Neurocrine Biosciences (NASDAQ:NBIX - Get Free Report)'s stock had its "hold" rating reiterated by analysts at Needham & Company LLC in a research report issued to clients and investors on Monday,Benzinga reports.

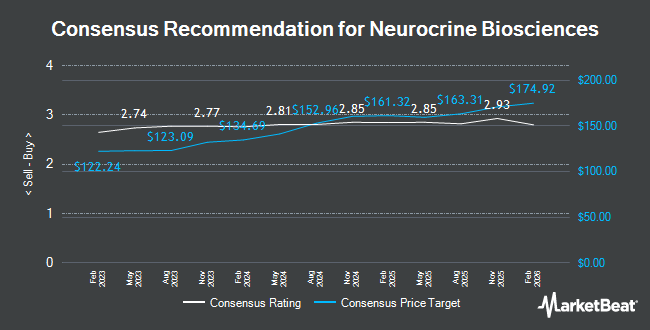

Other equities analysts have also issued reports about the stock. Piper Sandler raised shares of Neurocrine Biosciences from a "neutral" rating to an "overweight" rating and raised their target price for the stock from $131.00 to $159.00 in a research report on Thursday, August 29th. Jefferies Financial Group lifted their target price on shares of Neurocrine Biosciences from $177.00 to $189.00 and gave the company a "buy" rating in a report on Monday, August 19th. Robert W. Baird upped their price target on shares of Neurocrine Biosciences from $157.00 to $180.00 and gave the stock an "outperform" rating in a research report on Friday, August 2nd. Cantor Fitzgerald reaffirmed an "overweight" rating and issued a $155.00 price target on shares of Neurocrine Biosciences in a report on Monday, September 16th. Finally, BMO Capital Markets decreased their price objective on shares of Neurocrine Biosciences from $128.00 to $114.00 and set a "market perform" rating on the stock in a report on Thursday, October 17th. Five investment analysts have rated the stock with a hold rating, nineteen have given a buy rating and one has assigned a strong buy rating to the company. According to MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and a consensus target price of $163.91.

View Our Latest Research Report on NBIX

Neurocrine Biosciences Stock Up 1.3 %

NBIX traded up $1.58 during mid-day trading on Monday, reaching $127.32. 543,763 shares of the company traded hands, compared to its average volume of 862,205. The company's fifty day moving average price is $118.43 and its 200-day moving average price is $133.07. The stock has a market capitalization of $12.89 billion, a P/E ratio of 34.33 and a beta of 0.35. Neurocrine Biosciences has a 52-week low of $106.85 and a 52-week high of $157.98.

Insiders Place Their Bets

In related news, Director Gary A. Lyons sold 11,570 shares of the business's stock in a transaction that occurred on Tuesday, August 13th. The stock was sold at an average price of $150.43, for a total transaction of $1,740,475.10. Following the completion of the transaction, the director now directly owns 119,047 shares in the company, valued at approximately $17,908,240.21. The trade was a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which can be accessed through this link. In other news, Director Gary A. Lyons sold 11,570 shares of Neurocrine Biosciences stock in a transaction that occurred on Tuesday, August 13th. The shares were sold at an average price of $150.43, for a total transaction of $1,740,475.10. Following the sale, the director now owns 119,047 shares in the company, valued at $17,908,240.21. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available at the SEC website. Also, CFO Matt Abernethy sold 14,100 shares of the business's stock in a transaction on Tuesday, August 13th. The stock was sold at an average price of $150.38, for a total transaction of $2,120,358.00. Following the completion of the sale, the chief financial officer now owns 31,528 shares in the company, valued at $4,741,180.64. This represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 47,063 shares of company stock worth $7,023,330 over the last quarter. 4.30% of the stock is currently owned by corporate insiders.

Institutional Inflows and Outflows

Hedge funds have recently made changes to their positions in the stock. Sumitomo Mitsui DS Asset Management Company Ltd boosted its holdings in shares of Neurocrine Biosciences by 0.8% in the 2nd quarter. Sumitomo Mitsui DS Asset Management Company Ltd now owns 11,436 shares of the company's stock valued at $1,574,000 after buying an additional 90 shares in the last quarter. Fifth Third Bancorp boosted its stake in Neurocrine Biosciences by 14.7% during the 2nd quarter. Fifth Third Bancorp now owns 716 shares of the company's stock worth $99,000 after purchasing an additional 92 shares during the last quarter. Total Clarity Wealth Management Inc. boosted its stake in Neurocrine Biosciences by 4.3% during the 2nd quarter. Total Clarity Wealth Management Inc. now owns 2,433 shares of the company's stock worth $335,000 after purchasing an additional 100 shares during the last quarter. Commerce Bank raised its holdings in shares of Neurocrine Biosciences by 2.6% during the 3rd quarter. Commerce Bank now owns 4,199 shares of the company's stock worth $484,000 after acquiring an additional 108 shares during the period. Finally, Caprock Group LLC raised its holdings in shares of Neurocrine Biosciences by 7.0% during the 2nd quarter. Caprock Group LLC now owns 1,669 shares of the company's stock worth $230,000 after acquiring an additional 109 shares during the period. 92.59% of the stock is currently owned by institutional investors.

About Neurocrine Biosciences

(

Get Free Report)

Neurocrine Biosciences, Inc discovers, develops, and markets pharmaceuticals for neurological, neuroendocrine, and neuropsychiatric disorders in the United States and internationally. The company's products include INGREZZA for tardive dyskinesia and chorea associated with Huntington's disease; ALKINDI for adrenal insufficiency; Efmody capsules for classic congenital adrenal hyperplasia; Orilissa tablets for endometriosis; and Oriahnn capsules to treat uterine fibroids.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Neurocrine Biosciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Neurocrine Biosciences wasn't on the list.

While Neurocrine Biosciences currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.