New York State Teachers Retirement System purchased a new stake in shares of Alnylam Pharmaceuticals, Inc. (NASDAQ:ALNY - Free Report) during the third quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor purchased 5,283 shares of the biopharmaceutical company's stock, valued at approximately $1,453,000.

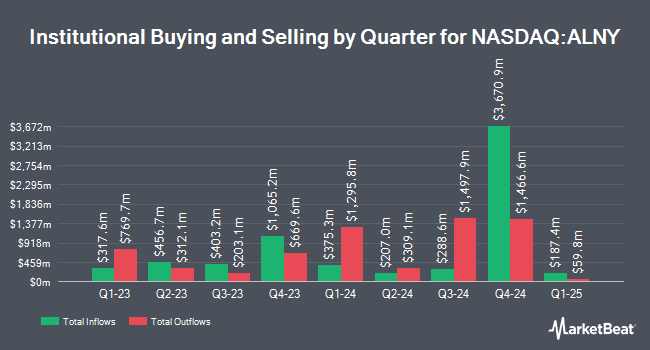

Several other institutional investors also recently modified their holdings of the business. Allspring Global Investments Holdings LLC boosted its position in Alnylam Pharmaceuticals by 572.0% in the first quarter. Allspring Global Investments Holdings LLC now owns 168 shares of the biopharmaceutical company's stock worth $25,000 after purchasing an additional 143 shares during the last quarter. Janney Montgomery Scott LLC grew its position in Alnylam Pharmaceuticals by 47.4% during the first quarter. Janney Montgomery Scott LLC now owns 2,775 shares of the biopharmaceutical company's stock valued at $415,000 after buying an additional 892 shares during the period. Empowered Funds LLC grew its position in Alnylam Pharmaceuticals by 3.9% during the first quarter. Empowered Funds LLC now owns 13,849 shares of the biopharmaceutical company's stock valued at $2,070,000 after buying an additional 524 shares during the period. Illinois Municipal Retirement Fund purchased a new stake in Alnylam Pharmaceuticals during the first quarter valued at approximately $3,942,000. Finally, Forsta AP Fonden raised its position in Alnylam Pharmaceuticals by 199.6% in the first quarter. Forsta AP Fonden now owns 68,300 shares of the biopharmaceutical company's stock worth $10,207,000 after acquiring an additional 45,500 shares during the period. 92.97% of the stock is owned by hedge funds and other institutional investors.

Analyst Ratings Changes

A number of brokerages have recently issued reports on ALNY. Canaccord Genuity Group boosted their price objective on shares of Alnylam Pharmaceuticals from $366.00 to $384.00 and gave the company a "buy" rating in a research report on Friday, November 1st. TD Cowen increased their price target on Alnylam Pharmaceuticals from $282.00 to $371.00 and gave the company a "buy" rating in a research note on Monday, October 21st. JPMorgan Chase & Co. raised their target price on shares of Alnylam Pharmaceuticals from $248.00 to $280.00 and gave the stock a "neutral" rating in a research report on Monday, August 26th. Royal Bank of Canada restated an "outperform" rating and set a $300.00 price target on shares of Alnylam Pharmaceuticals in a research report on Friday, November 1st. Finally, The Goldman Sachs Group upgraded shares of Alnylam Pharmaceuticals from a "neutral" rating to a "buy" rating and raised their price objective for the company from $198.00 to $370.00 in a report on Friday, August 16th. Six investment analysts have rated the stock with a hold rating and nineteen have issued a buy rating to the stock. According to data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and a consensus target price of $294.50.

Get Our Latest Stock Analysis on ALNY

Insider Transactions at Alnylam Pharmaceuticals

In other news, CEO Yvonne Greenstreet sold 15,000 shares of Alnylam Pharmaceuticals stock in a transaction dated Tuesday, August 20th. The shares were sold at an average price of $280.00, for a total transaction of $4,200,000.00. Following the sale, the chief executive officer now directly owns 73,441 shares in the company, valued at approximately $20,563,480. The trade was a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. 1.50% of the stock is owned by insiders.

Alnylam Pharmaceuticals Price Performance

Shares of NASDAQ ALNY traded up $5.21 during mid-day trading on Friday, reaching $277.43. 848,533 shares of the company traded hands, compared to its average volume of 925,552. Alnylam Pharmaceuticals, Inc. has a fifty-two week low of $141.98 and a fifty-two week high of $304.39. The firm has a market cap of $35.78 billion, a PE ratio of -105.89 and a beta of 0.39. The stock has a fifty day simple moving average of $274.17 and a 200-day simple moving average of $230.84. The company has a debt-to-equity ratio of 31.64, a current ratio of 2.75 and a quick ratio of 2.69.

Alnylam Pharmaceuticals (NASDAQ:ALNY - Get Free Report) last issued its earnings results on Thursday, October 31st. The biopharmaceutical company reported ($0.87) EPS for the quarter, missing the consensus estimate of ($0.51) by ($0.36). The firm had revenue of $500.90 million during the quarter, compared to analyst estimates of $532.91 million. During the same period in the previous year, the business posted $1.15 earnings per share. The firm's revenue for the quarter was down 33.3% compared to the same quarter last year. Equities research analysts anticipate that Alnylam Pharmaceuticals, Inc. will post -2.22 EPS for the current fiscal year.

About Alnylam Pharmaceuticals

(

Free Report)

Alnylam Pharmaceuticals, Inc, a biopharmaceutical company, focuses on discovering, developing, and commercializing novel therapeutics based on ribonucleic acid interference. Its marketed products include ONPATTRO (patisiran) for the treatment of the polyneuropathy of hereditary transthyretin-mediated amyloidosis in adults; AMVUTTRA for the treatment of hATTR amyloidosis with polyneuropathy in adults; GIVLAARI for the treatment of adults with acute hepatic porphyria; and OXLUMO for the treatment of primary hyperoxaluria type 1.

Further Reading

Before you consider Alnylam Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alnylam Pharmaceuticals wasn't on the list.

While Alnylam Pharmaceuticals currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.