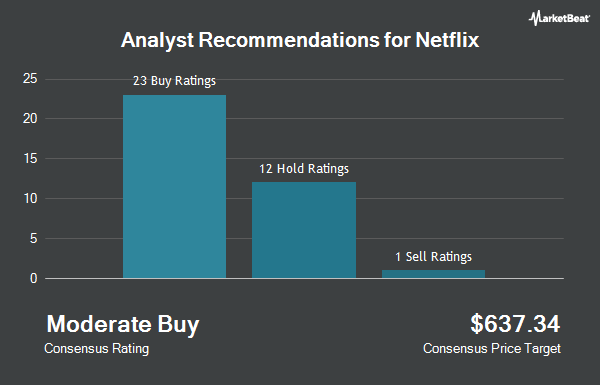

Shares of Netflix, Inc. (NASDAQ:NFLX - Get Free Report) have earned an average rating of "Moderate Buy" from the thirty-five research firms that are currently covering the firm, Marketbeat reports. Two investment analysts have rated the stock with a sell recommendation, nine have given a hold recommendation and twenty-four have given a buy recommendation to the company. The average twelve-month price objective among brokers that have updated their coverage on the stock in the last year is $758.76.

NFLX has been the subject of several research reports. UBS Group lifted their target price on Netflix from $750.00 to $825.00 and gave the company a "buy" rating in a research report on Friday, October 18th. TD Cowen increased their target price on shares of Netflix from $820.00 to $835.00 and gave the stock a "buy" rating in a report on Friday, October 18th. JPMorgan Chase & Co. boosted their price target on shares of Netflix from $750.00 to $850.00 and gave the stock an "overweight" rating in a research note on Friday, October 18th. Piper Sandler reiterated an "overweight" rating and issued a $840.00 price objective (up from $800.00) on shares of Netflix in a research note on Friday, October 18th. Finally, KeyCorp boosted their target price on Netflix from $760.00 to $785.00 and gave the stock an "overweight" rating in a research note on Friday, October 18th.

Read Our Latest Report on Netflix

Insider Buying and Selling

In other Netflix news, Director Jay C. Hoag sold 43,750 shares of the company's stock in a transaction that occurred on Thursday, September 12th. The stock was sold at an average price of $687.07, for a total transaction of $30,059,312.50. Following the completion of the sale, the director now directly owns 95,040 shares of the company's stock, valued at $65,299,132.80. This represents a 31.52 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, insider David A. Hyman sold 267 shares of Netflix stock in a transaction that occurred on Tuesday, November 5th. The shares were sold at an average price of $765.67, for a total value of $204,433.89. Following the completion of the transaction, the insider now owns 31,610 shares in the company, valued at $24,202,828.70. This trade represents a 0.84 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 185,277 shares of company stock worth $132,875,601 in the last 90 days. Company insiders own 1.76% of the company's stock.

Institutional Investors Weigh In On Netflix

Hedge funds have recently modified their holdings of the stock. State Street Corp raised its position in Netflix by 2.6% during the 3rd quarter. State Street Corp now owns 16,951,347 shares of the Internet television network's stock worth $12,023,082,000 after buying an additional 426,740 shares during the last quarter. Geode Capital Management LLC raised its holdings in Netflix by 1.4% during the third quarter. Geode Capital Management LLC now owns 9,148,356 shares of the Internet television network's stock worth $6,464,736,000 after purchasing an additional 123,029 shares in the last quarter. Jennison Associates LLC raised its holdings in Netflix by 4.7% during the third quarter. Jennison Associates LLC now owns 6,990,874 shares of the Internet television network's stock worth $4,958,417,000 after purchasing an additional 316,594 shares in the last quarter. International Assets Investment Management LLC lifted its position in Netflix by 116,620.0% in the third quarter. International Assets Investment Management LLC now owns 5,753,129 shares of the Internet television network's stock valued at $4,080,522,000 after purchasing an additional 5,748,200 shares during the period. Finally, Wellington Management Group LLP boosted its holdings in Netflix by 0.5% in the 3rd quarter. Wellington Management Group LLP now owns 4,897,389 shares of the Internet television network's stock valued at $3,473,571,000 after purchasing an additional 23,702 shares in the last quarter. 80.93% of the stock is owned by institutional investors and hedge funds.

Netflix Trading Up 0.6 %

Shares of NASDAQ:NFLX traded up $5.05 during mid-day trading on Wednesday, reaching $876.37. 2,139,135 shares of the company were exchanged, compared to its average volume of 3,655,176. Netflix has a 1 year low of $445.73 and a 1 year high of $890.33. The company has a debt-to-equity ratio of 0.62, a current ratio of 1.13 and a quick ratio of 1.13. The firm's 50-day simple moving average is $743.15 and its 200 day simple moving average is $685.41. The firm has a market cap of $374.61 billion, a price-to-earnings ratio of 49.36, a P/E/G ratio of 1.59 and a beta of 1.25.

Netflix (NASDAQ:NFLX - Get Free Report) last released its quarterly earnings results on Thursday, October 17th. The Internet television network reported $5.40 EPS for the quarter, topping the consensus estimate of $5.09 by $0.31. Netflix had a return on equity of 35.86% and a net margin of 20.70%. The business had revenue of $9.82 billion during the quarter, compared to analyst estimates of $9.77 billion. Equities research analysts forecast that Netflix will post 19.78 EPS for the current year.

Netflix Company Profile

(

Get Free ReportNetflix, Inc provides entertainment services. It offers TV series, documentaries, feature films, and games across various genres and languages. The company also provides members the ability to receive streaming content through a host of internet-connected devices, including TVs, digital video players, TV set-top boxes, and mobile devices.

Featured Articles

Before you consider Netflix, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Netflix wasn't on the list.

While Netflix currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.