Netflix (NASDAQ:NFLX - Get Free Report) had its target price hoisted by analysts at UBS Group from $825.00 to $1,040.00 in a report issued on Thursday, MarketBeat reports. The brokerage presently has a "buy" rating on the Internet television network's stock. UBS Group's price target would indicate a potential upside of 15.29% from the stock's current price.

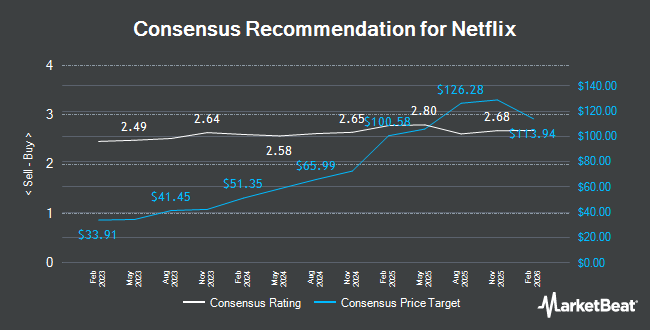

A number of other research firms also recently commented on NFLX. China Renaissance initiated coverage on Netflix in a report on Thursday, September 5th. They issued a "hold" rating and a $680.00 target price for the company. Morgan Stanley lifted their price target on shares of Netflix from $820.00 to $830.00 and gave the company an "overweight" rating in a research report on Friday, October 18th. Piper Sandler reaffirmed an "overweight" rating and set a $840.00 price objective (up from $800.00) on shares of Netflix in a report on Friday, October 18th. Deutsche Bank Aktiengesellschaft upped their target price on Netflix from $590.00 to $650.00 and gave the company a "hold" rating in a report on Wednesday, October 9th. Finally, Benchmark reiterated a "sell" rating and issued a $545.00 price objective on shares of Netflix in a research report on Tuesday, October 15th. Two equities research analysts have rated the stock with a sell rating, eleven have assigned a hold rating and twenty-three have given a buy rating to the stock. According to MarketBeat, the company currently has a consensus rating of "Moderate Buy" and an average target price of $807.70.

Check Out Our Latest Stock Report on Netflix

Netflix Stock Up 1.4 %

NFLX stock traded up $12.49 during midday trading on Thursday, reaching $902.04. 2,801,849 shares of the company were exchanged, compared to its average volume of 3,609,017. The stock's 50-day simple moving average is $829.03 and its 200 day simple moving average is $726.56. Netflix has a 1-year low of $461.86 and a 1-year high of $941.75. The company has a debt-to-equity ratio of 0.62, a quick ratio of 1.13 and a current ratio of 1.13. The company has a market cap of $385.58 billion, a price-to-earnings ratio of 51.05, a price-to-earnings-growth ratio of 1.77 and a beta of 1.27.

Netflix (NASDAQ:NFLX - Get Free Report) last released its quarterly earnings results on Thursday, October 17th. The Internet television network reported $5.40 EPS for the quarter, beating the consensus estimate of $5.09 by $0.31. Netflix had a net margin of 20.70% and a return on equity of 35.86%. The firm had revenue of $9.82 billion during the quarter, compared to the consensus estimate of $9.77 billion. On average, equities analysts forecast that Netflix will post 19.78 earnings per share for the current year.

Insider Buying and Selling at Netflix

In related news, Director Leslie J. Kilgore sold 402 shares of the firm's stock in a transaction on Wednesday, September 25th. The stock was sold at an average price of $725.00, for a total transaction of $291,450.00. Following the transaction, the director now directly owns 35,262 shares in the company, valued at $25,564,950. This trade represents a 1.13 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, insider David A. Hyman sold 267 shares of the stock in a transaction dated Tuesday, November 5th. The stock was sold at an average price of $765.67, for a total transaction of $204,433.89. Following the sale, the insider now owns 31,610 shares in the company, valued at approximately $24,202,828.70. This trade represents a 0.84 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 164,977 shares of company stock valued at $129,317,467 in the last ninety days. Insiders own 1.76% of the company's stock.

Hedge Funds Weigh In On Netflix

Hedge funds and other institutional investors have recently modified their holdings of the company. Independent Solutions Wealth Management LLC increased its stake in shares of Netflix by 10.8% in the third quarter. Independent Solutions Wealth Management LLC now owns 2,131 shares of the Internet television network's stock valued at $1,512,000 after purchasing an additional 208 shares during the period. SMART Wealth LLC acquired a new position in Netflix during the 3rd quarter worth $414,000. Lord Abbett & CO. LLC grew its stake in shares of Netflix by 20.0% in the third quarter. Lord Abbett & CO. LLC now owns 291,259 shares of the Internet television network's stock worth $206,581,000 after purchasing an additional 48,538 shares in the last quarter. DGS Capital Management LLC increased its holdings in shares of Netflix by 5.2% during the third quarter. DGS Capital Management LLC now owns 1,931 shares of the Internet television network's stock valued at $1,370,000 after purchasing an additional 95 shares during the period. Finally, Oddo BHF Asset Management Sas bought a new stake in shares of Netflix during the third quarter valued at about $21,594,000. Institutional investors and hedge funds own 80.93% of the company's stock.

About Netflix

(

Get Free Report)

Netflix, Inc provides entertainment services. It offers TV series, documentaries, feature films, and games across various genres and languages. The company also provides members the ability to receive streaming content through a host of internet-connected devices, including TVs, digital video players, TV set-top boxes, and mobile devices.

Featured Articles

Before you consider Netflix, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Netflix wasn't on the list.

While Netflix currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.