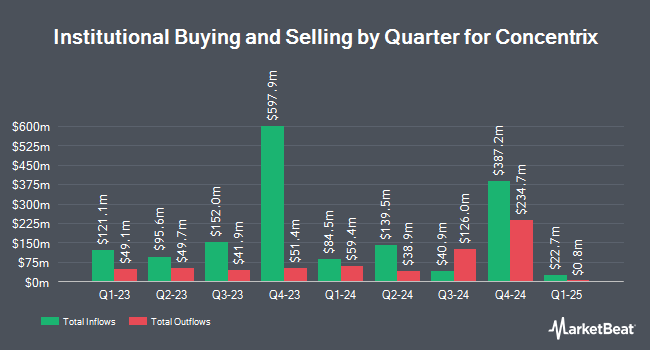

Neo Ivy Capital Management bought a new position in shares of Concentrix Co. (NASDAQ:CNXC - Free Report) during the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor bought 55,496 shares of the company's stock, valued at approximately $2,844,000. Concentrix accounts for approximately 0.9% of Neo Ivy Capital Management's investment portfolio, making the stock its 14th largest holding. Neo Ivy Capital Management owned 0.09% of Concentrix as of its most recent SEC filing.

A number of other large investors also recently modified their holdings of CNXC. GAMMA Investing LLC increased its position in Concentrix by 64.9% in the third quarter. GAMMA Investing LLC now owns 729 shares of the company's stock worth $37,000 after buying an additional 287 shares during the period. First Horizon Advisors Inc. lifted its position in Concentrix by 54.0% in the 2nd quarter. First Horizon Advisors Inc. now owns 813 shares of the company's stock valued at $51,000 after purchasing an additional 285 shares during the last quarter. Benjamin F. Edwards & Company Inc. bought a new stake in Concentrix in the 2nd quarter valued at about $68,000. Quarry LP grew its position in Concentrix by 769.9% in the 2nd quarter. Quarry LP now owns 1,244 shares of the company's stock worth $79,000 after purchasing an additional 1,101 shares during the last quarter. Finally, Fifth Third Bancorp increased its stake in shares of Concentrix by 51.7% in the second quarter. Fifth Third Bancorp now owns 1,573 shares of the company's stock valued at $100,000 after purchasing an additional 536 shares during the period. 90.34% of the stock is currently owned by institutional investors.

Analyst Ratings Changes

A number of equities analysts recently issued reports on CNXC shares. Canaccord Genuity Group decreased their price objective on Concentrix from $125.00 to $100.00 and set a "buy" rating for the company in a report on Thursday, September 26th. Barrington Research decreased their target price on shares of Concentrix from $84.00 to $70.00 and set an "outperform" rating for the company in a research report on Thursday, September 26th. Bank of America dropped their price target on shares of Concentrix from $85.00 to $70.00 and set a "neutral" rating on the stock in a research report on Thursday, September 26th. Baird R W raised shares of Concentrix to a "strong-buy" rating in a research note on Thursday, October 3rd. Finally, Robert W. Baird began coverage on shares of Concentrix in a research note on Thursday, October 3rd. They set an "outperform" rating and a $70.00 price objective on the stock. One equities research analyst has rated the stock with a hold rating, four have issued a buy rating and one has given a strong buy rating to the company. According to MarketBeat.com, the stock presently has an average rating of "Buy" and a consensus price target of $79.00.

Check Out Our Latest Stock Analysis on CNXC

Concentrix Price Performance

Shares of CNXC traded down $0.46 during mid-day trading on Wednesday, hitting $45.02. The company's stock had a trading volume of 184,943 shares, compared to its average volume of 575,779. Concentrix Co. has a fifty-two week low of $36.28 and a fifty-two week high of $106.10. The stock has a market capitalization of $2.92 billion, a price-to-earnings ratio of 14.77, a PEG ratio of 0.55 and a beta of 0.63. The firm has a 50-day moving average price of $44.87 and a 200 day moving average price of $57.99. The company has a debt-to-equity ratio of 1.18, a current ratio of 1.57 and a quick ratio of 1.57.

Concentrix (NASDAQ:CNXC - Get Free Report) last posted its quarterly earnings results on Wednesday, September 25th. The company reported $2.87 earnings per share (EPS) for the quarter, missing the consensus estimate of $2.93 by ($0.06). The company had revenue of $2.39 billion during the quarter, compared to the consensus estimate of $2.38 billion. Concentrix had a net margin of 2.18% and a return on equity of 16.57%. Concentrix's quarterly revenue was up 46.2% on a year-over-year basis. During the same period in the prior year, the company posted $2.54 EPS. On average, research analysts predict that Concentrix Co. will post 10.18 EPS for the current fiscal year.

Concentrix Increases Dividend

The company also recently announced a quarterly dividend, which was paid on Tuesday, November 5th. Shareholders of record on Friday, October 25th were issued a $0.333 dividend. This represents a $1.33 annualized dividend and a dividend yield of 2.96%. This is a boost from Concentrix's previous quarterly dividend of $0.30. The ex-dividend date was Friday, October 25th. Concentrix's dividend payout ratio (DPR) is presently 43.18%.

Insider Activity

In other news, CEO Christopher A. Caldwell sold 9,823 shares of the business's stock in a transaction on Friday, October 4th. The shares were sold at an average price of $52.70, for a total transaction of $517,672.10. Following the transaction, the chief executive officer now directly owns 241,841 shares in the company, valued at $12,745,020.70. The trade was a 3.90 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is available at this link. Also, EVP Cormac J. Twomey sold 1,544 shares of the stock in a transaction on Monday, September 30th. The stock was sold at an average price of $51.38, for a total value of $79,330.72. Following the sale, the executive vice president now owns 27,783 shares of the company's stock, valued at approximately $1,427,490.54. This represents a 5.26 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 12,367 shares of company stock worth $641,668 over the last 90 days. 3.10% of the stock is owned by company insiders.

Concentrix Company Profile

(

Free Report)

Concentrix Corporation engages in the provision of technology-infused customer experience (CX) solutions worldwide. The company provides CX process optimization, technology innovation, front- and back-office automation, analytics, and business transformation services, across various channels of communication, such as voice, chat, email, social media, asynchronous messaging, and custom applications.

Further Reading

Before you consider Concentrix, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Concentrix wasn't on the list.

While Concentrix currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.