PENN Entertainment (NASDAQ:PENN - Get Free Report)'s stock had its "buy" rating restated by equities researchers at Needham & Company LLC in a research note issued to investors on Friday,Benzinga reports. They currently have a $26.00 target price on the stock. Needham & Company LLC's target price would suggest a potential upside of 26.83% from the company's previous close.

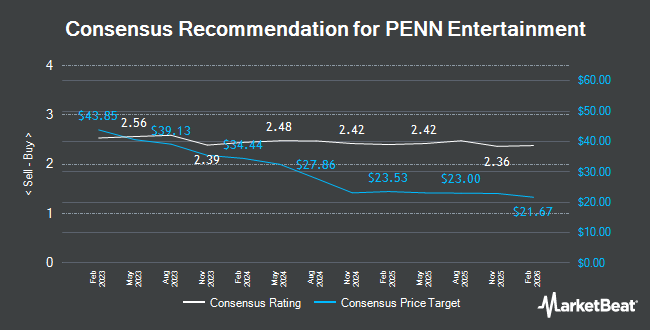

A number of other research firms have also weighed in on PENN. Wells Fargo & Company raised their target price on shares of PENN Entertainment from $18.00 to $20.00 and gave the stock an "equal weight" rating in a research note on Thursday, October 17th. Stifel Nicolaus upped their target price on PENN Entertainment from $19.00 to $20.00 and gave the company a "hold" rating in a report on Friday, August 9th. Mizuho lowered their price target on shares of PENN Entertainment from $25.00 to $24.00 and set an "outperform" rating on the stock in a research report on Tuesday, October 22nd. Susquehanna decreased their price objective on PENN Entertainment from $26.00 to $25.00 and set a "positive" rating on the stock in a report on Monday. Finally, JMP Securities reiterated a "market perform" rating on shares of PENN Entertainment in a report on Friday, October 4th. One equities research analyst has rated the stock with a sell rating, eight have issued a hold rating and eight have issued a buy rating to the stock. Based on data from MarketBeat, the stock currently has an average rating of "Hold" and an average target price of $22.89.

Get Our Latest Stock Analysis on PENN

PENN Entertainment Price Performance

Shares of NASDAQ PENN traded up $0.28 during midday trading on Friday, hitting $20.50. The stock had a trading volume of 3,864,299 shares, compared to its average volume of 5,122,846. The company has a quick ratio of 1.03, a current ratio of 1.03 and a debt-to-equity ratio of 2.35. The stock has a 50 day simple moving average of $18.98 and a 200-day simple moving average of $18.31. The company has a market capitalization of $3.13 billion, a PE ratio of -5.77 and a beta of 2.09. PENN Entertainment has a 1 year low of $13.50 and a 1 year high of $27.20.

PENN Entertainment (NASDAQ:PENN - Get Free Report) last announced its quarterly earnings data on Thursday, November 7th. The company reported ($0.24) earnings per share for the quarter, beating analysts' consensus estimates of ($0.28) by $0.04. The company had revenue of $1.64 billion for the quarter, compared to analyst estimates of $1.65 billion. PENN Entertainment had a negative return on equity of 7.13% and a negative net margin of 19.48%. The firm's revenue for the quarter was up 1.2% on a year-over-year basis. During the same quarter last year, the firm posted $1.21 EPS. On average, sell-side analysts expect that PENN Entertainment will post -1.36 EPS for the current fiscal year.

Insider Buying and Selling

In other news, Director Anuj Dhanda acquired 15,000 shares of the company's stock in a transaction on Friday, September 6th. The shares were bought at an average price of $18.40 per share, with a total value of $276,000.00. Following the completion of the acquisition, the director now owns 31,523 shares in the company, valued at $580,023.20. This trade represents a 0.00 % increase in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this link. In related news, Director David A. Handler purchased 10,000 shares of the business's stock in a transaction dated Tuesday, September 10th. The stock was acquired at an average price of $17.51 per share, for a total transaction of $175,100.00. Following the completion of the purchase, the director now directly owns 293,450 shares of the company's stock, valued at $5,138,309.50. This trade represents a 0.00 % increase in their ownership of the stock. The purchase was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, Director Anuj Dhanda acquired 15,000 shares of the stock in a transaction that occurred on Friday, September 6th. The stock was purchased at an average price of $18.40 per share, for a total transaction of $276,000.00. Following the completion of the transaction, the director now owns 31,523 shares in the company, valued at $580,023.20. The trade was a 0.00 % increase in their ownership of the stock. The disclosure for this purchase can be found here. Insiders have purchased 79,200 shares of company stock worth $1,450,548 in the last ninety days. 2.19% of the stock is owned by corporate insiders.

Institutional Trading of PENN Entertainment

Hedge funds and other institutional investors have recently made changes to their positions in the company. GAMMA Investing LLC lifted its position in PENN Entertainment by 233.6% in the second quarter. GAMMA Investing LLC now owns 1,441 shares of the company's stock valued at $28,000 after purchasing an additional 1,009 shares during the period. DekaBank Deutsche Girozentrale purchased a new stake in shares of PENN Entertainment in the third quarter valued at approximately $45,000. Quest Partners LLC acquired a new position in PENN Entertainment during the third quarter worth $56,000. International Assets Investment Management LLC boosted its position in shares of PENN Entertainment by 1,634.8% during the 3rd quarter. International Assets Investment Management LLC now owns 3,244 shares of the company's stock worth $61,000 after purchasing an additional 3,057 shares in the last quarter. Finally, J.Safra Asset Management Corp purchased a new position in shares of PENN Entertainment in the 2nd quarter valued at about $83,000. Hedge funds and other institutional investors own 91.69% of the company's stock.

PENN Entertainment Company Profile

(

Get Free Report)

PENN Entertainment, Inc, together with its subsidiaries, provides integrated entertainment, sports content, and casino gaming experiences. The company operates through five segments: Northeast, South, West, Midwest, and Interactive. It operates online sports betting in various jurisdictions; and iCasino under Hollywood Casino, L'Auberge, ESPN BET, and theScore Bet Sportsbook and Casino brands.

Recommended Stories

Before you consider PENN Entertainment, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PENN Entertainment wasn't on the list.

While PENN Entertainment currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.