Blue Bird (NASDAQ:BLBD - Get Free Report)'s stock had its "buy" rating reissued by equities researchers at Needham & Company LLC in a research report issued to clients and investors on Friday,Benzinga reports. They currently have a $66.00 price objective on the stock. Needham & Company LLC's price target suggests a potential upside of 51.00% from the company's previous close.

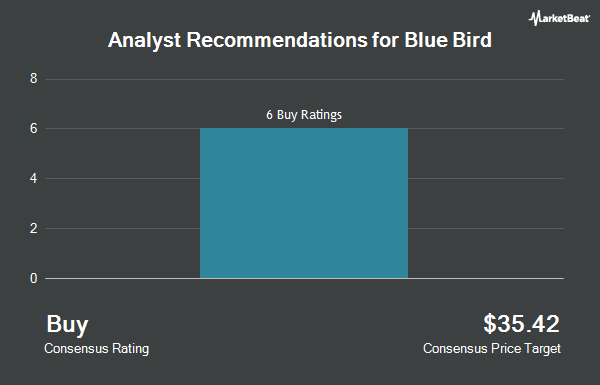

A number of other research firms have also recently commented on BLBD. BTIG Research began coverage on shares of Blue Bird in a report on Wednesday, October 9th. They issued a "buy" rating and a $55.00 price target for the company. StockNews.com raised shares of Blue Bird from a "hold" rating to a "buy" rating in a research report on Friday, November 8th. Roth Mkm lowered Blue Bird from a "buy" rating to a "neutral" rating and set a $48.00 target price for the company. in a research report on Thursday, October 3rd. Craig Hallum increased their price target on Blue Bird from $68.00 to $71.00 and gave the stock a "buy" rating in a report on Tuesday, November 26th. Finally, Roth Capital downgraded Blue Bird from a "strong-buy" rating to a "hold" rating in a report on Thursday, October 3rd. Two investment analysts have rated the stock with a hold rating and seven have issued a buy rating to the company's stock. Based on data from MarketBeat.com, Blue Bird presently has an average rating of "Moderate Buy" and a consensus target price of $60.64.

Read Our Latest Report on BLBD

Blue Bird Trading Up 3.7 %

Shares of NASDAQ:BLBD traded up $1.56 during midday trading on Friday, reaching $43.71. The company's stock had a trading volume of 622,218 shares, compared to its average volume of 625,676. Blue Bird has a fifty-two week low of $23.76 and a fifty-two week high of $59.40. The company has a debt-to-equity ratio of 0.56, a quick ratio of 0.83 and a current ratio of 1.37. The firm has a 50 day moving average price of $41.78 and a two-hundred day moving average price of $47.75. The firm has a market capitalization of $1.41 billion, a price-to-earnings ratio of 13.81, a PEG ratio of 1.05 and a beta of 1.59.

Institutional Inflows and Outflows

Hedge funds have recently modified their holdings of the stock. CWM LLC boosted its holdings in Blue Bird by 51.1% during the 2nd quarter. CWM LLC now owns 3,227 shares of the company's stock worth $174,000 after acquiring an additional 1,091 shares during the last quarter. Raymond James & Associates boosted its holdings in Blue Bird by 18.1% during the second quarter. Raymond James & Associates now owns 92,674 shares of the company's stock worth $4,990,000 after purchasing an additional 14,186 shares during the last quarter. Vista Investment Partners LLC purchased a new stake in Blue Bird in the 2nd quarter valued at about $484,000. Macroview Investment Management LLC purchased a new stake in Blue Bird in the 2nd quarter valued at about $29,000. Finally, Hennessy Advisors Inc. bought a new position in shares of Blue Bird during the 2nd quarter worth approximately $11,788,000. Hedge funds and other institutional investors own 93.59% of the company's stock.

About Blue Bird

(

Get Free Report)

Blue Bird Corporation, together with its subsidiaries, designs, engineers, manufactures, and sells school buses in the United States, Canada, and internationally. The company operates through two segments, Bus and Parts. It offers Type C, Type D, and specialty buses; and alternative power options through its propane powered, gasoline powered, compressed natural gas powered, and electric powered school buses, as well as diesel engines.

Read More

Before you consider Blue Bird, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Blue Bird wasn't on the list.

While Blue Bird currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.