NEOS Investment Management LLC lifted its stake in shares of D.R. Horton, Inc. (NYSE:DHI - Free Report) by 30.0% in the fourth quarter, according to its most recent filing with the SEC. The fund owned 16,167 shares of the construction company's stock after acquiring an additional 3,729 shares during the period. NEOS Investment Management LLC's holdings in D.R. Horton were worth $2,260,000 as of its most recent SEC filing.

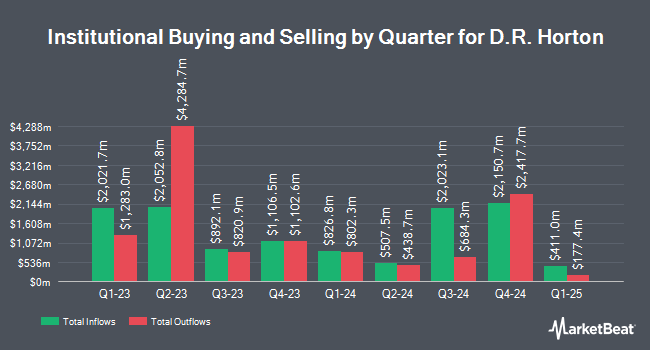

Several other hedge funds and other institutional investors also recently added to or reduced their stakes in the stock. Insigneo Advisory Services LLC grew its position in D.R. Horton by 1.9% during the 3rd quarter. Insigneo Advisory Services LLC now owns 3,644 shares of the construction company's stock valued at $695,000 after purchasing an additional 67 shares during the last quarter. Allworth Financial LP grew its holdings in shares of D.R. Horton by 5.5% during the fourth quarter. Allworth Financial LP now owns 1,561 shares of the construction company's stock valued at $229,000 after buying an additional 82 shares during the last quarter. Secure Asset Management LLC increased its position in shares of D.R. Horton by 4.8% during the fourth quarter. Secure Asset Management LLC now owns 1,836 shares of the construction company's stock valued at $257,000 after acquiring an additional 84 shares in the last quarter. Horizon Investments LLC raised its holdings in D.R. Horton by 1.7% in the 4th quarter. Horizon Investments LLC now owns 5,503 shares of the construction company's stock worth $767,000 after acquiring an additional 91 shares during the last quarter. Finally, Bfsg LLC lifted its position in D.R. Horton by 24.4% in the 4th quarter. Bfsg LLC now owns 484 shares of the construction company's stock valued at $68,000 after acquiring an additional 95 shares in the last quarter. 90.63% of the stock is currently owned by hedge funds and other institutional investors.

D.R. Horton Trading Up 0.9 %

NYSE DHI traded up $1.17 during trading hours on Monday, hitting $127.16. 2,316,316 shares of the company were exchanged, compared to its average volume of 2,808,721. The stock has a market cap of $40.07 billion, a PE ratio of 8.99, a price-to-earnings-growth ratio of 0.54 and a beta of 1.80. D.R. Horton, Inc. has a 52 week low of $124.23 and a 52 week high of $199.85. The stock has a 50-day moving average price of $132.91 and a 200 day moving average price of $154.80. The company has a quick ratio of 1.09, a current ratio of 6.92 and a debt-to-equity ratio of 0.20.

D.R. Horton (NYSE:DHI - Get Free Report) last released its quarterly earnings results on Tuesday, January 21st. The construction company reported $2.61 earnings per share for the quarter, beating the consensus estimate of $2.37 by $0.24. The company had revenue of $7.61 billion for the quarter, compared to analyst estimates of $7.12 billion. D.R. Horton had a return on equity of 18.48% and a net margin of 12.69%. D.R. Horton's quarterly revenue was down 1.5% compared to the same quarter last year. During the same quarter in the prior year, the firm posted $2.82 EPS. Analysts forecast that D.R. Horton, Inc. will post 13.04 earnings per share for the current fiscal year.

D.R. Horton Announces Dividend

The company also recently declared a quarterly dividend, which was paid on Friday, February 14th. Investors of record on Friday, February 7th were issued a dividend of $0.40 per share. The ex-dividend date was Friday, February 7th. This represents a $1.60 annualized dividend and a yield of 1.26%. D.R. Horton's payout ratio is 11.31%.

Analyst Ratings Changes

DHI has been the subject of several recent analyst reports. Royal Bank of Canada restated an "underperform" rating and issued a $125.00 price target on shares of D.R. Horton in a research note on Wednesday, January 22nd. The Goldman Sachs Group decreased their target price on D.R. Horton from $200.00 to $171.00 and set a "buy" rating for the company in a research report on Tuesday, January 14th. UBS Group dropped their price target on shares of D.R. Horton from $214.00 to $203.00 and set a "buy" rating on the stock in a report on Wednesday, January 8th. Citigroup decreased their price objective on shares of D.R. Horton from $185.00 to $152.00 and set a "neutral" rating for the company in a report on Monday, January 6th. Finally, Bank of America downgraded shares of D.R. Horton from a "buy" rating to a "neutral" rating and cut their target price for the stock from $160.00 to $150.00 in a research report on Monday, January 27th. Two equities research analysts have rated the stock with a sell rating, eight have issued a hold rating, six have issued a buy rating and one has given a strong buy rating to the stock. According to MarketBeat.com, the company currently has a consensus rating of "Hold" and a consensus target price of $170.93.

View Our Latest Analysis on D.R. Horton

D.R. Horton Company Profile

(

Free Report)

D.R. Horton, Inc operates as a homebuilding company in East, North, Southeast, South Central, Southwest, and Northwest regions in the United States. It engages in the acquisition and development of land; and construction and sale of residential homes in 118 markets across 33 states under the names of D.R.

See Also

Before you consider D.R. Horton, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and D.R. Horton wasn't on the list.

While D.R. Horton currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.