New Oriental Education & Technology Group (NYSE:EDU - Get Free Report) was downgraded by research analysts at China Renaissance from a "buy" rating to a "hold" rating in a research note issued to investors on Monday, MarketBeat reports.

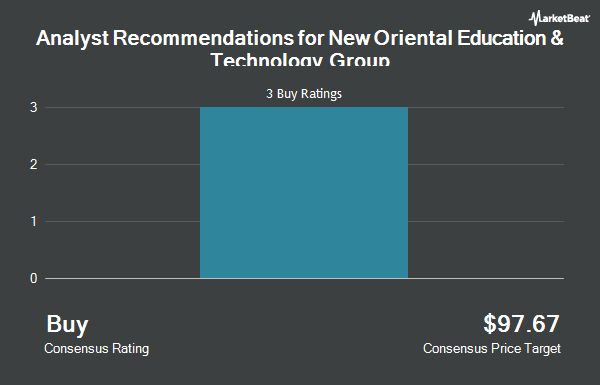

EDU has been the topic of several other reports. Morgan Stanley cut New Oriental Education & Technology Group from an "overweight" rating to an "equal weight" rating and reduced their target price for the stock from $83.00 to $52.00 in a report on Wednesday, January 22nd. Citigroup cut New Oriental Education & Technology Group from a "buy" rating to a "neutral" rating and decreased their price objective for the stock from $83.00 to $50.00 in a report on Friday, January 24th. StockNews.com lowered shares of New Oriental Education & Technology Group from a "buy" rating to a "hold" rating in a report on Thursday, March 13th. Macquarie downgraded shares of New Oriental Education & Technology Group from an "outperform" rating to an "underperform" rating and decreased their price target for the company from $79.00 to $44.00 in a research note on Wednesday, January 22nd. Finally, JPMorgan Chase & Co. cut shares of New Oriental Education & Technology Group from an "overweight" rating to a "neutral" rating and dropped their price objective for the stock from $85.00 to $50.00 in a research note on Wednesday, January 22nd. One analyst has rated the stock with a sell rating, five have assigned a hold rating and one has assigned a buy rating to the company's stock. According to data from MarketBeat, the stock currently has a consensus rating of "Hold" and a consensus target price of $61.20.

Read Our Latest Stock Report on New Oriental Education & Technology Group

New Oriental Education & Technology Group Trading Down 1.5 %

Shares of NYSE:EDU traded down $0.72 during midday trading on Monday, reaching $46.87. 317,874 shares of the company were exchanged, compared to its average volume of 1,904,464. The stock has a market cap of $7.95 billion, a PE ratio of 19.96 and a beta of 0.47. The business's fifty day moving average is $49.85 and its two-hundred day moving average is $58.84. New Oriental Education & Technology Group has a one year low of $44.46 and a one year high of $91.04.

Institutional Inflows and Outflows

Hedge funds have recently bought and sold shares of the company. GeoWealth Management LLC lifted its holdings in shares of New Oriental Education & Technology Group by 258.5% in the 4th quarter. GeoWealth Management LLC now owns 441 shares of the company's stock worth $28,000 after acquiring an additional 318 shares during the last quarter. Westpac Banking Corp purchased a new stake in New Oriental Education & Technology Group in the 4th quarter worth about $45,000. SBI Securities Co. Ltd. bought a new stake in New Oriental Education & Technology Group in the fourth quarter worth about $51,000. Natixis boosted its position in shares of New Oriental Education & Technology Group by 39.2% during the fourth quarter. Natixis now owns 881 shares of the company's stock valued at $57,000 after buying an additional 248 shares during the period. Finally, Zurcher Kantonalbank Zurich Cantonalbank grew its stake in shares of New Oriental Education & Technology Group by 14.2% during the third quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 1,658 shares of the company's stock valued at $126,000 after buying an additional 206 shares during the last quarter.

New Oriental Education & Technology Group Company Profile

(

Get Free Report)

New Oriental Education & Technology Group, Inc is a holding company, which engages in the provision of private educational services. It operates through the following segments: Educational Services and Test Preparation Courses, Private Label Products and Livestreaming E-Commerce, Overseas Study Consulting Services, and Educational Materials and Distribution.

Featured Articles

Before you consider New Oriental Education & Technology Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and New Oriental Education & Technology Group wasn't on the list.

While New Oriental Education & Technology Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.