New York State Teachers Retirement System reduced its position in Automatic Data Processing, Inc. (NASDAQ:ADP - Free Report) by 2.0% in the fourth quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 322,435 shares of the business services provider's stock after selling 6,427 shares during the period. New York State Teachers Retirement System owned approximately 0.08% of Automatic Data Processing worth $94,386,000 at the end of the most recent quarter.

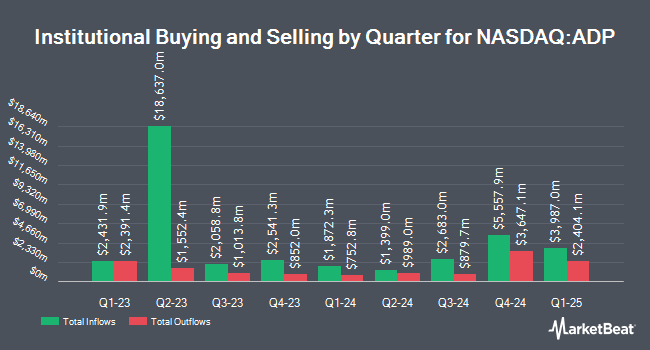

A number of other institutional investors and hedge funds also recently added to or reduced their stakes in the company. Accredited Investors Inc. raised its stake in shares of Automatic Data Processing by 4,431.5% in the 3rd quarter. Accredited Investors Inc. now owns 2,315,295 shares of the business services provider's stock valued at $640,712,000 after purchasing an additional 2,264,202 shares in the last quarter. International Assets Investment Management LLC raised its stake in shares of Automatic Data Processing by 28,478.6% in the 3rd quarter. International Assets Investment Management LLC now owns 1,194,587 shares of the business services provider's stock valued at $3,305,780,000 after purchasing an additional 1,190,407 shares in the last quarter. Holocene Advisors LP acquired a new stake in shares of Automatic Data Processing in the 3rd quarter valued at about $160,920,000. Healthcare of Ontario Pension Plan Trust Fund raised its stake in Automatic Data Processing by 332.3% during the third quarter. Healthcare of Ontario Pension Plan Trust Fund now owns 623,341 shares of the business services provider's stock worth $172,497,000 after acquiring an additional 479,145 shares during the period. Finally, State Street Corp raised its stake in Automatic Data Processing by 2.4% during the third quarter. State Street Corp now owns 18,334,580 shares of the business services provider's stock worth $5,098,541,000 after acquiring an additional 424,328 shares during the period. 80.03% of the stock is owned by hedge funds and other institutional investors.

Insider Activity at Automatic Data Processing

In related news, VP Brian L. Michaud sold 362 shares of the company's stock in a transaction that occurred on Thursday, January 2nd. The shares were sold at an average price of $293.83, for a total value of $106,366.46. Following the completion of the sale, the vice president now owns 13,706 shares in the company, valued at approximately $4,027,233.98. This represents a 2.57 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, CEO Maria Black sold 721 shares of the company's stock in a transaction that occurred on Friday, January 3rd. The shares were sold at an average price of $291.59, for a total transaction of $210,236.39. Following the completion of the sale, the chief executive officer now owns 68,856 shares of the company's stock, valued at approximately $20,077,721.04. This trade represents a 1.04 % decrease in their position. The disclosure for this sale can be found here. In the last 90 days, insiders sold 5,478 shares of company stock worth $1,617,241. 0.21% of the stock is owned by corporate insiders.

Automatic Data Processing Price Performance

NASDAQ:ADP traded up $1.74 during trading hours on Tuesday, reaching $309.89. 1,313,163 shares of the company's stock were exchanged, compared to its average volume of 1,622,654. The company has a market capitalization of $126.27 billion, a P/E ratio of 32.31, a price-to-earnings-growth ratio of 3.60 and a beta of 0.79. Automatic Data Processing, Inc. has a 12 month low of $231.27 and a 12 month high of $311.67. The company has a quick ratio of 1.00, a current ratio of 1.00 and a debt-to-equity ratio of 0.59. The business's 50-day simple moving average is $297.77 and its two-hundred day simple moving average is $289.10.

Automatic Data Processing (NASDAQ:ADP - Get Free Report) last issued its earnings results on Wednesday, January 29th. The business services provider reported $2.35 earnings per share for the quarter, topping analysts' consensus estimates of $2.30 by $0.05. Automatic Data Processing had a net margin of 19.76% and a return on equity of 80.86%. Sell-side analysts expect that Automatic Data Processing, Inc. will post 9.93 EPS for the current fiscal year.

Automatic Data Processing Announces Dividend

The company also recently declared a quarterly dividend, which will be paid on Tuesday, April 1st. Investors of record on Friday, March 14th will be given a $1.54 dividend. The ex-dividend date of this dividend is Friday, March 14th. This represents a $6.16 annualized dividend and a dividend yield of 1.99%. Automatic Data Processing's dividend payout ratio (DPR) is presently 64.23%.

Wall Street Analysts Forecast Growth

ADP has been the topic of several research reports. TD Cowen increased their price objective on shares of Automatic Data Processing from $276.00 to $285.00 and gave the stock a "hold" rating in a research note on Friday, November 1st. UBS Group increased their price objective on shares of Automatic Data Processing from $270.00 to $295.00 and gave the stock a "neutral" rating in a research note on Tuesday, October 22nd. Royal Bank of Canada reiterated a "sector perform" rating and set a $315.00 price objective on shares of Automatic Data Processing in a research note on Thursday, January 30th. Jefferies Financial Group increased their price objective on shares of Automatic Data Processing from $290.00 to $305.00 and gave the stock a "hold" rating in a research note on Thursday, January 30th. Finally, StockNews.com lowered shares of Automatic Data Processing from a "buy" rating to a "hold" rating in a research note on Wednesday, February 5th. Two equities research analysts have rated the stock with a sell rating, eight have given a hold rating and two have assigned a buy rating to the company. Based on data from MarketBeat.com, the stock currently has an average rating of "Hold" and an average price target of $293.55.

Read Our Latest Analysis on Automatic Data Processing

Automatic Data Processing Company Profile

(

Free Report)

Automatic Data Processing, Inc provides cloud-based human capital management solutions worldwide. It operates in two segments, Employer Services and Professional Employer Organization (PEO). The Employer Services segment offers strategic, cloud-based platforms, and human resources (HR) outsourcing solutions.

See Also

Before you consider Automatic Data Processing, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Automatic Data Processing wasn't on the list.

While Automatic Data Processing currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report