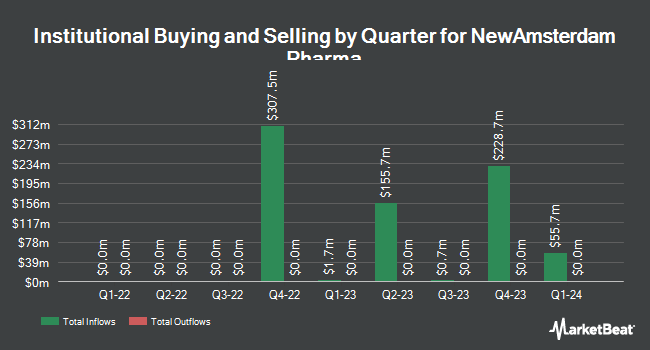

ArrowMark Colorado Holdings LLC boosted its position in NewAmsterdam Pharma (NASDAQ:NAMS - Free Report) by 19.5% in the third quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 354,975 shares of the company's stock after buying an additional 57,806 shares during the period. ArrowMark Colorado Holdings LLC owned approximately 0.39% of NewAmsterdam Pharma worth $5,893,000 at the end of the most recent quarter.

A number of other institutional investors have also added to or reduced their stakes in NAMS. Banque Cantonale Vaudoise acquired a new position in shares of NewAmsterdam Pharma during the second quarter worth approximately $38,000. Bellevue Group AG bought a new position in shares of NewAmsterdam Pharma in the third quarter valued at $128,000. Sei Investments Co. grew its holdings in shares of NewAmsterdam Pharma by 49.1% during the second quarter. Sei Investments Co. now owns 24,561 shares of the company's stock valued at $472,000 after buying an additional 8,087 shares during the last quarter. Wolverine Asset Management LLC increased its position in shares of NewAmsterdam Pharma by 117.7% during the second quarter. Wolverine Asset Management LLC now owns 15,524 shares of the company's stock worth $298,000 after acquiring an additional 8,394 shares in the last quarter. Finally, TimesSquare Capital Management LLC raised its holdings in shares of NewAmsterdam Pharma by 3.7% in the 3rd quarter. TimesSquare Capital Management LLC now owns 255,245 shares of the company's stock worth $4,237,000 after acquiring an additional 9,160 shares during the last quarter. 89.89% of the stock is owned by institutional investors and hedge funds.

Wall Street Analyst Weigh In

A number of equities analysts have issued reports on the company. Piper Sandler reiterated an "overweight" rating and set a $37.00 price target on shares of NewAmsterdam Pharma in a research note on Monday, September 23rd. Needham & Company LLC reiterated a "buy" rating and set a $36.00 price target on shares of NewAmsterdam Pharma in a report on Thursday, November 21st. Finally, Royal Bank of Canada restated an "outperform" rating and set a $31.00 price objective on shares of NewAmsterdam Pharma in a research note on Thursday, September 5th. Six analysts have rated the stock with a buy rating, According to MarketBeat.com, the company has an average rating of "Buy" and an average price target of $33.80.

Read Our Latest Report on NAMS

Insider Activity

In other NewAmsterdam Pharma news, major shareholder Nap B.V. Forgrowth sold 33,273 shares of the stock in a transaction dated Monday, November 18th. The shares were sold at an average price of $25.08, for a total transaction of $834,486.84. Following the completion of the transaction, the insider now owns 11,778,760 shares in the company, valued at $295,411,300.80. This trade represents a 0.28 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Also, CAO Louise Frederika Kooij sold 45,000 shares of the business's stock in a transaction that occurred on Tuesday, October 1st. The shares were sold at an average price of $15.72, for a total transaction of $707,400.00. The disclosure for this sale can be found here. Insiders sold a total of 86,803 shares of company stock valued at $1,755,307 in the last ninety days. 19.50% of the stock is currently owned by insiders.

NewAmsterdam Pharma Stock Performance

Shares of NAMS traded up $0.13 on Tuesday, reaching $19.77. 97,931 shares of the company's stock traded hands, compared to its average volume of 297,162. The stock's 50 day simple moving average is $19.55 and its two-hundred day simple moving average is $18.57. NewAmsterdam Pharma has a 52-week low of $8.90 and a 52-week high of $26.35.

About NewAmsterdam Pharma

(

Free Report)

NewAmsterdam Pharma Company N.V., a late-stage biopharmaceutical company, develops therapies to enhance patient care in populations with metabolic disease. It is developing obicetrapib, an oral low-dose cholesteryl ester transfer protein (CETP) inhibitor, that is in various clinical trials as a monotherapy and a combination therapy with ezetimibe for lowering LDL-C for cardiovascular diseases.

See Also

Before you consider NewAmsterdam Pharma, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NewAmsterdam Pharma wasn't on the list.

While NewAmsterdam Pharma currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.