns 1,550,009 shares of the biotechnology company's stock valued at $91,714,000 after buying an additional 323,518 shares in the last quarter. Virtu Financial LLC purchased a new stake in shares of Merus in the first quarter valued at about $555,000. D. E. Shaw & Co. Inc. increased its position in Merus by 90.6% during the second quarter. D. E. Shaw & Co. Inc. now owns 521,339 shares of the biotechnology company's stock worth $30,848,000 after buying an additional 247,813 shares in the last quarter. Finally, Price T Rowe Associates Inc. MD purchased a new position in Merus in the 1st quarter valued at about $53,377,000. Institutional investors and hedge funds own 96.14% of the company's stock.

Merus Company Profile

(

Get Free Report)

Merus N.V., a clinical-stage immuno-oncology company, engages in the development of antibody therapeutics in the Netherlands. Its bispecific antibody candidate pipeline includes Zenocutuzumab (MCLA-128), which is in a phase 2 clinical trials for the treatment of patients with metastatic breast cancer and castration-resistant prostate cancer, as well as in Phase 1/2 clinical trials for the treatment of solid tumors that harbor Neuregulin 1.

Featured Articles

Before you consider Merus, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Merus wasn't on the list.

While Merus currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.