Neurogene (NASDAQ:NGNE - Free Report) had its price target increased by HC Wainwright from $49.00 to $55.00 in a research report released on Tuesday,Benzinga reports. They currently have a buy rating on the stock.

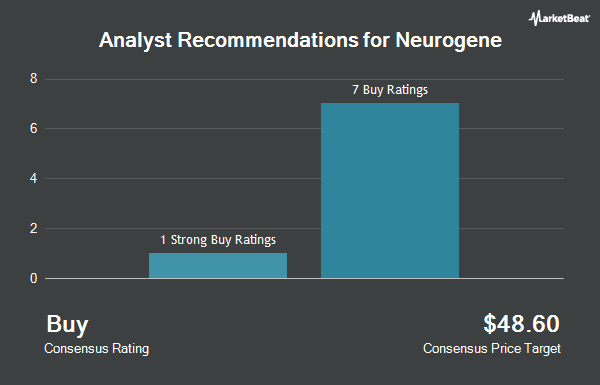

Separately, Robert W. Baird upped their price target on shares of Neurogene from $54.00 to $72.00 and gave the stock an "outperform" rating in a research report on Tuesday. Eight investment analysts have rated the stock with a buy rating and one has issued a strong buy rating to the stock. According to MarketBeat, the stock presently has a consensus rating of "Buy" and a consensus price target of $63.33.

View Our Latest Stock Analysis on NGNE

Neurogene Price Performance

NASDAQ NGNE traded down $31.53 during trading hours on Tuesday, reaching $40.00. The stock had a trading volume of 1,989,758 shares, compared to its average volume of 135,534. The stock has a fifty day moving average of $46.77 and a 200 day moving average of $40.05. Neurogene has a 52-week low of $12.49 and a 52-week high of $74.49.

Neurogene (NASDAQ:NGNE - Get Free Report) last announced its earnings results on Friday, August 9th. The company reported ($1.09) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($1.02) by ($0.07). The business had revenue of $0.93 million during the quarter. On average, sell-side analysts expect that Neurogene will post -4.44 earnings per share for the current year.

Hedge Funds Weigh In On Neurogene

Several institutional investors and hedge funds have recently added to or reduced their stakes in NGNE. Charles Schwab Investment Management Inc. lifted its position in shares of Neurogene by 2.5% during the 3rd quarter. Charles Schwab Investment Management Inc. now owns 30,317 shares of the company's stock valued at $1,272,000 after buying an additional 741 shares in the last quarter. Jennison Associates LLC acquired a new stake in shares of Neurogene in the third quarter worth approximately $3,300,000. SG Americas Securities LLC acquired a new stake in shares of Neurogene during the third quarter valued at about $150,000. Driehaus Capital Management LLC lifted its stake in Neurogene by 123.8% during the second quarter. Driehaus Capital Management LLC now owns 102,187 shares of the company's stock worth $3,719,000 after purchasing an additional 56,533 shares during the last quarter. Finally, Marshall Wace LLP raised its holdings in Neurogene by 37.2% during the second quarter. Marshall Wace LLP now owns 41,447 shares of the company's stock worth $1,508,000 after purchasing an additional 11,229 shares in the last quarter. 52.37% of the stock is currently owned by institutional investors and hedge funds.

Neurogene Company Profile

(

Get Free Report)

Neurogene Inc, a biotechnology company, develops genetic medicines for rare neurological diseases. The company's product candidates include NGN-401 which is packaged in an adeno-associated virus 9 that is in Phase 1/2 clinical trial for the treatment of Rett syndrome; and NGN-101, a conventional gene therapy candidate that is in Phase 1/2 clinical trial to treat CLN5 Batten disease.

Recommended Stories

Before you consider Neurogene, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Neurogene wasn't on the list.

While Neurogene currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.