New York State Common Retirement Fund grew its holdings in shares of F5, Inc. (NASDAQ:FFIV - Free Report) by 14.3% in the 3rd quarter, according to its most recent disclosure with the SEC. The fund owned 70,536 shares of the network technology company's stock after purchasing an additional 8,800 shares during the period. New York State Common Retirement Fund owned approximately 0.12% of F5 worth $15,532,000 as of its most recent SEC filing.

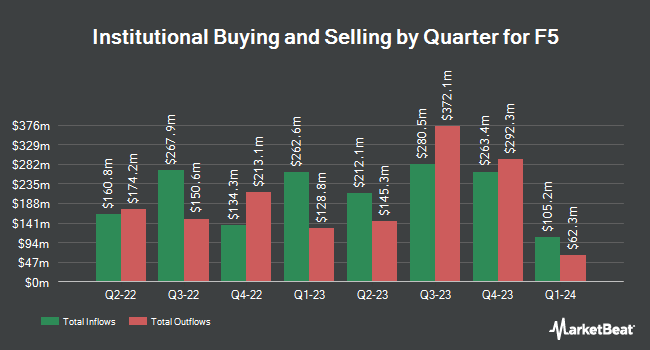

Other hedge funds have also recently made changes to their positions in the company. Vanguard Group Inc. raised its holdings in F5 by 0.4% in the first quarter. Vanguard Group Inc. now owns 7,465,022 shares of the network technology company's stock worth $1,415,294,000 after buying an additional 29,154 shares during the last quarter. American Century Companies Inc. raised its holdings in F5 by 10.5% in the 2nd quarter. American Century Companies Inc. now owns 1,709,296 shares of the network technology company's stock worth $294,392,000 after acquiring an additional 162,820 shares during the last quarter. Pacer Advisors Inc. raised its holdings in F5 by 6,700.2% in the 2nd quarter. Pacer Advisors Inc. now owns 848,388 shares of the network technology company's stock worth $146,118,000 after acquiring an additional 835,912 shares during the last quarter. AQR Capital Management LLC lifted its position in F5 by 48.9% in the 2nd quarter. AQR Capital Management LLC now owns 652,972 shares of the network technology company's stock valued at $111,932,000 after acquiring an additional 214,351 shares in the last quarter. Finally, Acadian Asset Management LLC boosted its stake in F5 by 14.2% during the 1st quarter. Acadian Asset Management LLC now owns 625,734 shares of the network technology company's stock valued at $118,607,000 after purchasing an additional 77,611 shares during the last quarter. 90.66% of the stock is owned by institutional investors.

F5 Price Performance

Shares of FFIV stock traded up $7.20 during trading hours on Wednesday, reaching $240.12. 588,221 shares of the company traded hands, compared to its average volume of 536,205. The firm has a 50-day moving average price of $216.08 and a 200 day moving average price of $190.82. The company has a market cap of $14.00 billion, a P/E ratio of 24.36, a P/E/G ratio of 3.14 and a beta of 1.05. F5, Inc. has a 12-month low of $154.11 and a 12-month high of $250.46.

F5 (NASDAQ:FFIV - Get Free Report) last announced its quarterly earnings data on Monday, October 28th. The network technology company reported $3.67 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $3.45 by $0.22. The firm had revenue of $747.00 million during the quarter, compared to analysts' expectations of $730.43 million. F5 had a net margin of 20.13% and a return on equity of 20.80%. The company's revenue for the quarter was up 5.7% compared to the same quarter last year. During the same period in the prior year, the company posted $2.76 earnings per share. Sell-side analysts predict that F5, Inc. will post 10.99 EPS for the current year.

F5 announced that its board has authorized a share repurchase program on Monday, October 28th that allows the company to repurchase $1.00 billion in outstanding shares. This repurchase authorization allows the network technology company to repurchase up to 7.9% of its stock through open market purchases. Stock repurchase programs are generally an indication that the company's leadership believes its stock is undervalued.

Analyst Ratings Changes

FFIV has been the topic of a number of research analyst reports. Morgan Stanley upped their price target on F5 from $215.00 to $230.00 and gave the company an "equal weight" rating in a report on Tuesday, October 29th. Piper Sandler raised their price target on shares of F5 from $186.00 to $246.00 and gave the company a "neutral" rating in a report on Tuesday, October 29th. StockNews.com raised shares of F5 from a "buy" rating to a "strong-buy" rating in a report on Tuesday, October 29th. JPMorgan Chase & Co. raised their target price on shares of F5 from $225.00 to $250.00 and gave the stock a "neutral" rating in a report on Tuesday, October 29th. Finally, Needham & Company LLC boosted their target price on shares of F5 from $220.00 to $235.00 and gave the company a "buy" rating in a research note on Tuesday, July 30th. Seven analysts have rated the stock with a hold rating, two have assigned a buy rating and one has issued a strong buy rating to the company. According to MarketBeat.com, F5 presently has a consensus rating of "Hold" and an average target price of $233.56.

Get Our Latest Analysis on FFIV

Insider Transactions at F5

In other F5 news, Director Alan Higginson sold 1,000 shares of the company's stock in a transaction that occurred on Monday, September 9th. The stock was sold at an average price of $201.65, for a total value of $201,650.00. Following the completion of the transaction, the director now directly owns 10,707 shares in the company, valued at $2,159,066.55. This represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available through the SEC website. In other F5 news, CEO Francois Locoh-Donou sold 1,450 shares of the firm's stock in a transaction that occurred on Thursday, October 3rd. The stock was sold at an average price of $218.26, for a total transaction of $316,477.00. Following the completion of the transaction, the chief executive officer now owns 121,122 shares in the company, valued at $26,436,087.72. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a filing with the SEC, which is available through this link. Also, Director Alan Higginson sold 1,000 shares of the company's stock in a transaction that occurred on Monday, September 9th. The stock was sold at an average price of $201.65, for a total value of $201,650.00. Following the sale, the director now directly owns 10,707 shares in the company, valued at $2,159,066.55. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 4,250 shares of company stock valued at $897,594 over the last 90 days. Company insiders own 0.58% of the company's stock.

About F5

(

Free Report)

F5, Inc provides multi-cloud application security and delivery solutions in the United States, Europe, the Middle East, Africa, and the Asia Pacific region. The company's distributed cloud services enable its customers to deploy, secure, and operate applications in any architecture, from on-premises to the public cloud.

Further Reading

Before you consider F5, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and F5 wasn't on the list.

While F5 currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report