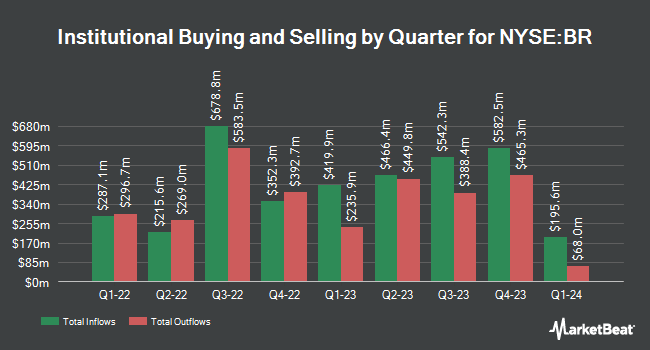

New York State Common Retirement Fund reduced its holdings in Broadridge Financial Solutions, Inc. (NYSE:BR - Free Report) by 14.9% during the 3rd quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 79,953 shares of the business services provider's stock after selling 13,976 shares during the quarter. New York State Common Retirement Fund owned 0.07% of Broadridge Financial Solutions worth $17,192,000 at the end of the most recent quarter.

Other hedge funds have also recently added to or reduced their stakes in the company. Bogart Wealth LLC boosted its holdings in shares of Broadridge Financial Solutions by 384.0% in the third quarter. Bogart Wealth LLC now owns 121 shares of the business services provider's stock valued at $26,000 after acquiring an additional 96 shares in the last quarter. EdgeRock Capital LLC bought a new position in Broadridge Financial Solutions during the 2nd quarter valued at $32,000. Rothschild Investment LLC acquired a new position in shares of Broadridge Financial Solutions during the 2nd quarter valued at $32,000. New Covenant Trust Company N.A. bought a new stake in shares of Broadridge Financial Solutions in the 1st quarter worth $34,000. Finally, Family Firm Inc. acquired a new stake in shares of Broadridge Financial Solutions in the second quarter valued at $37,000. Institutional investors own 90.03% of the company's stock.

Broadridge Financial Solutions Stock Up 0.5 %

Shares of BR traded up $1.02 during mid-day trading on Wednesday, hitting $219.32. 753,771 shares of the company's stock were exchanged, compared to its average volume of 521,053. The stock has a market cap of $25.64 billion, a price-to-earnings ratio of 37.05 and a beta of 1.05. The firm has a fifty day moving average of $213.71 and a two-hundred day moving average of $206.50. The company has a quick ratio of 1.08, a current ratio of 1.08 and a debt-to-equity ratio of 1.55. Broadridge Financial Solutions, Inc. has a twelve month low of $175.21 and a twelve month high of $225.29.

Broadridge Financial Solutions (NYSE:BR - Get Free Report) last posted its earnings results on Tuesday, November 5th. The business services provider reported $1.00 earnings per share for the quarter, beating the consensus estimate of $0.97 by $0.03. The company had revenue of $1.42 billion for the quarter, compared to analyst estimates of $1.48 billion. Broadridge Financial Solutions had a return on equity of 42.77% and a net margin of 10.73%. The business's revenue was down .6% compared to the same quarter last year. During the same period last year, the company earned $1.09 earnings per share. On average, sell-side analysts forecast that Broadridge Financial Solutions, Inc. will post 8.51 earnings per share for the current year.

Analysts Set New Price Targets

Several equities research analysts have commented on the stock. JPMorgan Chase & Co. boosted their price target on shares of Broadridge Financial Solutions from $224.00 to $225.00 and gave the stock a "neutral" rating in a research report on Tuesday, August 20th. Morgan Stanley boosted their target price on shares of Broadridge Financial Solutions from $200.00 to $207.00 and gave the stock an "equal weight" rating in a report on Wednesday. StockNews.com upgraded shares of Broadridge Financial Solutions from a "hold" rating to a "buy" rating in a report on Friday, November 1st. Finally, Royal Bank of Canada reiterated an "outperform" rating and set a $246.00 price objective on shares of Broadridge Financial Solutions in a research report on Wednesday. Three investment analysts have rated the stock with a hold rating and four have given a buy rating to the company's stock. According to data from MarketBeat, Broadridge Financial Solutions presently has a consensus rating of "Moderate Buy" and a consensus target price of $217.83.

Get Our Latest Stock Analysis on BR

Insider Buying and Selling

In related news, President Christopher John Perry sold 17,534 shares of the company's stock in a transaction on Tuesday, September 10th. The shares were sold at an average price of $213.41, for a total transaction of $3,741,930.94. Following the completion of the sale, the president now directly owns 50,237 shares of the company's stock, valued at approximately $10,721,078.17. This represents a 0.00 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. In related news, President Christopher John Perry sold 17,534 shares of the stock in a transaction that occurred on Tuesday, September 10th. The stock was sold at an average price of $213.41, for a total transaction of $3,741,930.94. Following the completion of the sale, the president now owns 50,237 shares in the company, valued at $10,721,078.17. This represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Also, CEO Timothy C. Gokey sold 25,000 shares of Broadridge Financial Solutions stock in a transaction that occurred on Friday, August 16th. The stock was sold at an average price of $209.11, for a total value of $5,227,750.00. Following the completion of the transaction, the chief executive officer now directly owns 200,675 shares in the company, valued at approximately $41,963,149.25. This represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders sold 134,386 shares of company stock worth $28,112,824. 1.30% of the stock is currently owned by insiders.

Broadridge Financial Solutions Profile

(

Free Report)

Broadridge Financial Solutions, Inc provides investor communications and technology-driven solutions for the financial services industry. The company's Investor Communication Solutions segment processes and distributes proxy materials to investors in equity securities and mutual funds, as well as facilitates related vote processing services; and distributes regulatory reports, class action, and corporate action/reorganization event information, as well as tax reporting solutions.

See Also

Before you consider Broadridge Financial Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Broadridge Financial Solutions wasn't on the list.

While Broadridge Financial Solutions currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.