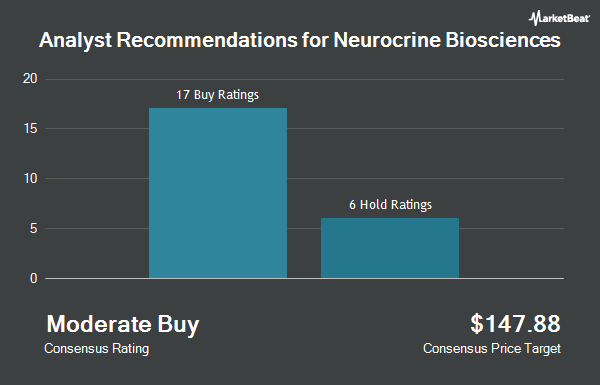

Neurocrine Biosciences, Inc. (NASDAQ:NBIX - Get Free Report) has received an average recommendation of "Moderate Buy" from the twenty-three research firms that are presently covering the firm, MarketBeat.com reports. Five analysts have rated the stock with a hold rating, seventeen have assigned a buy rating and one has issued a strong buy rating on the company. The average 1 year price target among analysts that have updated their coverage on the stock in the last year is $166.00.

A number of equities analysts have weighed in on NBIX shares. HC Wainwright restated a "buy" rating and issued a $190.00 price target on shares of Neurocrine Biosciences in a report on Monday, December 16th. BMO Capital Markets decreased their target price on Neurocrine Biosciences from $128.00 to $114.00 and set a "market perform" rating for the company in a research note on Thursday, October 17th. Barclays cut their target price on Neurocrine Biosciences from $180.00 to $160.00 and set an "overweight" rating on the stock in a research note on Monday, September 9th. Piper Sandler upgraded shares of Neurocrine Biosciences from a "neutral" rating to an "overweight" rating and upped their price target for the stock from $131.00 to $159.00 in a research report on Thursday, August 29th. Finally, William Blair reiterated an "outperform" rating on shares of Neurocrine Biosciences in a research report on Monday, December 16th.

Read Our Latest Stock Analysis on Neurocrine Biosciences

Insiders Place Their Bets

In related news, insider Jude Onyia sold 2,331 shares of the stock in a transaction dated Friday, November 29th. The stock was sold at an average price of $126.29, for a total value of $294,381.99. Following the completion of the sale, the insider now directly owns 15,449 shares of the company's stock, valued at approximately $1,951,054.21. This represents a 13.11 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, insider Ingrid Delaet sold 1,091 shares of the firm's stock in a transaction that occurred on Tuesday, December 17th. The stock was sold at an average price of $135.00, for a total transaction of $147,285.00. Following the sale, the insider now owns 2,507 shares of the company's stock, valued at approximately $338,445. This represents a 30.32 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Corporate insiders own 4.30% of the company's stock.

Institutional Investors Weigh In On Neurocrine Biosciences

Hedge funds and other institutional investors have recently made changes to their positions in the company. Sumitomo Mitsui DS Asset Management Company Ltd lifted its stake in Neurocrine Biosciences by 0.8% in the second quarter. Sumitomo Mitsui DS Asset Management Company Ltd now owns 11,436 shares of the company's stock valued at $1,574,000 after acquiring an additional 90 shares during the last quarter. Fifth Third Bancorp lifted its position in Neurocrine Biosciences by 14.7% during the 2nd quarter. Fifth Third Bancorp now owns 716 shares of the company's stock worth $99,000 after acquiring an additional 92 shares during the last quarter. Total Clarity Wealth Management Inc. grew its position in shares of Neurocrine Biosciences by 4.3% in the second quarter. Total Clarity Wealth Management Inc. now owns 2,433 shares of the company's stock valued at $335,000 after purchasing an additional 100 shares during the last quarter. Commerce Bank increased its stake in shares of Neurocrine Biosciences by 2.6% in the third quarter. Commerce Bank now owns 4,199 shares of the company's stock worth $484,000 after purchasing an additional 108 shares during the period. Finally, Caprock Group LLC lifted its position in shares of Neurocrine Biosciences by 7.0% during the 2nd quarter. Caprock Group LLC now owns 1,669 shares of the company's stock worth $230,000 after purchasing an additional 109 shares during the last quarter. 92.59% of the stock is owned by hedge funds and other institutional investors.

Neurocrine Biosciences Stock Performance

Shares of NASDAQ:NBIX traded up $0.46 during trading on Friday, reaching $135.42. 2,265,589 shares of the stock were exchanged, compared to its average volume of 884,102. Neurocrine Biosciences has a 12-month low of $110.95 and a 12-month high of $157.98. The firm's 50-day moving average price is $123.99 and its 200 day moving average price is $130.61. The firm has a market cap of $13.71 billion, a price-to-earnings ratio of 36.31 and a beta of 0.34.

About Neurocrine Biosciences

(

Get Free ReportNeurocrine Biosciences, Inc discovers, develops, and markets pharmaceuticals for neurological, neuroendocrine, and neuropsychiatric disorders in the United States and internationally. The company's products include INGREZZA for tardive dyskinesia and chorea associated with Huntington's disease; ALKINDI for adrenal insufficiency; Efmody capsules for classic congenital adrenal hyperplasia; Orilissa tablets for endometriosis; and Oriahnn capsules to treat uterine fibroids.

See Also

Before you consider Neurocrine Biosciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Neurocrine Biosciences wasn't on the list.

While Neurocrine Biosciences currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.