Robinhood Markets (NASDAQ:HOOD - Get Free Report) was upgraded by research analysts at Needham & Company LLC from a "hold" rating to a "buy" rating in a report released on Monday, MarketBeat reports. The firm currently has a $40.00 price objective on the stock. Needham & Company LLC's price target would suggest a potential upside of 14.29% from the stock's current price.

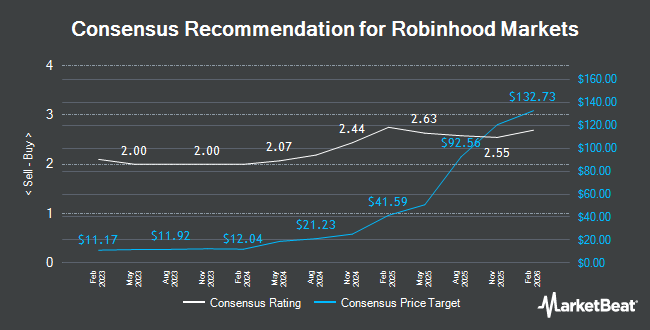

Other research analysts have also issued reports about the company. The Goldman Sachs Group cut their price objective on Robinhood Markets from $25.00 to $22.00 and set a "neutral" rating on the stock in a research report on Friday, November 1st. Morgan Stanley upped their price target on Robinhood Markets from $22.00 to $24.00 and gave the stock an "equal weight" rating in a report on Monday, November 11th. JPMorgan Chase & Co. boosted their target price on shares of Robinhood Markets from $17.00 to $21.00 and gave the stock an "underweight" rating in a research report on Thursday, October 17th. Deutsche Bank Aktiengesellschaft raised their price target on shares of Robinhood Markets from $27.00 to $32.00 and gave the company a "buy" rating in a report on Monday, November 11th. Finally, KeyCorp upped their price objective on shares of Robinhood Markets from $25.00 to $30.00 and gave the company an "overweight" rating in a research report on Monday, October 21st. One research analyst has rated the stock with a sell rating, six have assigned a hold rating and nine have assigned a buy rating to the stock. According to MarketBeat.com, Robinhood Markets has a consensus rating of "Moderate Buy" and a consensus target price of $27.34.

View Our Latest Research Report on Robinhood Markets

Robinhood Markets Stock Up 8.3 %

Shares of NASDAQ HOOD traded up $2.68 during trading on Monday, hitting $35.00. 35,016,953 shares of the company traded hands, compared to its average volume of 16,074,260. The firm has a market capitalization of $30.94 billion, a P/E ratio of 58.20, a P/E/G ratio of 0.77 and a beta of 1.84. The company has a 50-day moving average price of $25.47 and a 200-day moving average price of $22.37. Robinhood Markets has a 1 year low of $7.96 and a 1 year high of $35.62.

Robinhood Markets (NASDAQ:HOOD - Get Free Report) last announced its quarterly earnings results on Wednesday, October 30th. The company reported $0.17 EPS for the quarter, missing the consensus estimate of $0.18 by ($0.01). Robinhood Markets had a return on equity of 7.52% and a net margin of 21.80%. The firm had revenue of $637.00 million for the quarter, compared to analyst estimates of $660.53 million. During the same quarter in the prior year, the company earned ($0.09) earnings per share. The business's revenue was up 36.4% compared to the same quarter last year. Research analysts predict that Robinhood Markets will post 0.72 EPS for the current fiscal year.

Insider Activity at Robinhood Markets

In other news, CEO Vladimir Tenev sold 250,000 shares of the firm's stock in a transaction dated Wednesday, September 4th. The shares were sold at an average price of $19.26, for a total value of $4,815,000.00. The sale was disclosed in a document filed with the SEC, which is available at the SEC website. Also, CFO Jason Warnick sold 25,000 shares of the stock in a transaction that occurred on Monday, August 26th. The shares were sold at an average price of $20.96, for a total transaction of $524,000.00. Following the completion of the transaction, the chief financial officer now owns 1,077,162 shares in the company, valued at $22,577,315.52. This represents a 2.27 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 4,710,549 shares of company stock worth $115,477,194 in the last 90 days. 19.95% of the stock is owned by company insiders.

Hedge Funds Weigh In On Robinhood Markets

Institutional investors have recently modified their holdings of the stock. Vanguard Group Inc. boosted its stake in shares of Robinhood Markets by 1.8% during the 1st quarter. Vanguard Group Inc. now owns 56,828,633 shares of the company's stock worth $1,143,960,000 after acquiring an additional 1,003,535 shares during the period. Baker Avenue Asset Management LP increased its stake in Robinhood Markets by 77.9% during the 3rd quarter. Baker Avenue Asset Management LP now owns 464,306 shares of the company's stock worth $10,874,000 after acquiring an additional 203,354 shares during the period. UniSuper Management Pty Ltd raised its holdings in Robinhood Markets by 87.1% in the 1st quarter. UniSuper Management Pty Ltd now owns 5,800 shares of the company's stock valued at $117,000 after acquiring an additional 2,700 shares in the last quarter. Aigen Investment Management LP acquired a new stake in shares of Robinhood Markets during the 3rd quarter worth $770,000. Finally, Robeco Institutional Asset Management B.V. increased its position in shares of Robinhood Markets by 146.7% in the third quarter. Robeco Institutional Asset Management B.V. now owns 1,161,240 shares of the company's stock worth $27,196,000 after purchasing an additional 690,467 shares during the period. 93.27% of the stock is currently owned by institutional investors and hedge funds.

About Robinhood Markets

(

Get Free Report)

Robinhood Markets, Inc operates financial services platform in the United States. Its platform allows users to invest in stocks, exchange-traded funds (ETFs), American depository receipts, options, gold, and cryptocurrencies. The company offers fractional trading, recurring investments, fully-paid securities lending, access to investing on margin, cash sweep, instant withdrawals, retirement program, around-the-clock trading, and initial public offerings participation services.

See Also

Before you consider Robinhood Markets, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Robinhood Markets wasn't on the list.

While Robinhood Markets currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.