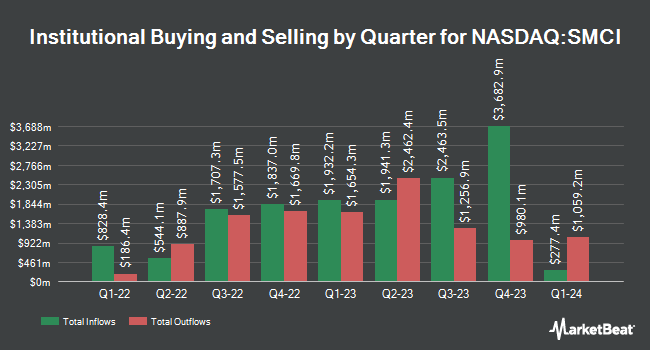

New Mexico Educational Retirement Board boosted its position in Super Micro Computer, Inc. (NASDAQ:SMCI - Free Report) by 860.0% in the 4th quarter, according to the company in its most recent 13F filing with the SEC. The fund owned 24,000 shares of the company's stock after purchasing an additional 21,500 shares during the quarter. New Mexico Educational Retirement Board's holdings in Super Micro Computer were worth $732,000 at the end of the most recent reporting period.

A number of other hedge funds and other institutional investors also recently added to or reduced their stakes in SMCI. Blue Trust Inc. raised its holdings in Super Micro Computer by 203.2% in the 4th quarter. Blue Trust Inc. now owns 1,231 shares of the company's stock valued at $38,000 after acquiring an additional 825 shares during the last quarter. New York State Teachers Retirement System increased its holdings in shares of Super Micro Computer by 803.1% in the fourth quarter. New York State Teachers Retirement System now owns 409,622 shares of the company's stock valued at $12,485,000 after purchasing an additional 364,263 shares during the last quarter. Chevy Chase Trust Holdings LLC purchased a new position in Super Micro Computer during the fourth quarter worth approximately $8,062,000. V Square Quantitative Management LLC lifted its position in Super Micro Computer by 4,881.1% during the fourth quarter. V Square Quantitative Management LLC now owns 10,012 shares of the company's stock worth $305,000 after buying an additional 9,811 shares in the last quarter. Finally, Compagnie Lombard Odier SCmA boosted its stake in Super Micro Computer by 1,219.1% during the fourth quarter. Compagnie Lombard Odier SCmA now owns 5,250 shares of the company's stock worth $160,000 after buying an additional 4,852 shares during the last quarter. Hedge funds and other institutional investors own 84.06% of the company's stock.

Super Micro Computer Trading Down 5.4 %

Shares of NASDAQ SMCI traded down $3.20 during trading on Friday, reaching $56.07. The stock had a trading volume of 104,165,992 shares, compared to its average volume of 71,845,594. The business's 50-day moving average price is $34.83 and its 200-day moving average price is $39.86. Super Micro Computer, Inc. has a fifty-two week low of $17.25 and a fifty-two week high of $122.90. The company has a debt-to-equity ratio of 0.32, a quick ratio of 1.93 and a current ratio of 3.77. The company has a market cap of $32.83 billion, a P/E ratio of 28.15 and a beta of 1.30.

Wall Street Analyst Weigh In

Several research analysts have recently commented on SMCI shares. Cfra upgraded Super Micro Computer from a "hold" rating to a "buy" rating and set a $48.00 price target on the stock in a report on Tuesday, February 11th. Wedbush lifted their target price on shares of Super Micro Computer from $24.00 to $40.00 and gave the stock a "neutral" rating in a research note on Wednesday, February 12th. Argus lowered shares of Super Micro Computer from a "buy" rating to a "hold" rating in a report on Thursday, October 31st. The Goldman Sachs Group cut their price target on shares of Super Micro Computer from $67.50 to $28.00 and set a "neutral" rating for the company in a report on Wednesday, November 6th. Finally, Northland Capmk upgraded Super Micro Computer to a "strong-buy" rating in a report on Friday, December 20th. Three research analysts have rated the stock with a sell rating, ten have given a hold rating, five have issued a buy rating and one has given a strong buy rating to the company. Based on data from MarketBeat.com, Super Micro Computer currently has a consensus rating of "Hold" and a consensus price target of $60.20.

View Our Latest Stock Report on SMCI

About Super Micro Computer

(

Free Report)

Super Micro Computer, Inc, together with its subsidiaries, develops and manufactures high performance server and storage solutions based on modular and open architecture in the United States, Europe, Asia, and internationally. Its solutions range from complete server, storage systems, modular blade servers, blades, workstations, full racks, networking devices, server sub-systems, server management software, and security software.

Featured Stories

Before you consider Super Micro Computer, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Super Micro Computer wasn't on the list.

While Super Micro Computer currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.