New York State Common Retirement Fund lessened its holdings in shares of Consolidated Water Co. Ltd. (NASDAQ:CWCO - Free Report) by 26.3% during the 4th quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 141,883 shares of the utilities provider's stock after selling 50,589 shares during the period. New York State Common Retirement Fund owned approximately 0.90% of Consolidated Water worth $3,673,000 at the end of the most recent quarter.

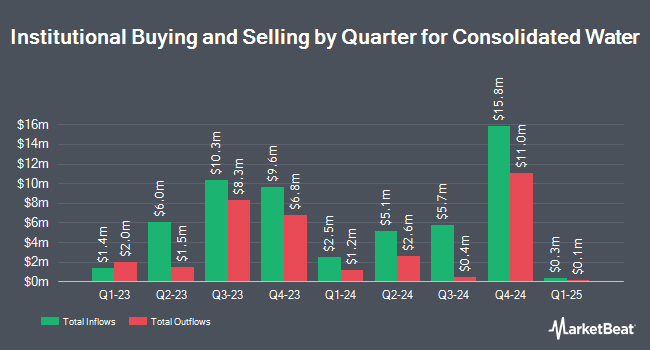

Several other large investors also recently made changes to their positions in CWCO. Byrne Asset Management LLC lifted its stake in Consolidated Water by 59.3% in the fourth quarter. Byrne Asset Management LLC now owns 1,720 shares of the utilities provider's stock valued at $45,000 after acquiring an additional 640 shares during the last quarter. Allworth Financial LP raised its holdings in Consolidated Water by 643.4% in the 4th quarter. Allworth Financial LP now owns 2,349 shares of the utilities provider's stock valued at $61,000 after acquiring an additional 2,033 shares during the period. Copeland Capital Management LLC grew its position in shares of Consolidated Water by 37.4% in the fourth quarter. Copeland Capital Management LLC now owns 2,634 shares of the utilities provider's stock valued at $68,000 after purchasing an additional 717 shares during the last quarter. SG Americas Securities LLC increased its stake in shares of Consolidated Water by 23.9% during the fourth quarter. SG Americas Securities LLC now owns 6,479 shares of the utilities provider's stock worth $168,000 after purchasing an additional 1,251 shares during the period. Finally, Atria Investments Inc lifted its holdings in Consolidated Water by 15.4% during the 3rd quarter. Atria Investments Inc now owns 12,281 shares of the utilities provider's stock worth $310,000 after purchasing an additional 1,639 shares during the last quarter. Institutional investors own 55.16% of the company's stock.

Insider Activity at Consolidated Water

In other news, CEO Frederick W. Mctaggart sold 2,000 shares of the company's stock in a transaction that occurred on Tuesday, February 18th. The stock was sold at an average price of $28.00, for a total transaction of $56,000.00. Following the transaction, the chief executive officer now directly owns 271,995 shares of the company's stock, valued at $7,615,860. This represents a 0.73 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. 5.87% of the stock is owned by corporate insiders.

Consolidated Water Price Performance

NASDAQ:CWCO traded down $0.05 during trading hours on Tuesday, reaching $27.25. 51,663 shares of the company were exchanged, compared to its average volume of 78,829. The business has a 50 day moving average of $26.42 and a 200 day moving average of $25.98. The company has a market capitalization of $431.57 million, a P/E ratio of 16.81, a P/E/G ratio of 2.44 and a beta of 0.22. Consolidated Water Co. Ltd. has a 1-year low of $23.55 and a 1-year high of $33.34.

Consolidated Water Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Wednesday, April 30th. Investors of record on Tuesday, April 1st will be issued a $0.11 dividend. The ex-dividend date of this dividend is Tuesday, April 1st. This represents a $0.44 annualized dividend and a yield of 1.61%. Consolidated Water's payout ratio is 27.16%.

Consolidated Water Company Profile

(

Free Report)

Consolidated Water Co Ltd., together with its subsidiaries, designs, constructs, manages, and operates water production and water treatment plants primarily in the Cayman Islands, the Bahamas, and the United States. The company operates through four segments: Retail, Bulk, Services, and Manufacturing.

Read More

Before you consider Consolidated Water, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Consolidated Water wasn't on the list.

While Consolidated Water currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.