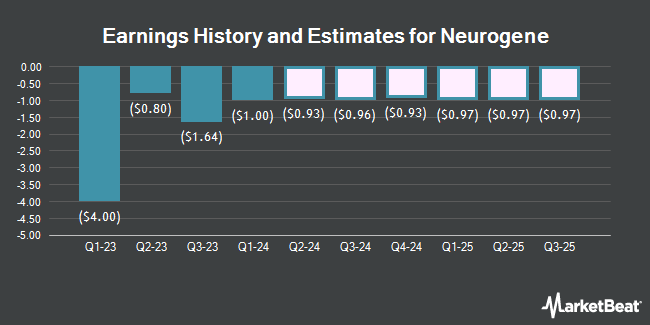

Neurogene Inc. (NASDAQ:NGNE - Free Report) - Investment analysts at Leerink Partnrs cut their FY2024 earnings estimates for shares of Neurogene in a research report issued on Monday, November 18th. Leerink Partnrs analyst M. Foroohar now forecasts that the company will post earnings per share of ($4.52) for the year, down from their previous forecast of ($4.40). The consensus estimate for Neurogene's current full-year earnings is ($4.45) per share. Leerink Partnrs also issued estimates for Neurogene's Q4 2024 earnings at ($1.22) EPS, FY2025 earnings at ($4.49) EPS and FY2026 earnings at ($5.96) EPS.

NGNE has been the subject of several other research reports. William Blair restated an "outperform" rating on shares of Neurogene in a research note on Tuesday. BMO Capital Markets lowered their price objective on shares of Neurogene from $60.00 to $45.00 and set an "outperform" rating on the stock in a research note on Wednesday. Robert W. Baird upped their target price on shares of Neurogene from $54.00 to $72.00 and gave the company an "outperform" rating in a research note on Tuesday, November 12th. Leerink Partners raised their price target on shares of Neurogene from $45.00 to $72.00 and gave the stock an "outperform" rating in a research report on Tuesday, November 12th. Finally, Stifel Nicolaus upped their price objective on shares of Neurogene from $44.00 to $60.00 and gave the company a "buy" rating in a research report on Tuesday, November 12th. Eight equities research analysts have rated the stock with a buy rating and one has given a strong buy rating to the company's stock. According to data from MarketBeat, the company currently has an average rating of "Buy" and an average price target of $60.83.

Check Out Our Latest Stock Analysis on NGNE

Neurogene Stock Down 11.0 %

Shares of NASDAQ:NGNE opened at $15.33 on Thursday. The stock's 50-day moving average is $45.90 and its 200-day moving average is $39.79. Neurogene has a 52-week low of $12.49 and a 52-week high of $74.49.

Institutional Trading of Neurogene

Several institutional investors have recently bought and sold shares of the stock. Charles Schwab Investment Management Inc. lifted its holdings in shares of Neurogene by 2.5% during the third quarter. Charles Schwab Investment Management Inc. now owns 30,317 shares of the company's stock valued at $1,272,000 after acquiring an additional 741 shares during the period. BNP Paribas Financial Markets lifted its holdings in Neurogene by 192.8% during the 3rd quarter. BNP Paribas Financial Markets now owns 2,170 shares of the company's stock valued at $91,000 after purchasing an additional 1,429 shares during the last quarter. Quest Partners LLC acquired a new position in Neurogene in the second quarter valued at about $55,000. SG Americas Securities LLC bought a new stake in Neurogene during the first quarter worth about $120,000. Finally, Baker BROS. Advisors LP increased its holdings in shares of Neurogene by 0.6% during the first quarter. Baker BROS. Advisors LP now owns 456,015 shares of the company's stock worth $23,211,000 after buying an additional 2,499 shares in the last quarter. Institutional investors and hedge funds own 52.37% of the company's stock.

About Neurogene

(

Get Free Report)

Neurogene Inc, a biotechnology company, develops genetic medicines for rare neurological diseases. The company's product candidates include NGN-401 which is packaged in an adeno-associated virus 9 that is in Phase 1/2 clinical trial for the treatment of Rett syndrome; and NGN-101, a conventional gene therapy candidate that is in Phase 1/2 clinical trial to treat CLN5 Batten disease.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Neurogene, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Neurogene wasn't on the list.

While Neurogene currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.