Robeco Institutional Asset Management B.V. increased its holdings in Neurocrine Biosciences, Inc. (NASDAQ:NBIX - Free Report) by 16.0% in the 3rd quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm owned 387,282 shares of the company's stock after buying an additional 53,301 shares during the period. Robeco Institutional Asset Management B.V. owned 0.38% of Neurocrine Biosciences worth $44,623,000 as of its most recent SEC filing.

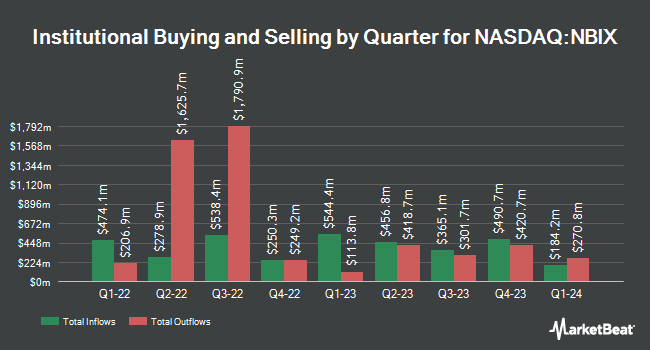

A number of other large investors have also recently made changes to their positions in NBIX. Wealth Enhancement Advisory Services LLC increased its stake in Neurocrine Biosciences by 48.5% in the 1st quarter. Wealth Enhancement Advisory Services LLC now owns 4,744 shares of the company's stock worth $654,000 after acquiring an additional 1,550 shares during the last quarter. State of Alaska Department of Revenue raised its position in Neurocrine Biosciences by 1.7% during the first quarter. State of Alaska Department of Revenue now owns 10,795 shares of the company's stock valued at $1,488,000 after purchasing an additional 185 shares in the last quarter. Norden Group LLC bought a new stake in Neurocrine Biosciences during the first quarter worth about $393,000. Janney Montgomery Scott LLC boosted its holdings in shares of Neurocrine Biosciences by 3.1% in the 1st quarter. Janney Montgomery Scott LLC now owns 8,907 shares of the company's stock worth $1,228,000 after purchasing an additional 270 shares in the last quarter. Finally, Daiwa Securities Group Inc. increased its position in shares of Neurocrine Biosciences by 32.5% during the 1st quarter. Daiwa Securities Group Inc. now owns 8,590 shares of the company's stock valued at $1,185,000 after purchasing an additional 2,109 shares during the last quarter. 92.59% of the stock is owned by institutional investors.

Neurocrine Biosciences Stock Performance

NBIX traded up $3.77 on Wednesday, hitting $125.30. The company had a trading volume of 1,207,778 shares, compared to its average volume of 916,220. The stock has a market capitalization of $12.69 billion, a price-to-earnings ratio of 33.59 and a beta of 0.35. The stock has a fifty day moving average price of $118.54 and a 200-day moving average price of $133.28. Neurocrine Biosciences, Inc. has a 12-month low of $103.63 and a 12-month high of $157.98.

Insider Activity

In other news, Director William H. Rastetter sold 14,250 shares of Neurocrine Biosciences stock in a transaction that occurred on Thursday, August 15th. The stock was sold at an average price of $146.69, for a total value of $2,090,332.50. Following the sale, the director now directly owns 37,491 shares of the company's stock, valued at $5,499,554.79. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available at this link. In related news, Director William H. Rastetter sold 14,250 shares of the stock in a transaction that occurred on Thursday, August 15th. The shares were sold at an average price of $146.69, for a total transaction of $2,090,332.50. Following the completion of the transaction, the director now owns 37,491 shares of the company's stock, valued at approximately $5,499,554.79. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, insider Ingrid Delaet sold 7,143 shares of the firm's stock in a transaction that occurred on Tuesday, August 13th. The shares were sold at an average price of $150.10, for a total transaction of $1,072,164.30. Following the completion of the transaction, the insider now directly owns 2,507 shares of the company's stock, valued at $376,300.70. This represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 47,063 shares of company stock worth $7,023,330 in the last ninety days. Company insiders own 4.30% of the company's stock.

Wall Street Analysts Forecast Growth

Several equities analysts recently issued reports on NBIX shares. Raymond James restated an "outperform" rating and set a $155.00 price target on shares of Neurocrine Biosciences in a research report on Thursday, October 10th. Jefferies Financial Group raised their price target on Neurocrine Biosciences from $177.00 to $189.00 and gave the stock a "buy" rating in a research note on Monday, August 19th. Needham & Company LLC reissued a "hold" rating on shares of Neurocrine Biosciences in a report on Tuesday, October 29th. HC Wainwright restated a "buy" rating and issued a $190.00 price objective on shares of Neurocrine Biosciences in a research report on Friday, November 1st. Finally, JPMorgan Chase & Co. lifted their price target on shares of Neurocrine Biosciences from $173.00 to $181.00 and gave the company an "overweight" rating in a report on Wednesday, August 7th. Five equities research analysts have rated the stock with a hold rating, nineteen have issued a buy rating and one has given a strong buy rating to the company. According to data from MarketBeat.com, Neurocrine Biosciences has an average rating of "Moderate Buy" and a consensus target price of $163.91.

Check Out Our Latest Report on Neurocrine Biosciences

About Neurocrine Biosciences

(

Free Report)

Neurocrine Biosciences, Inc discovers, develops, and markets pharmaceuticals for neurological, neuroendocrine, and neuropsychiatric disorders in the United States and internationally. The company's products include INGREZZA for tardive dyskinesia and chorea associated with Huntington's disease; ALKINDI for adrenal insufficiency; Efmody capsules for classic congenital adrenal hyperplasia; Orilissa tablets for endometriosis; and Oriahnn capsules to treat uterine fibroids.

Read More

Before you consider Neurocrine Biosciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Neurocrine Biosciences wasn't on the list.

While Neurocrine Biosciences currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.