New England Asset Management Inc. lifted its stake in CRH plc (NYSE:CRH - Free Report) by 19.6% in the 3rd quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 63,351 shares of the construction company's stock after purchasing an additional 10,383 shares during the period. New England Asset Management Inc.'s holdings in CRH were worth $5,875,000 as of its most recent SEC filing.

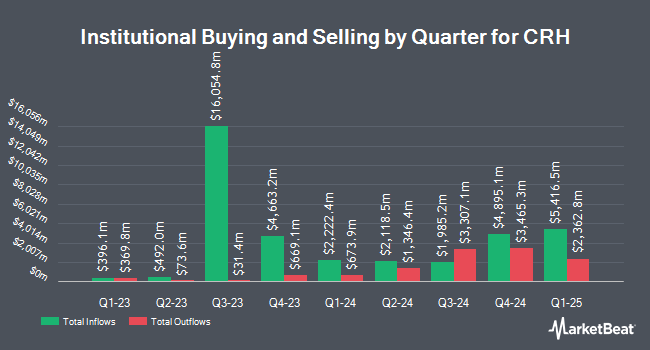

Several other hedge funds and other institutional investors have also recently made changes to their positions in CRH. Grove Bank & Trust grew its holdings in shares of CRH by 9.5% during the third quarter. Grove Bank & Trust now owns 1,419 shares of the construction company's stock worth $132,000 after buying an additional 123 shares in the last quarter. UMB Bank n.a. lifted its position in shares of CRH by 72.7% during the third quarter. UMB Bank n.a. now owns 297 shares of the construction company's stock worth $28,000 after purchasing an additional 125 shares in the last quarter. CVA Family Office LLC boosted its stake in shares of CRH by 2.1% in the third quarter. CVA Family Office LLC now owns 6,116 shares of the construction company's stock valued at $567,000 after purchasing an additional 128 shares during the period. Lindbrook Capital LLC boosted its stake in shares of CRH by 2.9% in the third quarter. Lindbrook Capital LLC now owns 4,815 shares of the construction company's stock valued at $447,000 after purchasing an additional 135 shares during the period. Finally, Baillie Gifford & Co. boosted its stake in shares of CRH by 70.7% in the third quarter. Baillie Gifford & Co. now owns 391 shares of the construction company's stock valued at $36,000 after purchasing an additional 162 shares during the period. Institutional investors and hedge funds own 62.50% of the company's stock.

Analyst Upgrades and Downgrades

A number of research analysts have commented on the stock. Barclays began coverage on shares of CRH in a research note on Tuesday, October 29th. They set an "overweight" rating and a $110.00 price objective on the stock. Hsbc Global Res raised shares of CRH to a "strong-buy" rating in a report on Monday, November 11th. HSBC began coverage on shares of CRH in a research report on Monday, November 11th. They issued a "buy" rating and a $116.00 target price for the company. Truist Financial increased their target price on shares of CRH from $110.00 to $120.00 and gave the company a "buy" rating in a research report on Friday, November 8th. Finally, StockNews.com upgraded shares of CRH from a "hold" rating to a "buy" rating in a research report on Monday, November 11th. One equities research analyst has rated the stock with a hold rating, eleven have issued a buy rating and one has issued a strong buy rating to the company's stock. Based on data from MarketBeat.com, the company has an average rating of "Buy" and a consensus target price of $105.55.

View Our Latest Stock Report on CRH

CRH Stock Up 0.1 %

CRH traded up $0.14 during trading on Tuesday, reaching $99.79. 4,447,517 shares of the company's stock were exchanged, compared to its average volume of 4,875,525. The company has a market capitalization of $67.78 billion, a P/E ratio of 19.96, a PEG ratio of 1.44 and a beta of 1.29. The business has a 50 day moving average price of $93.07 and a 200 day moving average price of $85.11. CRH plc has a fifty-two week low of $58.57 and a fifty-two week high of $102.51.

CRH Cuts Dividend

The business also recently disclosed a Variable dividend, which will be paid on Wednesday, December 18th. Shareholders of record on Friday, November 22nd will be issued a dividend of $0.262 per share. The ex-dividend date of this dividend is Friday, November 22nd. This represents a dividend yield of 1.4%. CRH's payout ratio is presently 32.00%.

About CRH

(

Free Report)

CRH plc, together with its subsidiaries, provides building materials solutions in Ireland and internationally. It operates through four segments: Americas Materials Solutions, Americas Building Solutions, Europe Materials Solutions, and Europe Building Solutions. The company provides solutions for the construction and maintenance of public infrastructure and commercial and residential buildings; and produces and sells aggregates, cement, readymixed concrete, and asphalt, as well as provides paving and construction services.

Featured Articles

Before you consider CRH, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CRH wasn't on the list.

While CRH currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.