New Age Alpha Advisors LLC acquired a new stake in shares of CACI International Inc (NYSE:CACI - Free Report) in the fourth quarter, according to its most recent disclosure with the SEC. The firm acquired 13,258 shares of the information technology services provider's stock, valued at approximately $5,357,000. New Age Alpha Advisors LLC owned approximately 0.06% of CACI International at the end of the most recent reporting period.

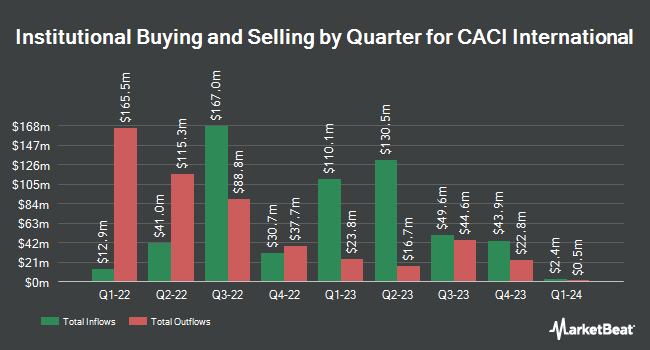

Other institutional investors and hedge funds have also recently modified their holdings of the company. Zions Bancorporation N.A. lifted its position in shares of CACI International by 18.3% in the fourth quarter. Zions Bancorporation N.A. now owns 5,981 shares of the information technology services provider's stock worth $2,417,000 after buying an additional 925 shares in the last quarter. KLP Kapitalforvaltning AS bought a new stake in CACI International in the 4th quarter worth approximately $2,546,000. Quantbot Technologies LP purchased a new stake in shares of CACI International during the 4th quarter worth approximately $4,023,000. VSM Wealth Advisory LLC bought a new position in shares of CACI International during the 4th quarter valued at approximately $69,000. Finally, River Road Asset Management LLC purchased a new position in shares of CACI International in the fourth quarter valued at $8,585,000. Institutional investors own 86.43% of the company's stock.

Wall Street Analysts Forecast Growth

Several equities analysts have commented on the stock. StockNews.com lowered shares of CACI International from a "buy" rating to a "hold" rating in a research report on Saturday, January 25th. William Blair downgraded shares of CACI International from an "outperform" rating to a "market perform" rating in a report on Friday, February 21st. Raymond James reissued an "outperform" rating and set a $490.00 price objective (up from $475.00) on shares of CACI International in a research note on Thursday, January 23rd. Cantor Fitzgerald upgraded CACI International to a "strong-buy" rating in a research report on Tuesday, February 25th. Finally, The Goldman Sachs Group lowered shares of CACI International from a "neutral" rating to a "sell" rating and dropped their price objective for the stock from $540.00 to $373.00 in a research note on Thursday, December 12th. One investment analyst has rated the stock with a sell rating, two have assigned a hold rating, eleven have assigned a buy rating and one has assigned a strong buy rating to the company's stock. According to data from MarketBeat, CACI International currently has an average rating of "Moderate Buy" and a consensus price target of $517.31.

Get Our Latest Research Report on CACI International

CACI International Stock Up 9.1 %

CACI International stock traded up $33.67 during midday trading on Wednesday, hitting $403.57. 711,633 shares of the company's stock were exchanged, compared to its average volume of 234,940. CACI International Inc has a 12 month low of $318.60 and a 12 month high of $588.26. The company has a debt-to-equity ratio of 0.80, a quick ratio of 1.52 and a current ratio of 1.52. The company has a market cap of $9.05 billion, a PE ratio of 18.93, a P/E/G ratio of 1.01 and a beta of 0.88. The firm has a 50-day moving average of $369.11 and a two-hundred day moving average of $439.59.

CACI International (NYSE:CACI - Get Free Report) last issued its quarterly earnings data on Wednesday, January 22nd. The information technology services provider reported $5.95 EPS for the quarter, topping analysts' consensus estimates of $5.28 by $0.67. CACI International had a net margin of 5.90% and a return on equity of 15.30%. As a group, analysts expect that CACI International Inc will post 23.94 earnings per share for the current fiscal year.

Insider Buying and Selling

In related news, Director Debora A. Plunkett sold 309 shares of the business's stock in a transaction that occurred on Wednesday, March 12th. The shares were sold at an average price of $363.62, for a total transaction of $112,358.58. Following the completion of the transaction, the director now owns 2,315 shares in the company, valued at $841,780.30. The trade was a 11.78 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is available through this link. 1.35% of the stock is currently owned by company insiders.

About CACI International

(

Free Report)

CACI International Inc, through its subsidiaries, engages in the provision of expertise and technology to enterprise and mission customers in support of national security in the intelligence, defense, and federal civilian sectors. The company operates through two segments, Domestic Operations and International Operations.

See Also

Before you consider CACI International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CACI International wasn't on the list.

While CACI International currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.